How To Complete A Form 1065

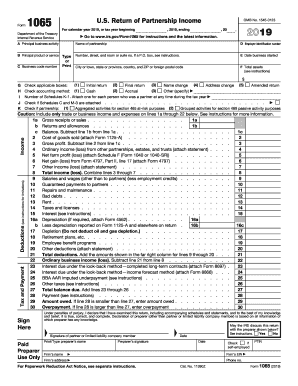

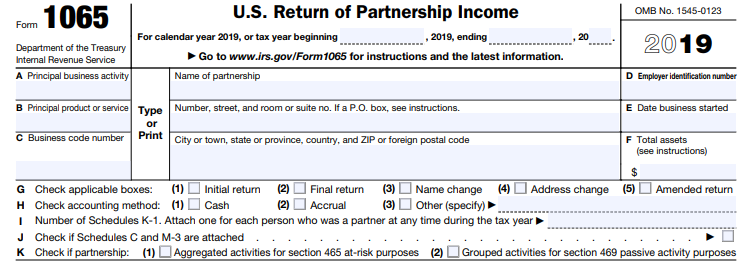

On top of the form you have to fill-up all the basic details of the partnership. Add your own info and speak to data.

Form 1065 Partnership Income Tax Return Fill Out Onlne Pdf Formswift

Form 1065 Partnership Income Tax Return Fill Out Onlne Pdf Formswift

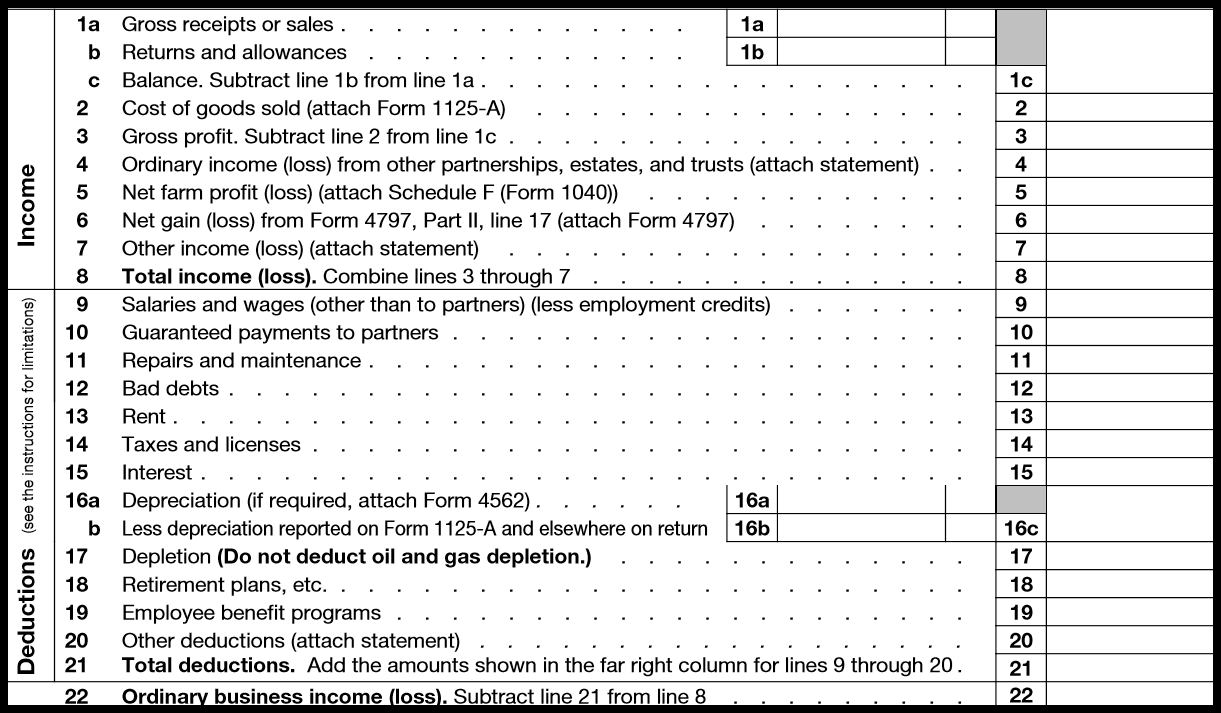

Complete Form 1065 income deductions section.

How to complete a form 1065. Adjust any items that are different from book income loss to the income loss on the tax return. Get Great Deals at Amazon Here. Get the Form 1065.

Some of these may include a profit and. Or you can download it and fill it manually after printing it. Form CT1065CT1120SI must be filed electronically and payments must be made electronically unless a taxpayer has received an electronic filing and payment waiver from DRS.

I highly recommend hiring a qualified CPA to do this for you but t. You can file your Schedule K-1 form when you submit your Form 1065 or 1120S to the IRS. Httpamznto2FLu8NwHow to fill out Form 1065 - US.

Attach a statement that identifies the line number of each amended item the corrected amount or other treatment of the item and. New payroll credit for required paid sick leave or family leave. First off youll need to gather a number of important financial and tax documents.

This video will show you the basics involved with form 1065 for partnership tax returns. The due amount did not change either. Then open the IRS Form 1065 in PDFelement after you have downloaded it.

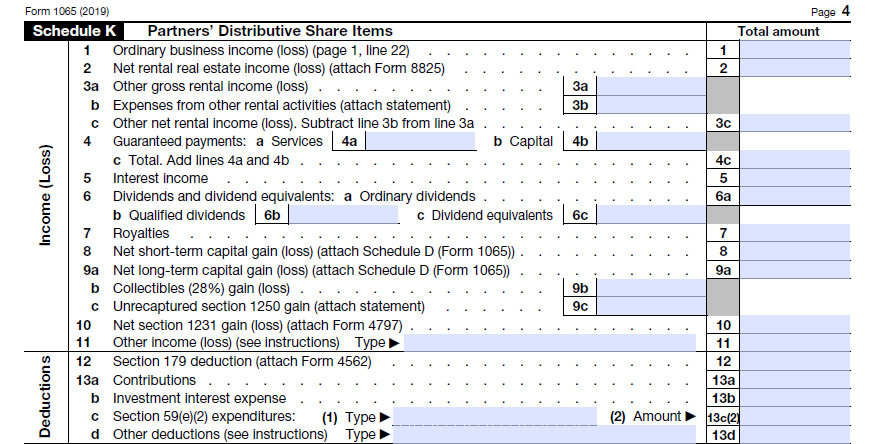

Time to File Form 1065. The codes are no longer listed on page 2 of Schedule K-1 Form 1065. This information could include.

If the amended return will be filed electronically complete Form 1065 and check box G5 to indicate that you are filing an amended return. You will need your partnerships important year-end financial statements to fill the form. You can also file the form by mail.

Another form 1065 has 0s for all entries in Part III and I entered them step by step. The first major step when preparing form 1065 is the gather relevant information. Then TurboTax asked me why I need to amend and I put something I received Schedule K-1 with Form 1065 but TurboTax could not complete the amend.

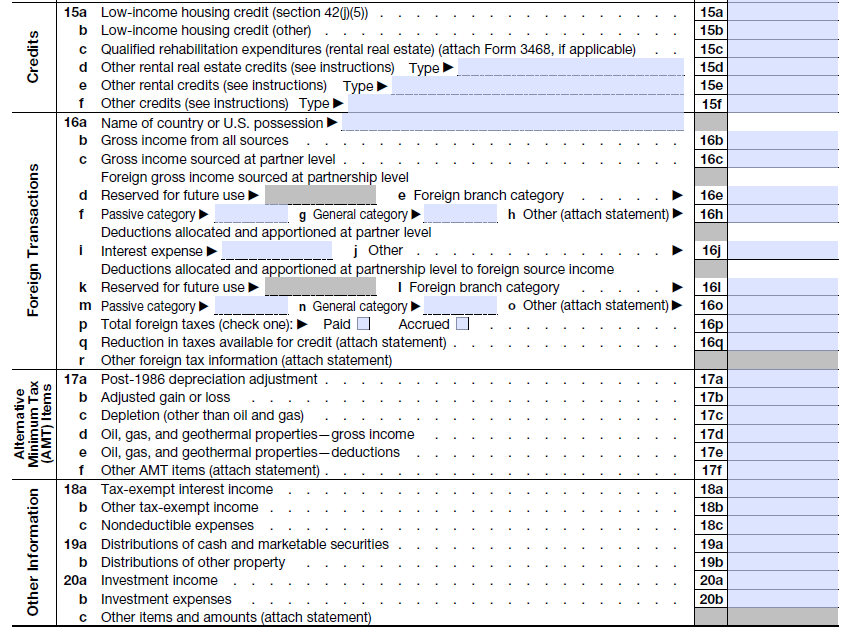

Move on to Form 1065. Under the Families First Coronavirus Response Act as. Codes for Schedule K-1.

Form CT1065CT1120SI can be filed through the Connecticut FederalState Electronic Filing Modernized efile MeF Program. The easiest way to file a 1065 is to use an online filing service that supports Form 1065. You can get the IRS Form 1065 the official website of Department of the Treasury Internal Revenue Service or you can simply Google it.

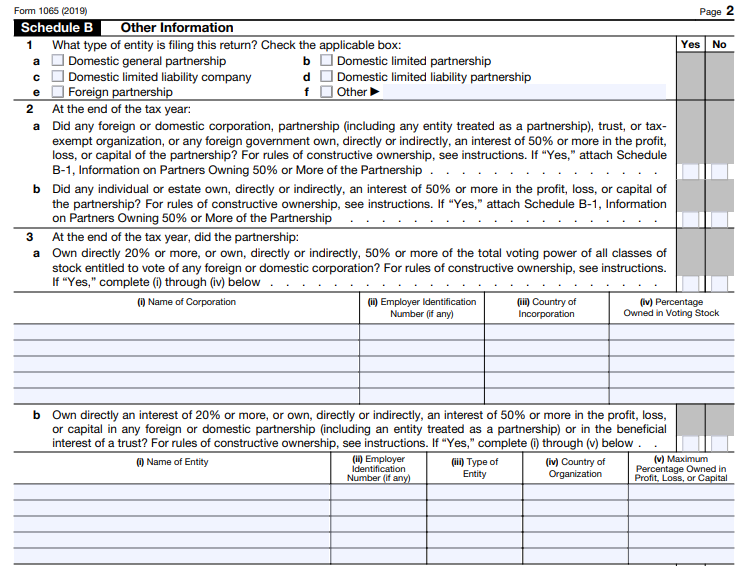

Return of Partnership Income - General Partnership LLC - 2017 Example. The easiest thing to do is to submit the form electronically by using IRS Free File or tax prep software. Fill Out Schedule B.

The IRS provides Form 1065 on its website. From there you can complete the form online or download the form and print it to complete it by. You can also download it and complete it or you can print it out.

It is interactive and can be completed online. In case your company is an LLC and didnt pay tax as a corporation then you will file taxes as being in the partnership business and then you can submit Form 1065. Heres where to send the different K-1 forms.

You can avail the form from the IRS official website. The form is interactive so you can complete it online. Most popular online tax filing services like HR Block TurboTax and TaxAct offer support for filing Form 1065.

If youre looking to compare a few options heres a complete list of IRS-approved e-filing. How to Fill Out Form 1065. How to Easily Complete Form 1065.

Complete descriptions of codes for Schedule K-1 are provided at Specific Instructions Schedules K and K-1 Part III Except as Noted. Complete the Remainder of Page 1. From the main menu of the tax return Form 1065 select Schedule M-1 Reconciliation.

You should enter this menu to generate the Schedule even if no adjustments will be made. IRS Form 1065 Instructions. See Where to File on Page 10.

Fill out the general info section. Use your indications to submit established track record areas. Fill in Boxes A Through J.

You can find the 1065 tax form on the IRS website. How to complete any Form 1065 Schedule C online. On the site with all the document click on Begin immediately along with complete for the editor.

Understanding The 1065 Form Scalefactor

Understanding The 1065 Form Scalefactor

2020 Form Irs 1065 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1065 Fill Online Printable Fillable Blank Pdffiller

Form 1065 Instructions Information For Partnership Tax Returns

Form 1065 Instructions Information For Partnership Tax Returns

How To Fill Out An Llc 1065 Irs Tax Form

How To Fill Out An Llc 1065 Irs Tax Form

Form 1065 Instructions In 8 Steps Free Checklist

Form 1065 Instructions In 8 Steps Free Checklist

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Form 1065 Instructions In 8 Steps Free Checklist

Form 1065 Instructions In 8 Steps Free Checklist

Form 1065 Instructions In 8 Steps Free Checklist

Form 1065 Instructions In 8 Steps Free Checklist

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Form 1065 Instructions In 8 Steps Free Checklist

Form 1065 Instructions In 8 Steps Free Checklist

What Is Form 1065 Get Form Filing Instructions For 2020

What Is Form 1065 Get Form Filing Instructions For 2020

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Form 1065 Instructions In 8 Steps Free Checklist

Form 1065 Instructions In 8 Steps Free Checklist

1065 Calculating Book Income Schedules M 1 And M 3 K1 M1 M3

How To Fill Out Schedule K 1 Form 1065 Example Completed Explained General Partner Llc Youtube

How To Fill Out Schedule K 1 Form 1065 Example Completed Explained General Partner Llc Youtube

How To Fill Out Form 1065 Partnerships Youtube

How To Fill Out Form 1065 Partnerships Youtube