How To Find A Company Vat Registration Number

How to batch check VAT number. Lack of this document is an indication they are operating illegally.

My European Vat Number Is Not Validated What Can I Do Press Customizr Documentation

My European Vat Number Is Not Validated What Can I Do Press Customizr Documentation

Consequently where vendors are newly registered the number being searched may not yet appear.

How to find a company vat registration number. 51 rows VAT lookup enables you to lookup and verify VAT numbers. The first step is to ensure you know the companys full official name and where its headquartered. You can also check VAT.

Users must please note that the database is updated weekly. The total of the above calculation is 24423030321210180. 6 x 5 30.

On the Individual portfolio select Home to find the SARS Registered Details functionality On the Tax Practitioner and Organisations eFiling profiles the SARS Registered Details functionality is under the Organisations menu tab 3. Select Verify service from the list of online services. It will usually be at the top or bottom of the page.

If this isnt an option the detective work really begins. VAT Certificate No Singapore. If you have an invoice it should be listed there.

However other individuals and businesses may need to check the VAT database for validation. Results are limited to a maximum of 19 possible companies in the results list. 4 x 3 12.

Identify a companys official name before looking for additional. The best way is to ask your customer in written form so that you have a proof of communicating the VAT number. 5 x 6 30.

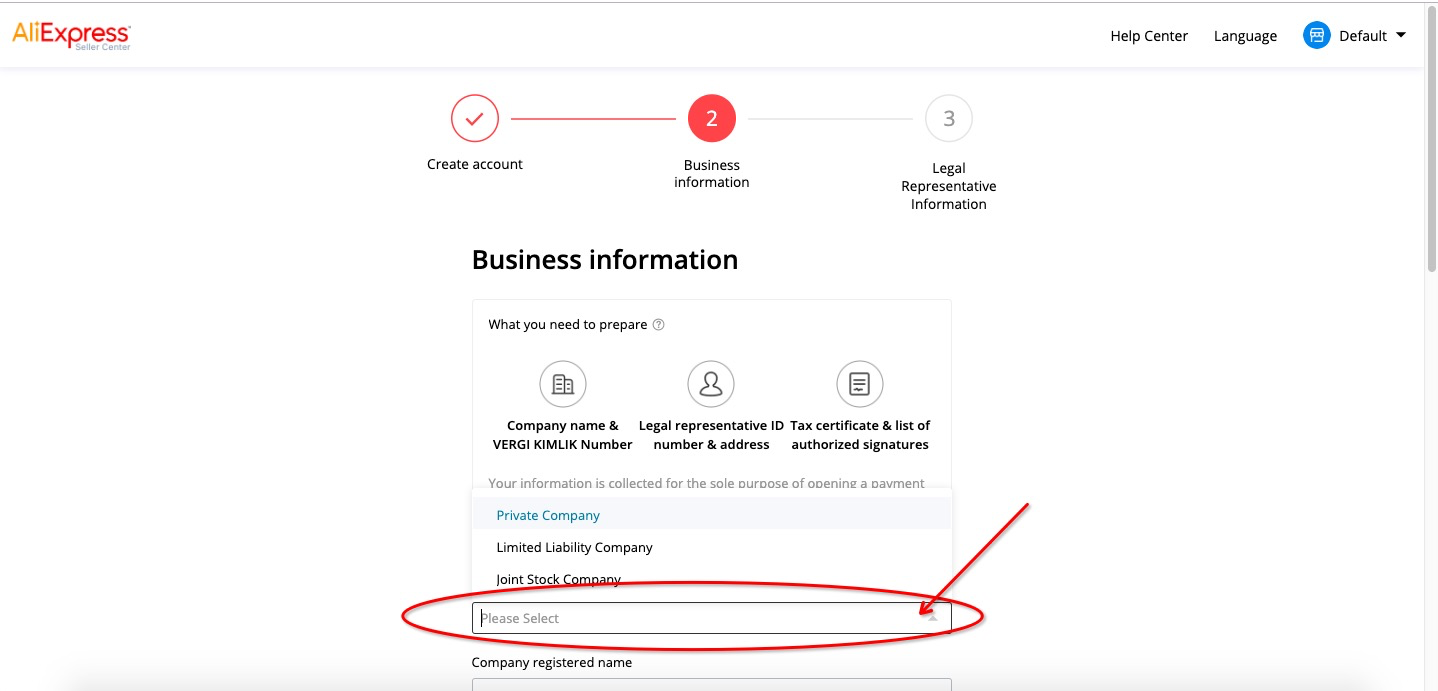

The result is a business license that has a unique registration number business license numbers. Searching for VAT Numbers in the European Union. Enter the Authority Portal.

Start by checking the invoices and other legal documents issued by that company. Using a Trading Name to find the VAT Number Enter a minimum of 5 characters to get a listing of possible matches continue to add characters to the search criteria until it narrows the results to the trade name you looking for. Select Verify VAT registration certificate service.

How to Find a Companys VAT Number Method 1 of 3. Then multiply each value of VAT registered number starting with 8 and ending with 2. Businesses can find their VAT registration numbers in the certificate issued by the South African Revenue Service.

There are a number of things you can do to find the VAT registration number of a company both online and offline. Method 3 of 3. How to Verify the Value Added Tax number.

Navigate to SARS Registered Details functionality. 25 rows Company Registration VAT No. Look up the country code for a European company.

8 x 4 32. 6 x 7 42. There is a limited range of goods and services which are subject to VAT at the zero rate or are exempt from VAT.

Confirming the correct VAT Number. Learning how to get a VAT number right is crucial. You may apply to cancel your Value Added Tax VAT registration if the value of taxable supplies falls below the limit of R1 million or if all business.

The check is mainly essential when dealing with a new business partner. List the VAT number vertically excluding the first two letters that is excluding the country code. Get company information including registered address previous company names directors details accounts annual returns and company reports if its been dissolved.

Cancel VAT registration. When you register youll be sent a VAT registration certificate. Add up all the values obtained after multiplying each value of the VAT.

Deduct 97 twice from this to make the result negative and the result is 180-97-97-14 which is the same as the last two digits so the VAT number is valid. Enter the required data and Click the Search button. The number gets logged as government records under authorities in charge of business registration AIC -Administration for Industry and Commerce in a given province.

In some countries VAT number is publicly available usually via official business register so you can look it up by company name. You must register your business for VAT with HM Revenue and Customs HMRC if its VAT taxable turnover is more than 85000. To find a VAT number look for two letters followed by a hyphen and 7-15 numbers.

EU businesses for example list their VAT ID along with their name and contact details on invoices. Finding Information on a Company. The VAT Vendor Search is subject to the general Terms and Conditions of SARS e-Filing.

5 x 2 10. Method 2 of 3.

Automatic Vat Validation For Eu Sap Blogs

Automatic Vat Validation For Eu Sap Blogs

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

Plant Abroad In Sap Within European Union And Outside Eu Sap Blogs

Plant Abroad In Sap Within European Union And Outside Eu Sap Blogs

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

5 Steps For Vat Registration Process Gccfilings Trade Finance Marketing Budget Business Finance

5 Steps For Vat Registration Process Gccfilings Trade Finance Marketing Budget Business Finance

Automatic Vat Validation For Eu Sap Blogs

Automatic Vat Validation For Eu Sap Blogs

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

Company Registration Number What Is It

Company Registration Number What Is It

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

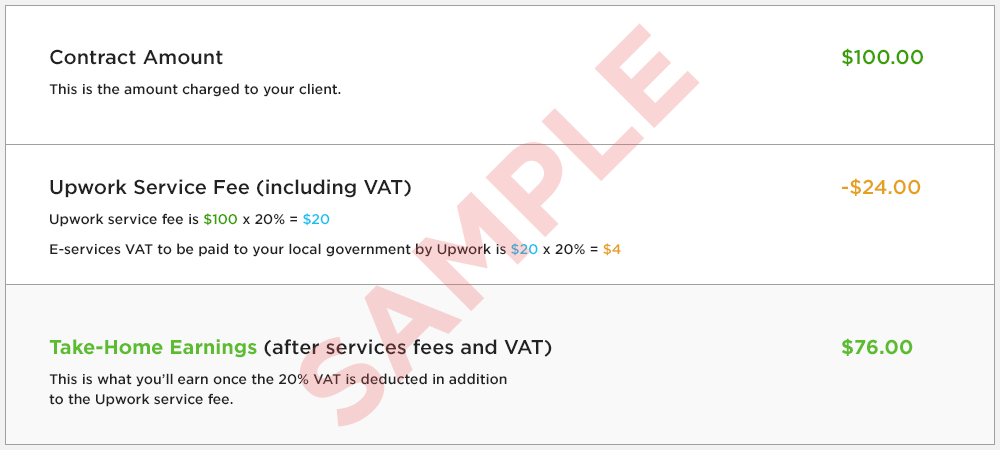

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow