How Much Does It Cost To Register A Business With Hmrc

The easiest way to register is online on the HMRC website. If you need to register immediately you must apply online at Companies House before 3pm and pay an additional 100 fee.

Sole Trader Vs Limited Company Sole Trader Accounting Classes Investment Business Ideas

Sole Trader Vs Limited Company Sole Trader Accounting Classes Investment Business Ideas

Incorporation costs in Year 1 amount to 950 and annual company costs in Year 2 and thereafter amount to 0.

How much does it cost to register a business with hmrc. If HMRC refuses your application to register we will refund your premises fee if. Registering a company name costs 12 online at Companies House and can be paid by debit or credit card or PayPal account. If you do not want to use limited in your company name you must.

Your company is usually registered within 24 hours. Voluntary strike off 10. The 1000 is based on your GROSS income this is the amount you receive BEFORE deducting costs and expenses.

If youre registering a new business the name registration is typically included in the filing fee. But most people now use our digital services to set up a private limited. Registering as a sole trader will keep HMRC happy but you wont have to do much paperwork and there is just a single simple tax return to do.

The average fee per UK company registration engagement amounts to 7890 which includes company incorporation opening a local corporate bank account and all government fees. Youll need to provide your name address National Insurance number and some details about your business. Most businesses register as a sole trader limited.

Registration of a. When you register you must pay 300 for each of the premises you include in your application. For example LLCs and corporations pay 180 in Washington state and 300 in Texas.

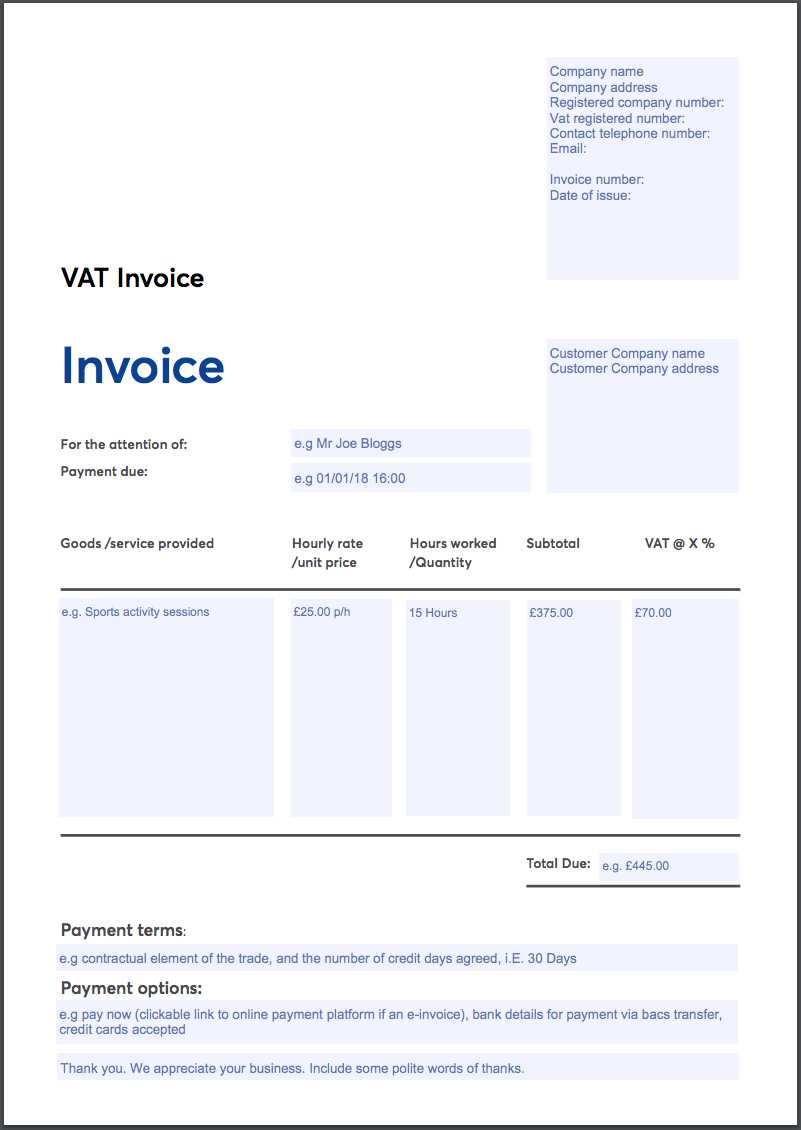

LLPs are generally treated the same as general partnerships for tax purposes. HMRC will then set up the right tax records for the partnership. Refer to the invoice embedded here.

Tax doesnt need to be taxing Well email you expert tips to help you manage your business finances. Register as soon as you can after starting your business. If you are starting a small business on your own or just testing the waters on a new idea then a sole trader registration is a low cost way to do things.

HMRC now have a 1000 annual tax allowance for trading which is for those who make small amounts of money. This cost varies by state but is often several hundred dollars. The cheapest and simplest way to register is online but you can register by posting a.

Today if you want to register your company on paper this will cost you 40 giving you 10 change from your 50 note. Your annual income must be 1000 or less and you are not currently registered for self-assessment and do not submit a tax return. To register under CIS that is in addition to your basic registration as a self-employed individual.

Register with HMRC for the Construction Industry Scheme. Value added tax VAT registration number. How soon do I need to register.

What you need to do to set up depends on your type of business where you work and whether you take people on to help. Failure to notify the department within this period may result in a fine so its important to register a business as quickly as possible. When you first start your own business there is a three-month window in which you need to tell HMRC that you have started trading.

There is no cost to register an ordinary business partnership. You can also phone HMRC on 0300 200 3500 or print a copy of the online form and send it by post. Like partnerships profits are shared among the members of a limited partnership.

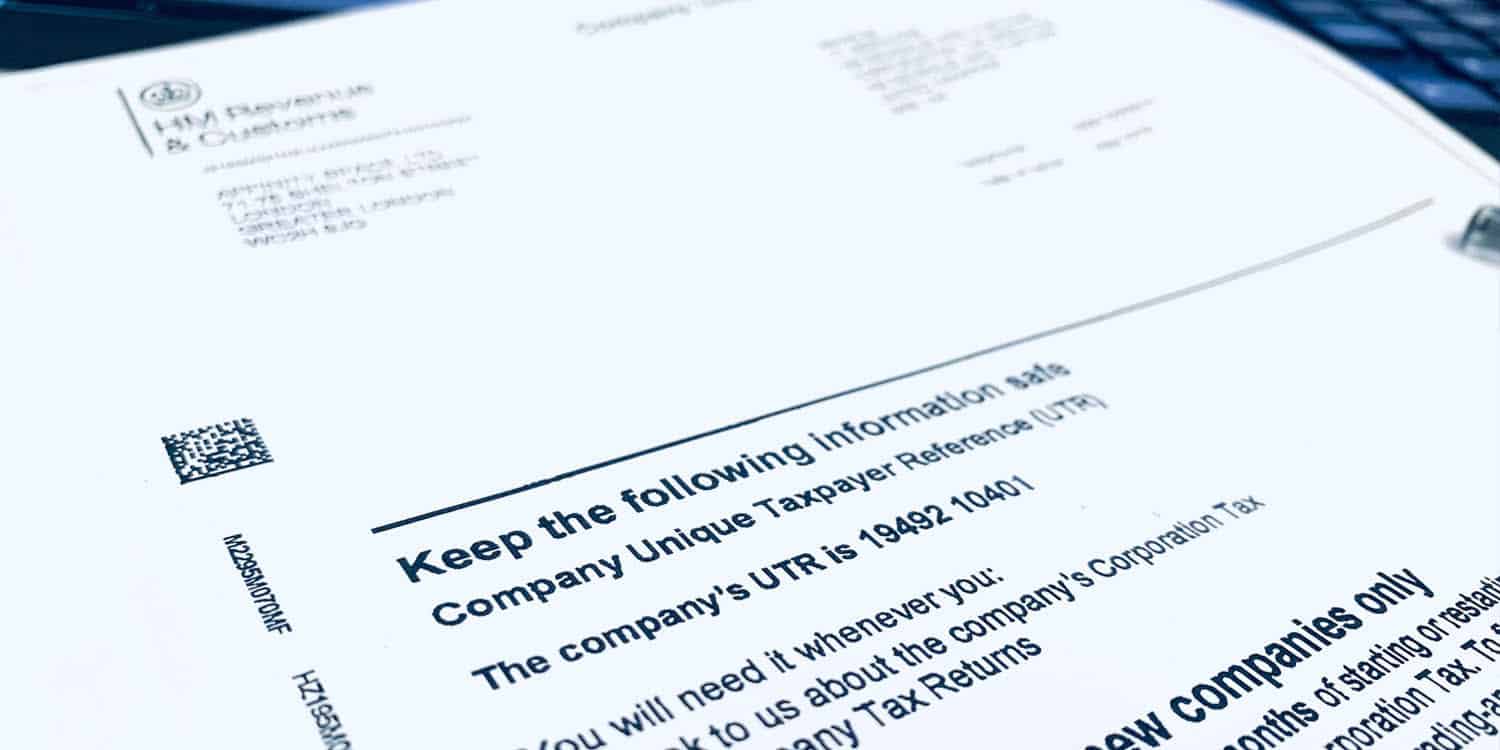

A company is usually registered within 24 hours. You can unsubscribe at any time. To register a subcontractor will then notify the HMRC and they will require the business name along with your UTR code and National Insurance number.

Registering a business in the UK costs between 12 and 100 depending on what method you choose. Each partner in the LLP must also register separately with HMRC to get their own tax records set up. At the latest you should register by 5 October in your businesss second tax year.

Postal applications take 8-10 days and cost 40. For example if you start working as a sole trader between April 2018 to April 2019 you should register before 5 October 2019. It costs 12 and can be paid by debit or credit card or Paypal account.

You can trade under your own name or you can choose another name for your business. File state documents and fees In most cases the total cost to register your business will be less than 300 but fees vary depending on your state and business structure. Confirmation fee you only pay with your first confirmation statement in the 12 month payment period 13.

You do not need to register your name.

How To Get A Replacement Certificate Of Incorporation

How To Get A Replacement Certificate Of Incorporation

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

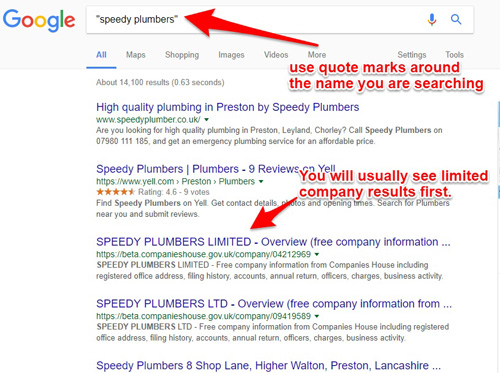

Where Can I Find My Company Registration Number Crn

Where Can I Find My Company Registration Number Crn

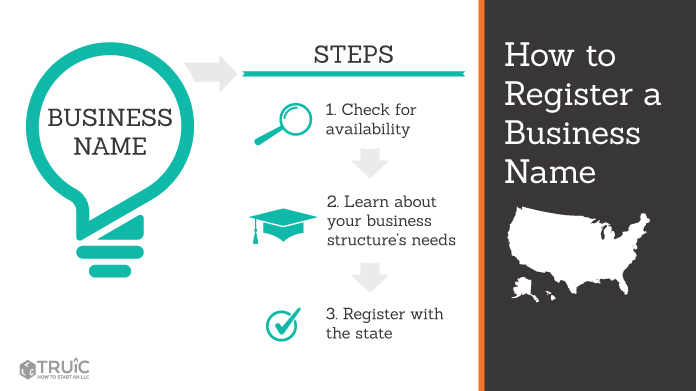

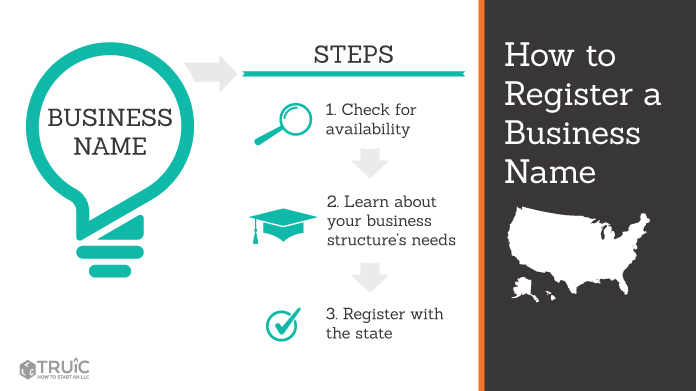

How To Register A Business Name

How To Register A Business Name

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

The Independent Girls Collective Courses Resources Community For Creative Female Entrepreneurs Financia Independent Girls Personal Finance Blogs Finance Blog

The Independent Girls Collective Courses Resources Community For Creative Female Entrepreneurs Financia Independent Girls Personal Finance Blogs Finance Blog

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

How Much Does It Cost To Start A Business In The Uk Tide Business

How Much Does It Cost To Start A Business In The Uk Tide Business

Uk Cryptocurrency Tax Guide Cointracker

Company Registration Number What Is It

Company Registration Number What Is It

15 Steps To Start A Business From Scratch With Almost No Money

15 Steps To Start A Business From Scratch With Almost No Money

Uk Cryptocurrency Tax Guide Cointracker

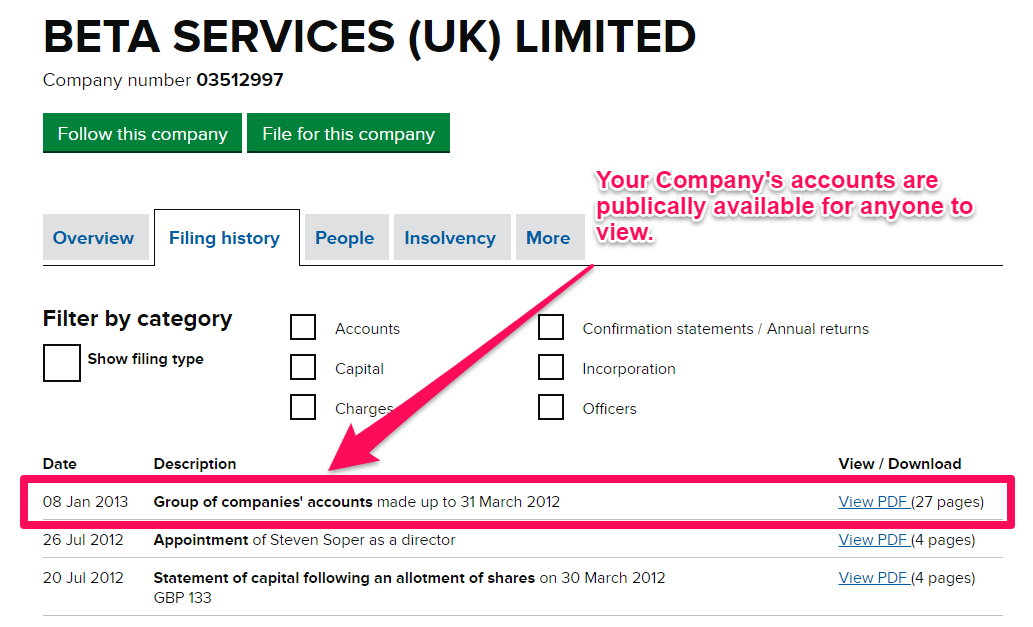

Checking The Public Company Record Companies House

Checking The Public Company Record Companies House

How To Tell Hmrc A New Company Is Dormant

How To Tell Hmrc A New Company Is Dormant

How To Register As Self Employed In The Uk A Simple Guide

How To Register As Self Employed In The Uk A Simple Guide

Vat Advice For Small Businesses Easy As Vat Woman Business Owner Business Goods And Services

Vat Advice For Small Businesses Easy As Vat Woman Business Owner Business Goods And Services

Advantages And Disadvantages Of A Limited Company Thecompanywarehouse Co Uk

Advantages And Disadvantages Of A Limited Company Thecompanywarehouse Co Uk

Free Invoice Template Sole Trader Ltd Company Vat Invoice Gocardless

Free Invoice Template Sole Trader Ltd Company Vat Invoice Gocardless