Montana Corporate Income Tax Extension Form

CT-Payment-Voucher Montana Corporate Income Tax Payment Voucher Description. Learn more about Montana Residency or see the NonresidentPart-Year Resident Ratio Schedule instructions in the Montana Individual income Tax Return Form 2 Instruction Booklet for more information.

Hawaii Tax Forms And Instructions For 2020 Form N 11

Hawaii Tax Forms And Instructions For 2020 Form N 11

The 15th day of the third month following the close of the S corporations tax year.

Montana corporate income tax extension form. Check your state tax extension requirements. Approved Corporate Income Tax Software Download PDF Form. This form is for income earned in tax year 2020 with tax returns due in April 2021.

Montana Department of Revenue. Extended Deadline with Montana Tax Extension. Montanas business extension is automatic so theres no formal application or written request to submit.

This form replaced the Montana Corporation License Tax Return Form CLT-4 in 2014. You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state. Due Dates and Extensions.

A corporation is allowed an automatic extension of time for filing its return of up to 6 months following the date prescribed for filing of its tax return. File Now with TurboTax. File Your Business Tax Extension Now.

You can pay your corporate tax liability with your paper voucher or by using one of our e-pay options. CIT-Instructions Montana Form CIT Instructions 2020 Description. These instructions address the laws for most tax filers.

Use the Montana Corporate Income Tax Return Form CIT. If you file within 180 days of your last day in a combat zone you wont be charged any penalties or interest. Montana Extension Payment Requirement.

You can submit a state tax payment using Montana Form EXT-15 IT Extension Payment Worksheet Individual Income Tax Payment Voucher. It was originally provided with the certificate of authority to do business in Montana or when the corporation was incorporated in Montana. Montana S corporation returns are due at the same time as your federal Form 1120S.

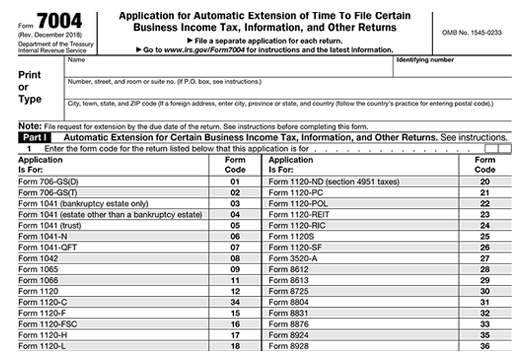

When you file your return write Combat zone or contingency operations extension in red ink at the top of your Montana Individual Income Tax Return Long Form Form 2. Deadline for taxpayers who got a MT Tax Extension to file their MT Income Tax Return by mail-in Forms - the Forms incl. Form 7004 Due - Apr 15 2021 Business Tax Extension - Get Up to 6 months Extension.

If your S corporations tax year ends on March 31 your return is due on June 15. All corporations doing business in Montana must file a Corporate Income Tax Return unless exempted under 15-31-102 MCA. 406 444-6900 Choose e-file and direct deposit for a faster refund.

Enter the letter followed by. If you have no business activity during the tax year you may file an Affidavit of Inactivity for Corporations Partnerships and Disregarded Entities Form INA-CT. File Your State Tax Extension Now.

2018 Montana Form CIT Corporate Income Tax Instructions MONTANA DEPARTMENT OF REVENUE Its Easy to File and Pay Electronically. TransAction Portal TAP Business Tax. Montana Tax Extension Form.

An extension of time to file is not an extension of time to. We last updated Montana Form EXT in March 2020 from the Montana Department of Revenue. You may use this form to file your Montana corporate income taxes.

2019 Montana Form CIT Instructions Page 3 States office and begins with a letter followed by six to eight digits. Form EXT-FID is a Montana Corporate Income Tax form. Mailing addresses are listed below - is October 15 2021.

Check out Online Services at revenuemtgov. Montana offers a 6-month extension which moves the corporation filing deadline to November 15 for calendar year filers. See the Montana Form CIT Corporate Income Tax Booklet for more details on filing Corporate Income Tax.

If you have a tax situation not represented in the booklet see Title 15 of the Montana Code Annotated. Optionally the eFileIT deadline is Oct. The instructions do not include the Form CIT.

Form 8868 Due - May 17 2021 Nonprofit Tax Extension - Get 6 months Extension. Obtaining an extension will prevent you from being subject to often very large failure-to-file penalties. The tax penalty and interest must be paid when the return is filedThe tentative payment must be submitted with the Form CT Estimated Tax Coupon.

We will update this page with a new version of the form for 2022 as soon as it is made available by the Montana government. Approved Corporate Income Tax Software Download PDF Form. File Your Business Federal Tax Extension.

Your State Extension Form is FREE. The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns which can be obtained by filing the proper extension request form. Montana corporation tax returns are due by the 15 th day of the 5 th month after the close of the tax year.

If youre unsure whether you need to make a Montana extension payment complete the Worksheet on Form EXT-15. You may use this form to make corporate income tax payments.

Arkansas Tax Forms And Instructions For 2020 Form Ar1000f

Arkansas Tax Forms And Instructions For 2020 Form Ar1000f

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Income Tax Procrastinators Can Breathe Easy State Pdclarion Com

Income Tax Procrastinators Can Breathe Easy State Pdclarion Com

New Mexico Tax Forms And Instructions For 2020 Form Pit 1

New Mexico Tax Forms And Instructions For 2020 Form Pit 1

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Missouri Tax Forms 2020 Printable State Mo 1040 Form And Mo 1040 Instructions

Missouri Tax Forms 2020 Printable State Mo 1040 Form And Mo 1040 Instructions

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Virginia Tax Forms 2020 Printable State Va 760 Form And Va 760 Instructions

Virginia Tax Forms 2020 Printable State Va 760 Form And Va 760 Instructions

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Colorado Tax Forms 2020 Printable State Co 104 Form And Co 104 Instructions

Colorado Tax Forms 2020 Printable State Co 104 Form And Co 104 Instructions