How To Make A 1099 For Someone

If you sold physical products subtract your returns and cost of good sold to get your gross income. You can also buy 1099-MISC forms at your local office supply store although most only come in batches of 25 or 50.

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Small Business Tax Tax Organization Tax Quote

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Small Business Tax Tax Organization Tax Quote

If you know the company name but not the persons name leave the Company Name field blank to avoid double names on the 1099-MISC form.

How to make a 1099 for someone. How to file a 1099 form There are two copies of Form 1099. The amount of income paid to you during the year in the appropriate box based on the type of income you received 4. If the vendor is a person the vendors legal name should appear in the First Name MI and Last Name fields.

At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest. Use our 1099 Form generator to create and customize your 1099-MISC Form document. Step 2 - Grab Your Forms.

Make sure you have the current name address and social security numbers on file for. File Form 1099-MISC for each person to whom you have paid during the year. Use our 1099 Form generator to create and customize your 1099-MISC Form document.

If you pay them 600 or more over the course of a year you will need to file a 1099-MISC with the IRS and send a copy to your contractor. The 1099-MISC Form generally includes. At least 600 in.

If you hire an independent contractor you must report what you pay them on Copy A and submit it to the IRS. Step 3 - Fill Out the Forms. Rents profits or other gains reported on Form 1099-MISC Commissions fees or other payment for independent contractor work reported on 1099-MISC Payments by brokers reported on Form 1099-B Payments by fishing boat operators reported on Form 1099-MISC but only the money part and it should represent a share of the proceeds of the catch.

Obtain a 1099-MISC form from the IRS or another reputable source. The name address and taxpayer ID number of the company or individual who issued the form 3. Make sure the Address field contains the correct two-letter state abbreviation and ZIP code.

You cannot download these. Youll send Copy B to your contractor via post or if you have their consent in writing you can email it to them. If you need help with employee classification or filing the appropriate paperwork post your need in UpCounsels marketplace.

Once you have your TCC you can use the IRS FIRE system to file your 1099-NEC electronically. Prepare a new information return. IRS offices CPA offices or office supply stores may have some available for you to use.

If youre using a 1099 employee you will first want to create a written contract. Medical and health care payments. 247 Customer Support 1.

You can ask the IRS to send you the necessary form by calling 1-800-TAX-FORM 1-800-829-3676 or navigating to their online ordering page. Benefits of Using a 1099 Employee. Your name address and taxpayer ID number 2.

If the following four conditions are met you must generally report a payment as nonemployee compensation. Write your business name business tax ID number the contractors name and contractors tax ID number--likely her Social Security number--on the 1099 Form. Step 1 - Check Your Information.

You have to either order them from the IRS or pick them up at an. You probably received a 1099-NEC form because you worked for someone during the past year but not as an employee. You must report the same information on Copy B and send it to the contractor.

For example if you got paid as a freelancer or contractor the person you worked for is required to keep track of these payments and give you a 1099-NEC form showing the total you received during the year. A freelancers favorite easy online tool. Include all the correct information on the form including the correct TIN name and address.

A freelancers favorite easy online tool. You need one 1099-MISC form for every independent contractor you paid that year. Heres a brief rundown of how to fill out Schedule C.

How To 1099 Someone. How to file Schedule C for 1099-MISC. Calculate your gross income by adding up all the income from your 1099 forms and any employer who paid you less than 600.

1099 employees can obtain a number of important benefits from this working relationship including the ability to work on a more flexible basis change work environments on a routine basis run their own business and have greater freedom. Create your form 1099-MISC now httpsbitly35mKNzVHow to create a form 1099-MISC instantly online - No software neededSubscribe for more tutorials and h. Form 1098 1099 5498 or W2G.

You made the payment to someone who is not your employee. Prepare a new transmittal Form 1096. Theres a correct way to get consent and.

Prepare the new return as though it is an original. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. However the benefits to employers are often extensive and worth taking notice of.

Copy A and Copy B. Do not enter an X in the CORRECTED box at the top of the form.

How To Fill Out Form 1099 R Distributions From Pensions Annuities Retirement Etc Retirees Need To File Retirement Advice Retirement Fund Irs Tax Forms

How To Fill Out Form 1099 R Distributions From Pensions Annuities Retirement Etc Retirees Need To File Retirement Advice Retirement Fund Irs Tax Forms

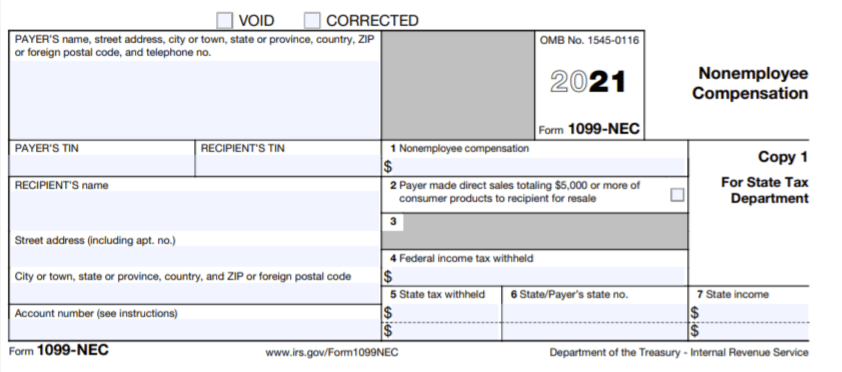

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What Is Form 1099 Misc Irs Tax Forms Tax Forms 1099 Tax Form

What Is Form 1099 Misc Irs Tax Forms Tax Forms 1099 Tax Form

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Everything You Need To Know About 1099s Amy Northard Cpa The Accountant For Creatives Tax Deadline Irs Business Tax

Everything You Need To Know About 1099s Amy Northard Cpa The Accountant For Creatives Tax Deadline Irs Business Tax

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What Is A W2 Employee What Is A 1099 Paying Taxes Employee

What Is A W2 Employee What Is A 1099 Paying Taxes Employee

W2 Vs 1099 What S The Difference Between W2 And 1099 Quickbooks Independent Contractor Employee Quickbooks

W2 Vs 1099 What S The Difference Between W2 And 1099 Quickbooks Independent Contractor Employee Quickbooks

Missing An Irs Form 1099 For Your Taxes Keep Quiet Don T Ask Irs Forms The Krazy Coupon Lady Irs

Missing An Irs Form 1099 For Your Taxes Keep Quiet Don T Ask Irs Forms The Krazy Coupon Lady Irs

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099