How Much Does It Cost To Set Up A Vat Registered Company

23rd Mar 2012 1429. Depending on the initial capitalization the fee you pay to Maltas Registrar for Companies varies from 245 to.

What Is An Eori Number Eori Number Application Eori Check Shippo

What Is An Eori Number Eori Number Application Eori Check Shippo

Apply within minutes in one streamlined process.

How much does it cost to set up a vat registered company. Company formation fee. Get your certificate of incorporation within hours. Email and phone support and Adobe Sign.

5 rows You will be spending 199 VAT to incorporate a company and 100 VAT to register it for. How Much Does it Cost to Open a Company in Malta. Today if you want to register your company on paper this will cost you 40 giving you 10 change from your 50 note.

VAT is an indirect tax on the consumption of goods and services in the economy. I charge a minimum of 200 VAT just for a company formation. Due to this problem we have setup Shelf Companies with a PAYE Number and VAT Number which can be activated within 1-2 weeks.

If the VAT on your purchases is greater than the VAT on your sales you are due a refund. The Essential Company Registration Package. Yes its really free.

The official fee for registration of the memorandum of association for a private limited company is 50 baht per 100000 baht of registered capital. The official registration fee for 1000000 baht of registered capital is 1000 baht for a public limited company. When the VAT return Form VAT3 is processed by Revenue the result is simple.

Submit the registration form to your local SARS branch within 21 days from date of exceeding R1 million. VAT - how to register effective date of registration registration thresholds calculate taxable turnover change your details deregister cancel or transfer a VAT registration. Register a limited company and open a business account all in one go for FREE.

The next level up is My Standard Hub which is tailored for slightly larger businesses who are VAT registered. How much it costs to open a company in Malta breaks down like this. If you exceeded the VAT threshold in the past 12 months.

Thanks 2 By mn2taxhbj. Backdate claims for VAT for up to 4 years on goods assuming you still have them and 6 months on services for business related purchases for which you retain a valid VAT invoice. In certain provinces the GST is known as the Harmonized Sales Tax HST and in order to collect this tax a Canadian company or individual is required to register for VAT with the tax authorities.

The price varies depending on the services you require. VAT is levied at a standard rate of 15 on the supply of goods and services by registered vendors. The most important indirect tax is the value added tax VAT however in Canada it is known as the Goods and Services Tax GST.

Luckily the fee for incorporating a company has not kept up with inflation. A virtual office package has a cost of approximately 208 euros per month. Maltese company formation fees are relatively low but the price goes up for large or complicated operations.

We pay the 12 incorporation fee on your behalf. The Canadian taxation system is made of direct and indirect taxes. The CRO charge 50 per company registration application and fees are included in our package so you dont have any extra costs.

How much does it cost to set up a limited company in Ireland. VAT returns and bookkeeping. If its a Friday night it can take until Monday help.

If you have not actively been trading with a Registered Company VAT Registration will NOT be possible for your company to get within less than 2 months. The least amount you have to pay for this is 500 baht and it can go up to 25000 baht. You have to.

The incorporation of the business into the company is where I charge real fees which have been in excess of 2k and are usually based on the tax benefits to the client. You must register if by the end of any month your total VAT taxable turnover for the last 12 months was over 85000. The VAT recovery on expenses such as Accountancy and Legal on Selling part of a business which comprises exempt business eg.

The package starts from 149 plus VAT and includes everything in the essential plus. Businesses that are VAT registered can usually claim a VAT credit for VAT they have suffered from other VAT registered businesses or individuals who are sole traders. The company formation fee for opening a legal entity in Germany is approximately 1800 euros.

We will enroll your company on the Annual VAT Accounting Scheme this will ensure that you need only file one VAT. Residential lets and taxable activities such as Landscaping Maintenance services etc can be tricky as the business carried out is partly exempt professional fees are usually put in his residual input tax but as a transfer of a going concern is not a. For setting up a limited company in Ireland we always try to provide a competitive quote tailored to your individual needs.

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Vat On Imported Goods From China A Complete Guide

Vat On Imported Goods From China A Complete Guide

Sample Invoice Non Vat Registered Serversdb Example Invoice Not Vat Registered Invoicing Invoice Template Invoice Template Word

Sample Invoice Non Vat Registered Serversdb Example Invoice Not Vat Registered Invoicing Invoice Template Invoice Template Word

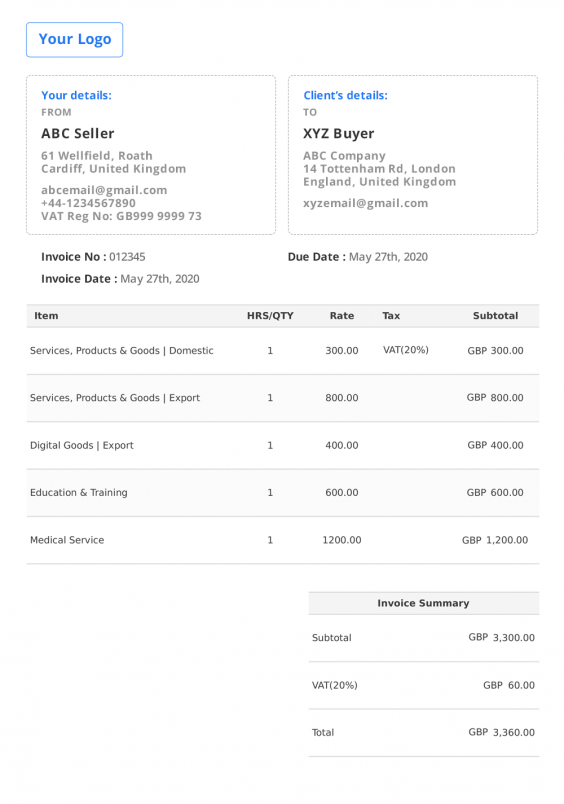

Uk Invoice Template Free Invoice Generator

Uk Invoice Template Free Invoice Generator

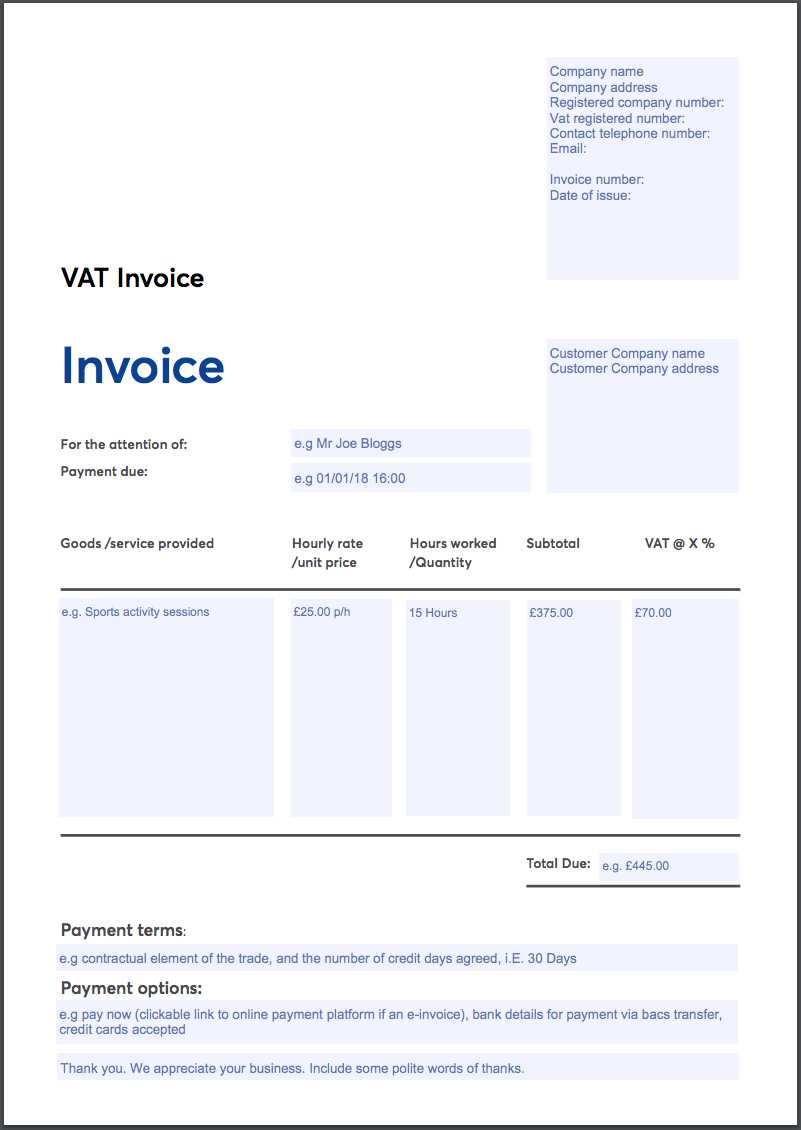

Free Invoice Template Sole Trader Ltd Company Vat Invoice Gocardless

Free Invoice Template Sole Trader Ltd Company Vat Invoice Gocardless

Vat Registration Requirements List In South Africa 2021

Vat Registration Requirements List In South Africa 2021

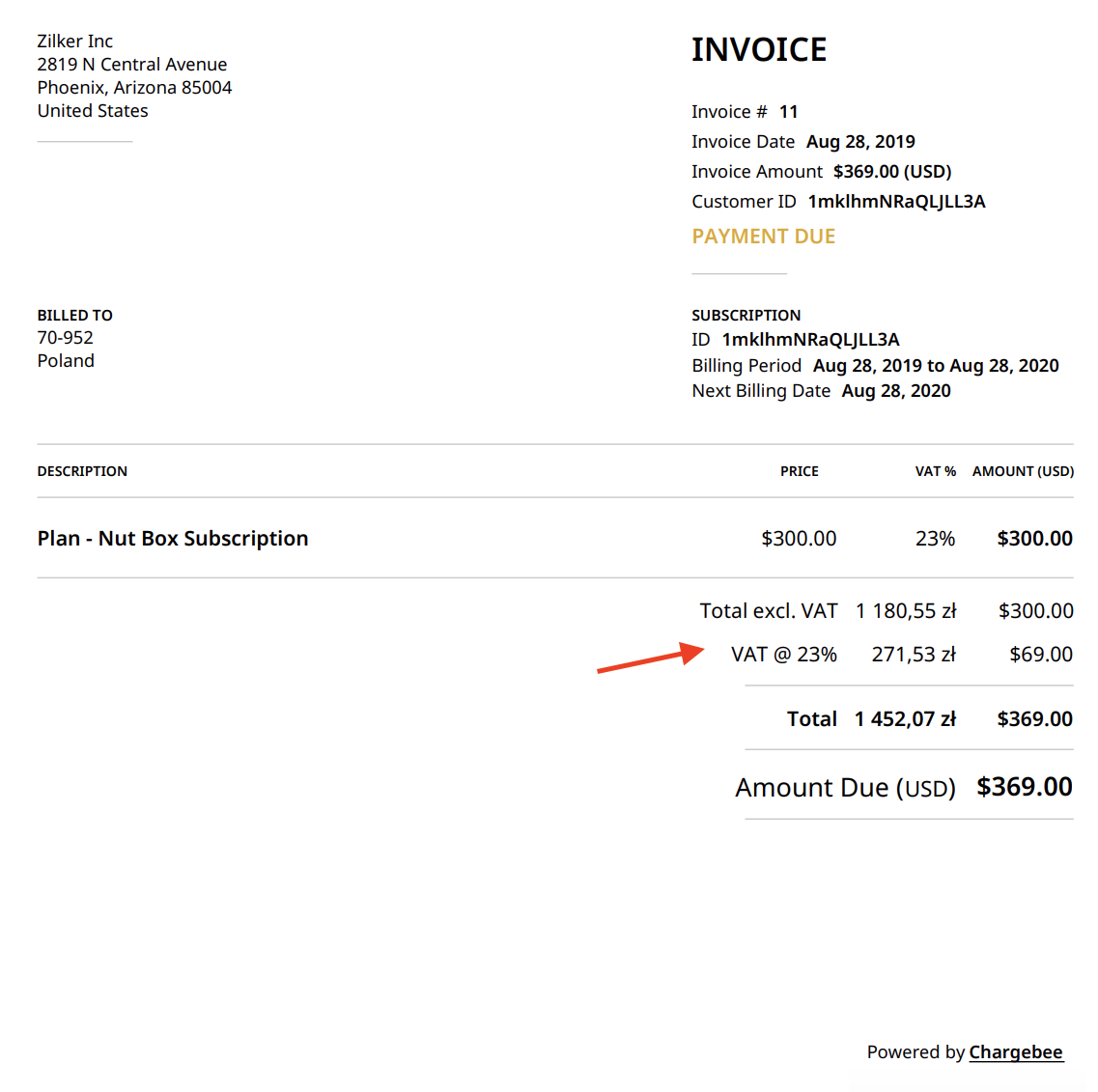

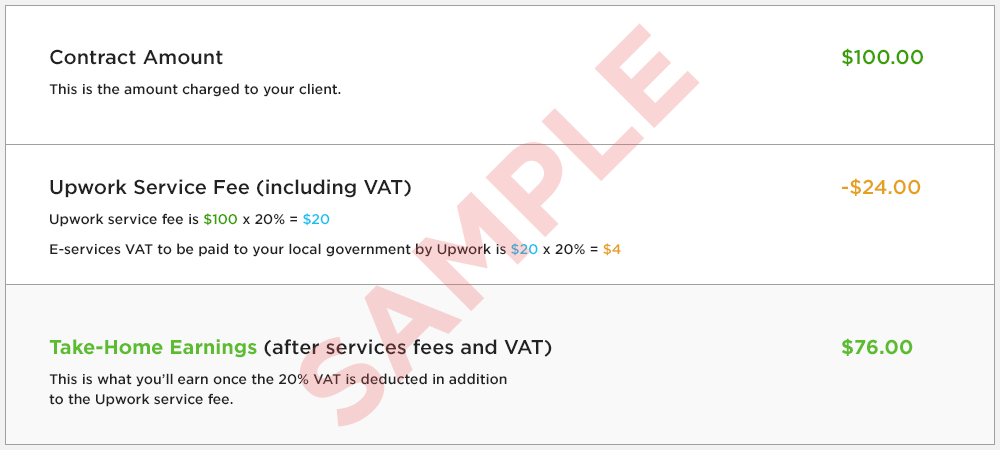

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

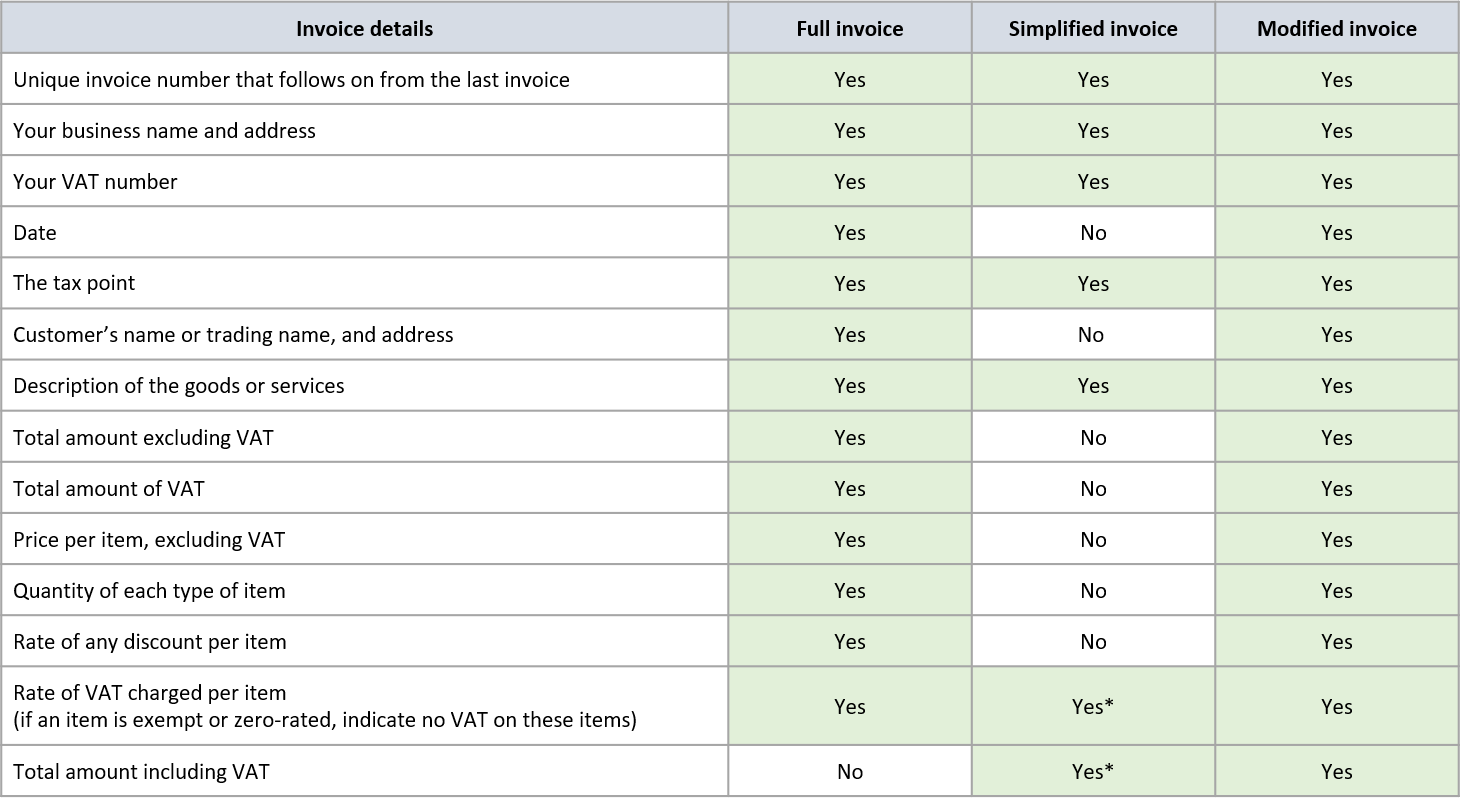

What Is Vat Our Guide To Value Added Tax 2021

What Is Vat Our Guide To Value Added Tax 2021

The Advantages Of Voluntary Vat Registration For Small Business Thecompanywarehouse Co Uk

The Advantages Of Voluntary Vat Registration For Small Business Thecompanywarehouse Co Uk

Can I Invoice Without A Vat Number Debitoor Invoicing Software

Can I Invoice Without A Vat Number Debitoor Invoicing Software

Vat Report What Is A Vat Report Debitoor Invoicing Software

Vat Report What Is A Vat Report Debitoor Invoicing Software

An Introduction To The Standard Vat Method Inniaccounts

An Introduction To The Standard Vat Method Inniaccounts

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know