How To Put Money Order In Bank Account

You can pay cash and cheques into your bank account over the counter at your local branch. Money orders from other sources may need to be deposited at a branch.

:max_bytes(150000):strip_icc()/how-do-you-fill-out-a-money-order-315051-ADD-FINAL-0dff19a2360545d7ab81d84299677045.png) Guide To Filling Out A Money Order

Guide To Filling Out A Money Order

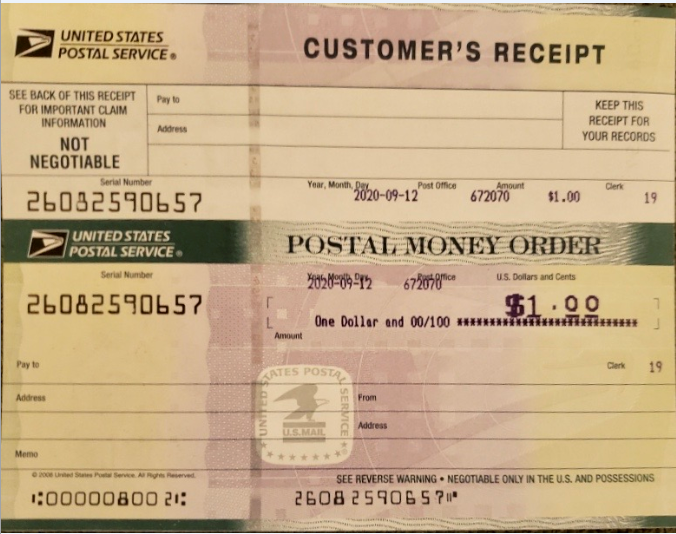

Postal Service money orders are affordable widely accepted and never expire.

How to put money order in bank account. Theyll have some or you may have deposit slips already in the back of your checkbook. Some banks will also allow you to deposit money orders by mailing them to the bank by depositing them in an ATM or even by taking a photo of the money order with your smartphone. The money order will need to be made out to the name on the bank account into which it is being deposited.

If you prefer to put your funds directly into your checking account you can deposit a money order instead of cashing it. USPS money orders include an address field on the left for the recipients address and another one on the right for the purchasers address such that both the recipients address and your address appear. Use those because they already have your account number printed on them Then go to the teller and give them the slip and the cash.

Make sure you keep your receipt in case you need to trace or cancel your money order. You pay for the money order filling it out similarly to how youd fill out a check sign it and then deliver it either in person or by mail. When sending money by mail use money orders as a safe alternative to cash and personal checks.

Fill out a deposit slip. Sign-up for an account and follow instructions to link your bank account. They will put the.

When a levy is issued your bank accounts are frozen and you cant access the money in your account until the debt has been repaid. Although modern paying in machines in branch will give you a receipt beware that some older machines dont. Sending Money Orders.

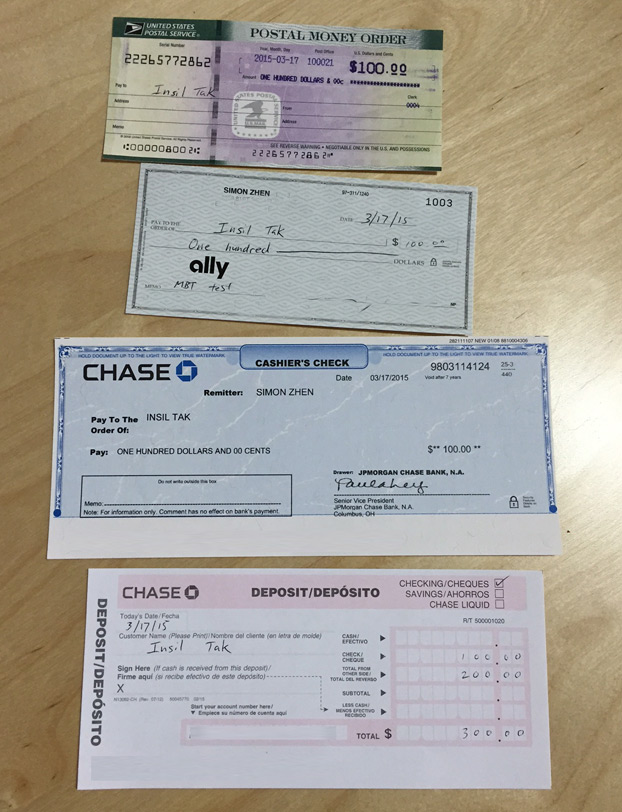

Banks usually accept post office money orders like they would a regular check at branches ATMs or even on a mobile app. When you want to deposit the money into your online account use the online banks name and address. If your bank doesnt have this feature you can mail it to the.

An international money order in US Dollars USD issued by the United States Postal Service. Tell your banker where you got the money order. If a creditor gets a court judgment against you they may be able to ask the court for a bank levy - a process where when the creditor takes the money from your bank account to satisfy a court-ordered debt.

Youll typically pay a minimal fee for a money order. Show the money order that you want to deposit. You may be asked about the money order sender if the banker does not recognize the name.

Your money order receipt will help you track your payment and show proof of value in case the money order gets lost stolen or damaged. Ask the money order issuer and the recipient what is required. Just fill in a paying-in form and give it to the cashier along with the cheque or cash.

Money orders are easy to buy and cash and about as simple to fill out as writing a check. You should know the company and why are are being paid In order to deposit a check in a bank account you must have an account at the bank. For example USPS charges 120 for a money order of up to 500 and 160 for one from 50001 to 1000.

As long as your bank accepts money orders you can simply sign the document and deposit it into your account. Once you fill in the recipients name. Avoid using a credit card.

To transfer funds to your bank account. If your online bank has an electronic scan feature you can snap a photo and upload the money order to your account for deposit. Most banks will allow you to deposit a money order with a teller and you may need to fill out a deposit slip.

To purchase a money order you must provide the payees name and address. Fees vary widely so check in advance. Go to the Netspend Online Account Center.

Once youve found an ATM take your cash to the ATM fill out a deposit slip with your account information and put the money into the deposit. A Netspend Prepaid Card will allow you to move money to your bank account as well as to other Netspend cardholders. Some branches have machines you can use for this as well.

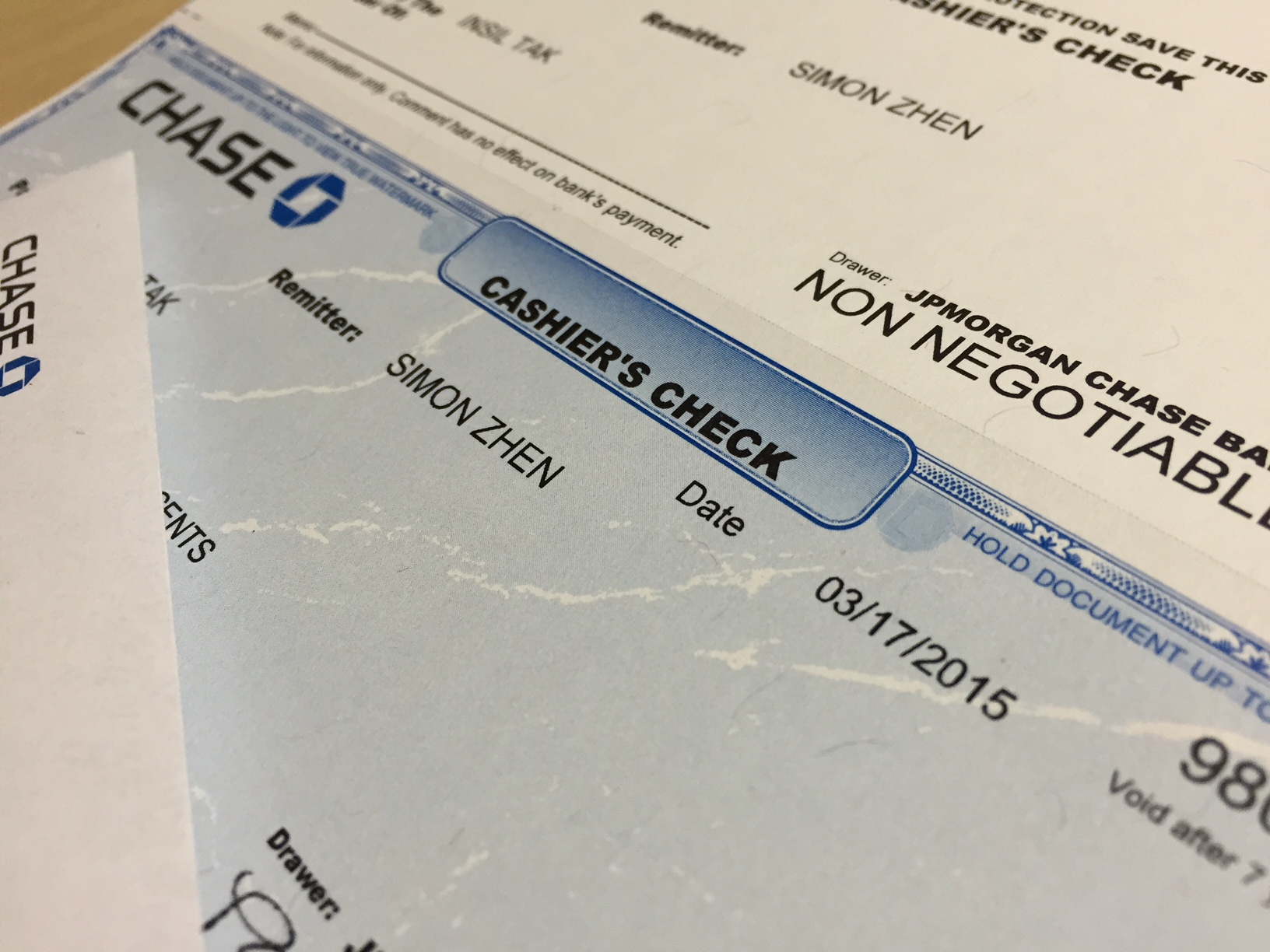

Cashiers Check Can Be Helpful From Time To Time Cashier S Check Payroll Checks Printable Checks

Cashiers Check Can Be Helpful From Time To Time Cashier S Check Payroll Checks Printable Checks

:max_bytes(150000):strip_icc()/how-to-fill-out-a-deposit-slip-315429-FINAL-88cd427461ed43c6b5b7fc93d74030d2.png) Guide To Filling Out A Money Order

Guide To Filling Out A Money Order

Cashier S Check Vs Money Order What S The Difference Bankrate

Cashier S Check Vs Money Order What S The Difference Bankrate

How To Protect Yourself From Money Order Scams Money Order Fake Money Need Money

How To Protect Yourself From Money Order Scams Money Order Fake Money Need Money

How To Fill Out A Money Order Step By Step Nerdwallet

How To Fill Out A Money Order Step By Step Nerdwallet

How To Fill Out A Money Order Money Order Money Filling

How To Fill Out A Money Order Money Order Money Filling

Where Can I Cash A Money Order Smartasset

Where Can I Cash A Money Order Smartasset

/how-do-you-fill-out-a-money-order-315051-ADD-FINAL-0dff19a2360545d7ab81d84299677045.png) Guide To Filling Out A Money Order

Guide To Filling Out A Money Order

3 Ways To Fill Out A Moneygram Money Order Wikihow

3 Ways To Fill Out A Moneygram Money Order Wikihow

3 Ways To Fill Out A Moneygram Money Order Wikihow

3 Ways To Fill Out A Moneygram Money Order Wikihow

3 Ways To Fill Out A Moneygram Money Order Wikihow

3 Ways To Fill Out A Moneygram Money Order Wikihow

Cashier S Check Vs Money Order What S The Difference Bankrate

Cashier S Check Vs Money Order What S The Difference Bankrate

Cashier S Check Vs Money Order Which Clears Faster

Cashier S Check Vs Money Order Which Clears Faster

What Is A Money Order And How Does It Work Forbes Advisor

What Is A Money Order And How Does It Work Forbes Advisor

Cashier S Check Vs Money Order Which Clears Faster

Cashier S Check Vs Money Order Which Clears Faster

3 Ways To Fill Out A Moneygram Money Order Wikihow

3 Ways To Fill Out A Moneygram Money Order Wikihow

/MoneyOrderFilledOut-582dc6525f9b58d5b15ab5f5.jpg) How To Fill Out A Money Order To Send Money Safely

How To Fill Out A Money Order To Send Money Safely

:max_bytes(150000):strip_icc()/GettyImages-949219696-e4c7b0e0b92847cb91ac7cc928362bad.jpg)