1099 Nec Form Box 7

If you made any direct sales of 5000 or more of consumer products for resale buy-sell deposit-commission or any other basis enter an X in the checkbox. My paper 1099-NEC says nonemployee compensation in box 7.

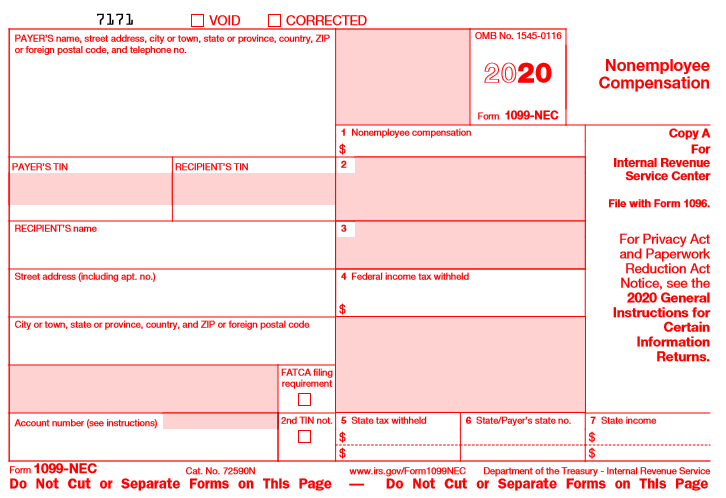

The 1099-NEC is the new form to report nonemployee compensationthat is pay from independent contractor jobs also sometimes referred to as self-employment income.

1099 nec form box 7. Previously companies reported this income information on Form 1099-MISC Box 7. Follow The Protecting Americans from Tax Hikes PATH Act of 2015 requires Forms 1099-MISC reporting non-employee compensation NEC in box 7 to be filed by January 31. Payers may use either box 2 on Form 1099-NEC or box 7 on Form 1099-MISC to report any sales totaling 5000 or more of consumer products for resale on buy-sell deposit-commission or any other basis.

You can enter your form. And if the issuer sent you a 1099-MISC with your payment listed in another box thats ok. Examples of this include freelance work or driving for DoorDash or Uber.

Changes in the reporting of income and the forms box numbers are listed below. If payments to individuals are not subject to this tax and are not reportable elsewhere on Form 1099-MISC report the payments in Box 3. Or you can enter an X in Box 7 on Form 1099-MISC.

This is the most common situation and the only box most businesses will need to select for payment types. On the new 1099-misc box 7 is for something completely different. If you filed 1099-MISC with only Box 7 in the past you should most likely choose Box 1 - Nonemployee Compensation on the 1099-NEC.

Automatic Extension for Form 1099-Misc Box 7. It is simply a checkbox. As the New Year is approaching faster than ever businesses are preparing for a less-challenging 2021 by gathering all the information needed to e-file Form 1099-NEC for the tax year 2020-2021.

Do not enter an amount in Box 2. Generally amounts reportable in Box 7 are subject to self-employment tax. Due to the creation of Form 1099-NEC we have revised Form 1099-MISC and rearranged box numbers for reporting certain income.

The IRS provides an easy way for 1099-misc filers to request an automatic 30-day extension for filing 1099 Tax Forms. Form 1099-NEC box 2. The IRS will automatically provide a 30-day extension if the filer is requested.

Payer made direct sales of 5000 or more checkbox in box 7. The 1099-MISC box 7 was also used to report fees commissions prizes awards and other forms of compensation for services. Reporting NEC whether filed on paper or electronically.

If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. So did the person send you the wrong form. Prior to 2020 you would include nonemployee compensation in Box 7 on Form 1099-MISC.

In box 7 turbo tax has state income. For further information see the instructions later for box 2 Form 1099-NEC or box 7 Form 1099-MISC. Therefore a Form 1099-MISC is due as follows.

Depending on the agreement this form was also used to report golden parachute payments. What is reported on 1099-NEC. In 2020 Box 7 on Form 1099-MISC turned into Payer made direct sales of 5000 or more of consumer products to a buyer recipient for resale and nonemployee compensation is reported on Form 1099-NEC instead.

If your 1099-MISC is from 2020 and box 7 is checked but there is no other information on the form then the issuer most likely also sent you a 1099-NEC that reports your payments. Beginning in 2020 box 7 will be used to indicate the payer made direct sales of 5000 or more of consumer products to a buyer. Crop insurance proceeds are reported in box 9.

Just enter your 1099-NEC as you would normally theres nothing you need to do with this blank 1099-MISC. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. The following are some examples of payment to be reported in box 7.

Prior to the 2020 tax year when you filed your 1099-MISC tax return with the IRS box 7 was a money field used to report Nonemployee compensation but now if you look at the form you can see that box 7 is a check box for indicating if the payer made direct sales of 5000 or more of consumer products to a buyer recipient for resale. With Box 7 eliminated from Form 1099-MISC the new Form 1099-NEC is where businesses have to report nonemployee compensations. The old 1099-misc box 7 now goes to the new 1099-NEC box 1.

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Nec 2020 Public Documents 1099 Pro Wiki

1099 Nec 2020 Public Documents 1099 Pro Wiki

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Https Www Idmsinc Com Pdf 1099 Nec Pdf

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

1099 Nec Form Copy C 2 Discount Tax Forms

1099 Nec Form Copy C 2 Discount Tax Forms

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Misc Vs Form 1099 Nec How Are They Different

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services