Small Business Formation Expenses

Does not carry on a business and does not control and is not controlled by an entity carrying on a business in the relevant income year that is not an SBE in that income year. Expenses incurred in preparing to open a new business are deducted over 180 months rather than all at once as they would be if the business were already operating.

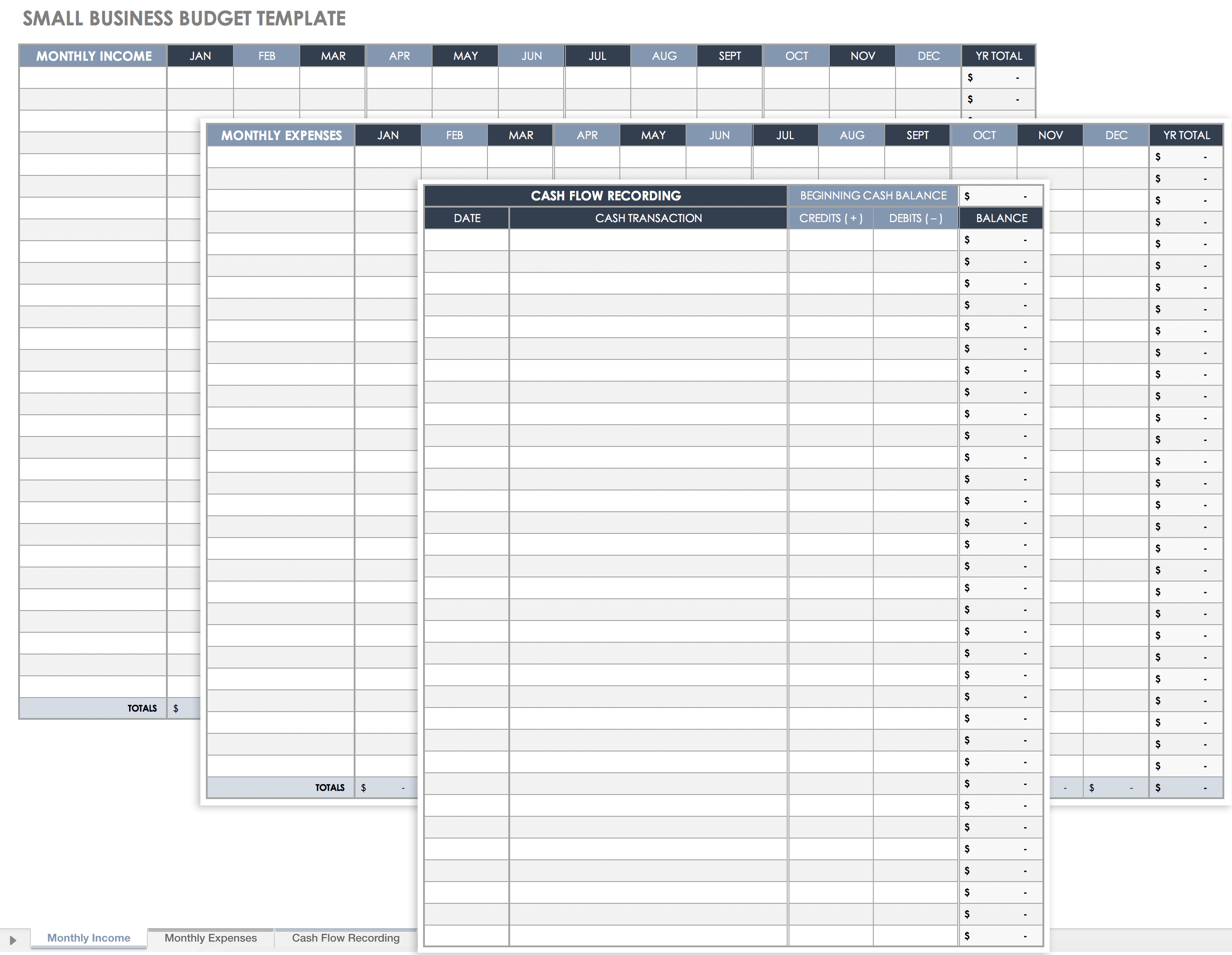

Business Income Spreadsheet Jpg 600 380 Pixels Small Business Expenses Business Expense Business Budget Template

Business Income Spreadsheet Jpg 600 380 Pixels Small Business Expenses Business Expense Business Budget Template

You can claim the necessary expenses that you had to pay for a while on a company trip which later the company will use it for deducting themselves.

/AppleISdec2018OpCosts-5c6edec5c9e77c000151b9d2.jpg)

Small business formation expenses. These expenses are common costs of doing business and are usually tax deductible if your business is for-profit. May 21 2020 The classification of startup costs as capital expenses is important because it means you cant take all of these costs as an expense to your business in the first year. Property coverage for your furniture equipment and buildings Liability coverage Group health dental and vision insurance for employees Professional liability or malpractice insurance Workers compensation coverage Auto insurance for business vehicles Life insurance that covers.

Find out how rent utilities marketing and other operating costs affect your income statement. A small business entity SBE for that income year or. Similarly it operates for self-employed who have to file the deductions for the tax return.

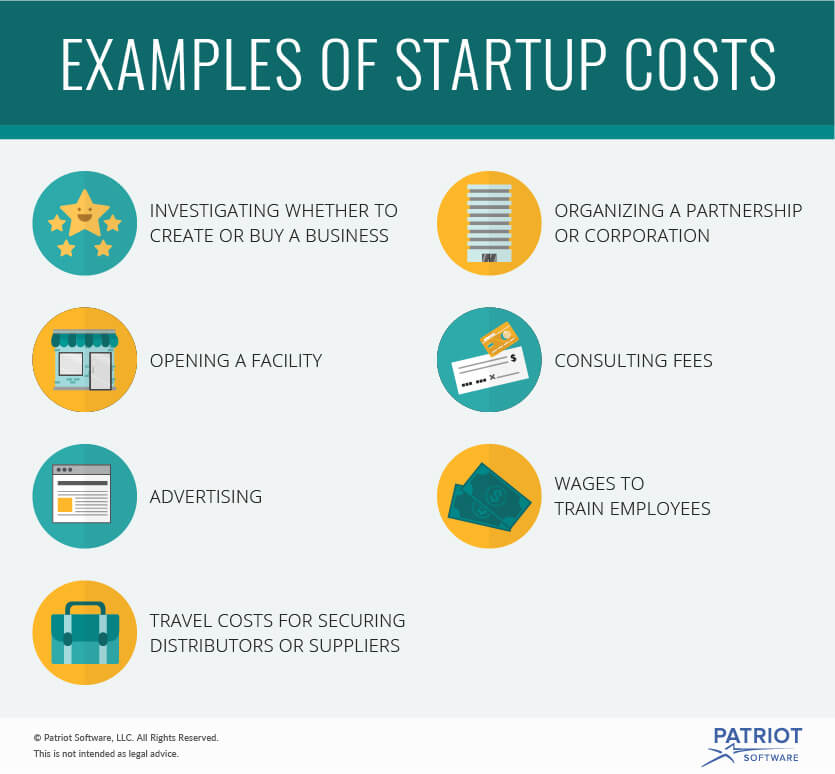

Every person while doing some kind of an activity incurs various expenditures. Typical costs include investigating whether to open a business ordering supplies needed and training employees. Dec 31 2017 Typical deductions include plane tickets meals taxis hotels dry cleaning phone calls car miles tips and any shipping of material needed.

This particular form is used simply to record all such cost of expenditure for the reimbursement purpose. By Mark Williams Director of Operations BizFilings. Buying major equipment hiring a logo designer and paying for permits licenses and fees are generally considered to be one-time expenses.

Business startup costs are considered to be intangible assets with no tangible form so they must be amortized spread out over 15 years. For example costs of renting a storefront business travel and paying employees are all deductible business expenses. One-time expenses are the initial costs needed to start the business.

Types of start-up costs for which an immediate deduction is allowed. You can typically deduct one-time expenses for tax purposes which can save you money on the amount of taxes youll owe. Business expenses Business expenses are the cost of conducting a trade or business.

A business expense form is a type of a form which highlights in detail every kind of expenditure that has been incurred by a person in any kind of activity. Mar 18 2020 Operating expenses reflect the cost of keeping your business running. May 29 2020 As a bonus all of your business-related expenses are recorded on a regular basis making it easy to track and deduct expenses where appropriate.

These business expense forms are for anyone who is employed with an organization or self-employed. Jan 25 2021 This may include.

Monthly Business Expense Worksheet Template Business Budget Template Business Expense Expense Sheet

Monthly Business Expense Worksheet Template Business Budget Template Business Expense Expense Sheet

Small Business Tax Spreadsheet Small Business Tax Business Tax Deductions Small Business Expenses

Small Business Tax Spreadsheet Small Business Tax Business Tax Deductions Small Business Expenses

Monthly Expense Report Template Profit Loss Report Spreadsheet Demo Looking Business Budget Template Small Business Expenses Spreadsheet Template Business

Monthly Expense Report Template Profit Loss Report Spreadsheet Demo Looking Business Budget Template Small Business Expenses Spreadsheet Template Business

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Expense Printable Forms Worksheets Expenses Printable Spreadsheet Business Business Expense

Expense Printable Forms Worksheets Expenses Printable Spreadsheet Business Business Expense

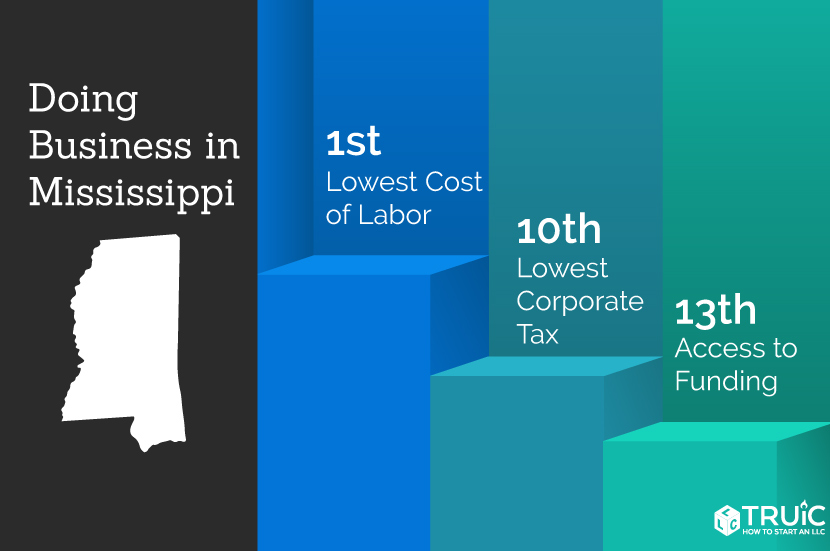

How To Start A Business In Mississippi A Truic Small Business Guide

How To Start A Business In Mississippi A Truic Small Business Guide

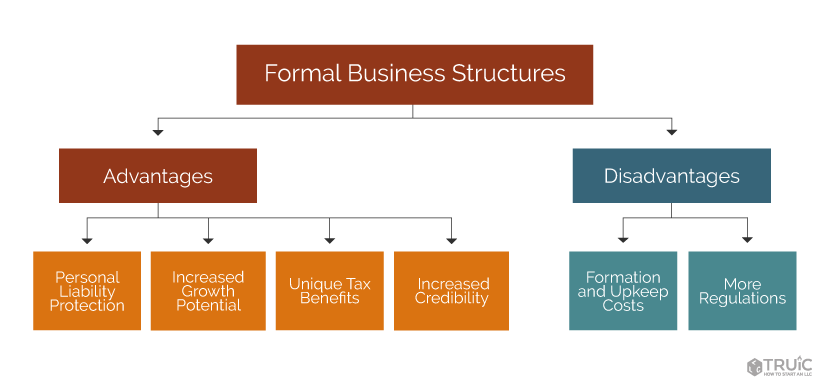

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Accounting For Startup Costs How To Track Your Expenses

Accounting For Startup Costs How To Track Your Expenses

Business Income Expense Spreadsheet Template Spreadsheet Template Business Spreadsheet Business Financial Plan Template

Business Income Expense Spreadsheet Template Spreadsheet Template Business Spreadsheet Business Financial Plan Template

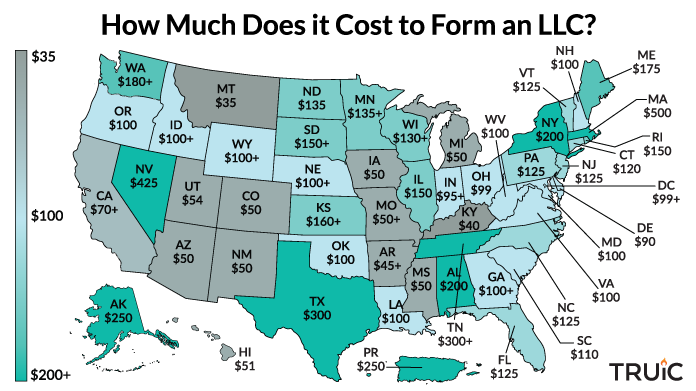

Llc Cost How Much Does It Cost To Start An Llc Truic

Llc Cost How Much Does It Cost To Start An Llc Truic

Free Business Tracking Printable Templates Business Organization Printables Business Printables Small Business Organization

Free Business Tracking Printable Templates Business Organization Printables Business Printables Small Business Organization

Free Startup Plan Budget Cost Templates Smartsheet

Free Startup Plan Budget Cost Templates Smartsheet

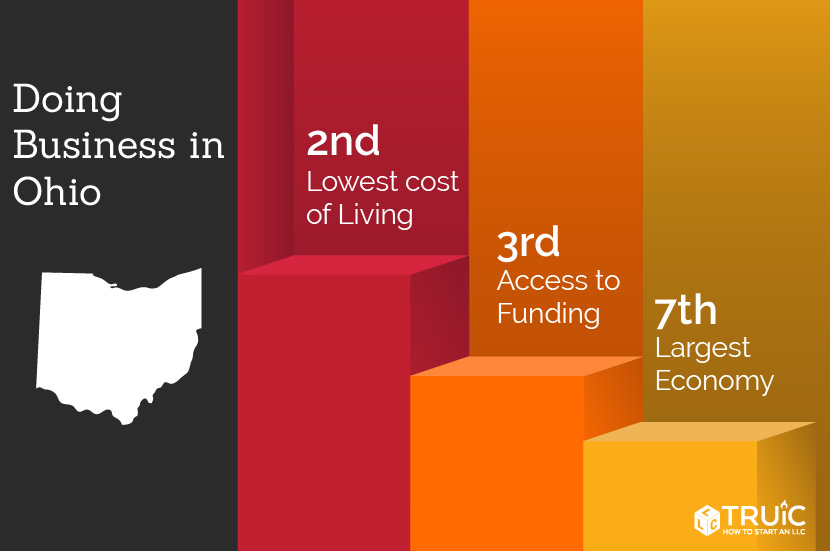

How To Start A Business In Ohio A Truic Small Business Guide

How To Start A Business In Ohio A Truic Small Business Guide

Small Business Tax Deductions For 2021 Llc S Corp Write Offs

Small Business Tax Deductions For 2021 Llc S Corp Write Offs

Income And Expense Tracking Printables The Happy Housewife Home Management Profit And Loss Statement Business Expense Tracker Tax Organization

Income And Expense Tracking Printables The Happy Housewife Home Management Profit And Loss Statement Business Expense Tracker Tax Organization

Expense Report Template Expenses Printable Small Business Expenses Report Template

Expense Report Template Expenses Printable Small Business Expenses Report Template

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Finance

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Finance

How To Calculate Small Business Startup Costs 2021 Complete Guide

How To Calculate Small Business Startup Costs 2021 Complete Guide