Business Loan Origination Fees Tax Treatment

Whether loan origination costs should be deducted as ordinary and necessary business expenses or capitalized over the life of the loan. Rent or other charges relating to occupancy of the property before closing.

Pin On Martin Alvarado Lending

Pin On Martin Alvarado Lending

In both cases the IRS concluded that the commitment fees were deductible under Sec.

Business loan origination fees tax treatment. The Advice supports a dichotomy between the federal income tax treatment for commitment fees for credit fees based on the current amount of unissued commitment and that for unused commitment fees lending fees based on the unused amount of a commitment to loan money. A packaging fee works much like an origination fee in that its meant to cover various lender costs. 91 requires among other things that loan origination costs be capitalized and amortized as a yield adjustment over the life of the associated loan.

Neither the Internal Revenue Service Service nor any court has ruled on this issue. Often these fees range from two to six percent of the loans principal. Appraisal fees if required by the lender The costs associated with obtaining a mortgage on rental property are amortized spread out over the life of the loan.

Specifically the loan costs allocable to loans repurchased for money were deductible when the loans were repurchased and the loan costs allocable to loans exchanged for new term loans were deductible upon the exchange. If loans produce the banks income loan origination costs are the ordinary expenses associated with that production of income. Are loan origination fees tax deductible for a business With the wide variety of lending institutions available today the fees are at the discretion of the lender.

Additionally if the seller pays a part of the interest for you these fees are also tax deductible because you can claim a deduction for the points the seller paid. Points or loan origination fees. It also requires that the capitalization and amortization of loan commitment fees is a prime source of divergence between tax and financial accounting.

Instead they should be written off as part of the gain or loss on the sale of the loan. For example if it cost you 3000 to refinance your 30-year mortgage youd be able to deduct 100 per year for the next 30 years. Origination fees are usually calculated as a percentage of the total loan amount with many falling in the 05 to 2 range.

For a 10000 loan two hundred to six hundred dollars in fees will. If you take out a loan to buy commercial real estate the points and loan origination fees cannot be deducted as business expensesthey have to be. When a loan is acquired.

In the case of the bank in the particular example they use the fees were deductible as a period expense for tax purposes as opposed to being amortized which is the requirement for GAAP because the banks loan marketing activities were a core activity of its day-to-day business. The IRS concluded that all of the unamortized loan costs were deductible. Loan origination fees are charged at a rate of 05 to 1 of the loan value.

162 as business expenses rather than under Sec. Items 4 and 5 must be capitalized as costs of getting a loan and can be deducted over the period of the loan. Lending institutions have fees and loan costs they customarily pass to commercial enterprises.

The following are settlement fees and closing costs you cannot include in your basis in the property. Although lenders have long deducted loan origination costs without Service opposition Service Field. Another type of commitment fee also referred to as a standby charge is an upfront amount paid by a borrower for the right to borrow loans over a set term.

If the loans are classified as held for sale the net fees and costs should not be amortized. Points discount points loan origination fees b. However businesses often pay at a rate of 1 to 6.

Loan origination and rebate focuses are both tax-deductible as well as interest and property taxes. One question that commonly arises is. This article discusses IRS guidance on the various types of fees.

Deferred loan origination fees and costs should be netted and presented as a component of loans. If these costs relate to business property items 1 through 3 are deductible as business expenses. Loan origination fees are tax deductible when the fees reflect the prepaid interest on a loan.

In the event that loan origination focuses were high yet you didnt pay other costs for example escrow account arrangement charge home appraisal and attorney fees and so forth the loan origination expense isnt tax-deductible. However the Third Circuit also needed to overturn the Tax Courts determination that the costs were capital expenses. Charges connected with getting or refinancing a loan such as.

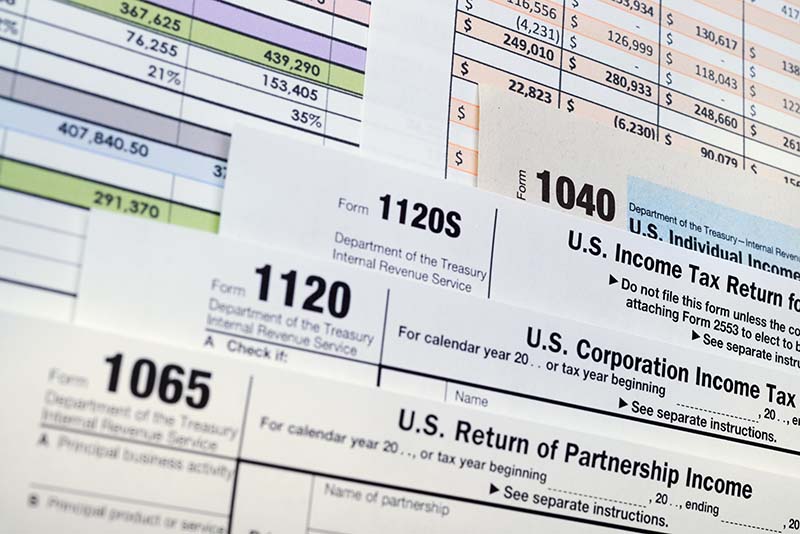

Are Loan Origination Fees Tax Deductible For Your Business

Are Loan Origination Fees Tax Deductible For Your Business

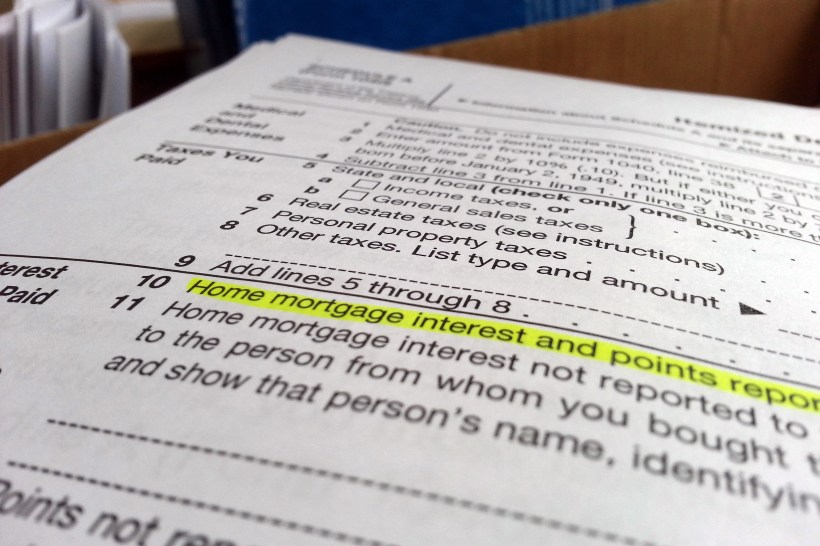

Mortgage Points Deduction Itemized Deductions Houselogic

Mortgage Points Deduction Itemized Deductions Houselogic

Case Presentation Percentage For Your Dental Practice Case Presentation Dental Practice Dental Practice Management

Case Presentation Percentage For Your Dental Practice Case Presentation Dental Practice Dental Practice Management

Full Circle Financial Planning Financial Planning Insurance Investments Investing

Full Circle Financial Planning Financial Planning Insurance Investments Investing

Is Your Business Loan Tax Deductible Camino Financial

Is Your Business Loan Tax Deductible Camino Financial

Are Closing Costs Tax Deductible Smartasset

Are Closing Costs Tax Deductible Smartasset

What Are Intangible Assets Henry Horne

What Are Intangible Assets Henry Horne

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

Is Your Business Loan Tax Deductible Camino Financial

Is Your Business Loan Tax Deductible Camino Financial

Tax Considerations For Direct Investments Middle Market Growth

Tax Considerations For Direct Investments Middle Market Growth

3rd Renewable Energy Expo 2009 In New Delhi India Green Electronics Energy Renewable Energy

3rd Renewable Energy Expo 2009 In New Delhi India Green Electronics Energy Renewable Energy

Making Sense Of Deferred Tax Assets And Liabilities

Making Sense Of Deferred Tax Assets And Liabilities

![]() Tax Law Provisions Changed Or Extended Https Cookco Us News Tax Law Provisions Changed Or Extended In 2020 Tax Advisor Tax Internal Revenue Service

Tax Law Provisions Changed Or Extended Https Cookco Us News Tax Law Provisions Changed Or Extended In 2020 Tax Advisor Tax Internal Revenue Service

Irs Laws On Tax Deductible Mortgage Broker Fees

Irs Laws On Tax Deductible Mortgage Broker Fees

Are Small Business Loans Tax Deductible A Guide To Tax Deductions

Are Small Business Loans Tax Deductible A Guide To Tax Deductions

What Closing Costs Are Tax Deductible Vs Added To Basis

What Closing Costs Are Tax Deductible Vs Added To Basis

Is Your Business Loan Tax Deductible Camino Financial

Is Your Business Loan Tax Deductible Camino Financial