Is 1099 Income Qbi

I fully agree with your interpretation. These includable items must be effectively connected with the conduct of a trade or business within the United.

Something Went Wrong Adding Gmail To Outlook Outlook Ads Gmail Outlook

Something Went Wrong Adding Gmail To Outlook Outlook Ads Gmail Outlook

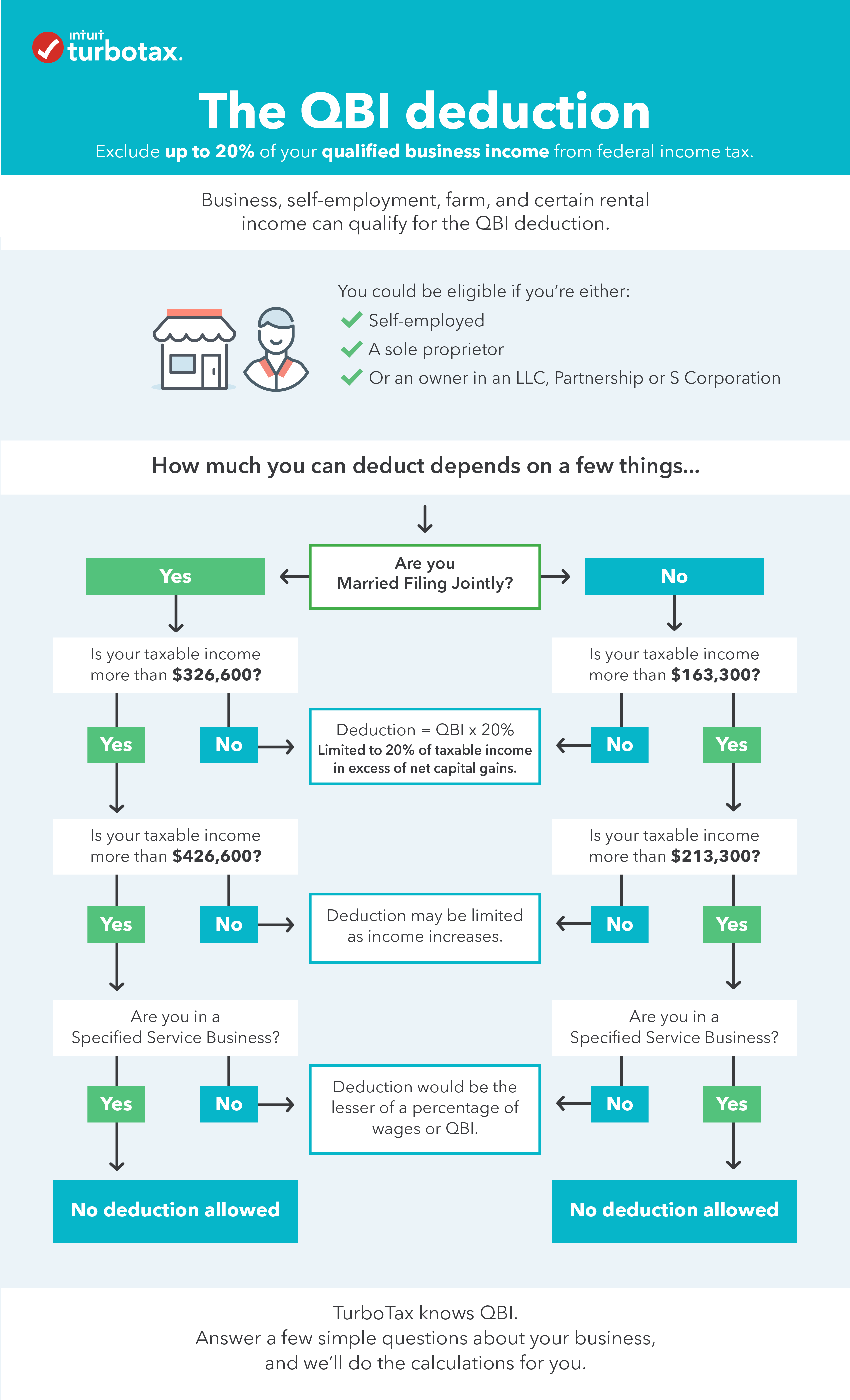

For more help understanding whether your income qualifies for the QBI deduction consider talking with a CPA or tax attorney.

Is 1099 income qbi. Most freelancers operate a sole proprietorship which is also the most common type of business structure in the United States. In other words QBI does not include the 199Ag deduction or the regular 199Aa deduction because the deduction is not included in taxable income for purposes of this section and only those items that are included in taxable income for this section can be qualified items of income gain deduction or loss. My opinion could be changed with the regulations which are supposed to come out soon.

The Qualified Business Income QBI Deduction is a tax deduction for pass-through entities. If your taxable income before the QBI deduction isnt more than 157500 315000 if married filing jointly your specified service trade or business is a qualified trade or business and thus may generate income eligible for the QBI deduction. This is true even if you dont file a Schedule C.

20 percent of your qualified business income QBI. The deduction is limited to the lesser of the QBI component plus the REITPTP component or 20 percent of the taxable income minus net capital gain. I work as an independent contractor in my home for a website.

Yes Sole Proprietors can qualify for QBI. The 20 QBI deduction under Sec. If you are getting a 1099-MISC for your work then you are likely an independent contractor or freelancer.

Learn if your business qualifies for the QBI deduction of up to 20. Qualified business income QBI is ordinary business income not interest dividends or capital gain from 1099-MISC Schedule C or K-1 plus qualified REIT dividends and qualified publicly-traded partnership income. With rare exception you get the 20 QBI and the program will deal with it just fine.

115-97 is available only for activities that qualify as a trade or business. It does not include the W-2 compensation of an S-corp shareholder nor the K-1 guaranteed payments paid to a partner. Rental Owners 1099s And the New QBI Guidance The IRS released a revenue procedure today Friday that clarifies the treatment of rental properties and the qualified business income deduction.

You can find the amount of your qualified REIT dividends in box 5 of a 1099-DIV. The QBI deduction applies to freelancers just like it would apply to anyone else who operates a sole proprietorship. Work as a Sole Proprietor or a contractor is considered Qualified Business income as.

The revenue procedure provides a safe harbor where rental activity can be presumed to be a trade or business for QBI purposes. Income reported on Form 1099-MISC as an insurance agent would be subject to self-employment tax but possibly be eligible for the QBI deduction. 199A introduced by the law known as the Tax Cuts and Jobs Act PL.

You are relating things that do not relate. This question has entered the spotlight with the qualified business income QBI final regulations issued this year TD. Social Security taxable wages are capped at a maximum each year.

Income reported on Form 1099-MISC from services as an investment adviser would be subject to self-employment tax but is also income derived from an SSTB that would not be taken into account in determining the QBI deduction. For this deduction qualified REIT dividends include most of the REIT dividends that people earn. Thus in Mikes case his Section 199A deduction is the lesser of.

If you are a Form 1099 worker you will be responsible for the entire 153 FICA tax on the net income from your business which is usually referred to as the self-employment tax While this may seem unfair the rationale is that you are serving as both the employee and employer and should pay both halves of. That if youre using the 1099 to aver reasonable compensation you cant use that income for the QBI deduction due to 199A c 4 A. 20 times 90000 plus 10000 plus 1000 less 707 less 1000 less 12000 87293 17459.

Do I qualify for QBI if I receive a 1099-MISC. REIT dividends PTP income. If your taxable income before the QBI deduction is more than 157500 but not 207500 315000.

If the income is reported in box 7 then its self-employment income. The deduction for one-half of self-employment taxes is factored into the determination of QBI. Yes if you have 1099 income you are considered to be self-employed and you will need to pay self-employment taxes Social Security and Medicare taxes on this income.

QBI is the net amount of qualified items of income gain deduction and loss from any qualified trade or business including income from partnerships S corporations sole proprietorships and. The 1099-Misc is a notational function which means it is used for reporting what happened when it meets the reporting threshold. 20 of Taxable Income.

It doesnt define anything regarding the QBI. QBI is the net amount of qualified items of income gain deduction and loss from any qualified trade or business including income from partnerships S corporations sole proprietorships and certain trusts. If your client made 5m from consulting but no one paid more than 599 there would never be any 1099-Misc forms used for reporting.

/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Knowledge Base Business Assets Help Center Financial Planning Software Rightcapital

Knowledge Base Business Assets Help Center Financial Planning Software Rightcapital

Microsoft Bluetooth Notebook Mouse 5000 Not Working Youtube Bluetooth Setup Notebook

Microsoft Bluetooth Notebook Mouse 5000 Not Working Youtube Bluetooth Setup Notebook

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Understanding The New Qualified Business Income Deduction

Understanding The New Qualified Business Income Deduction

Can Independent Contractors Take The Qualified Business Income Deduction Taxhub

Can Independent Contractors Take The Qualified Business Income Deduction Taxhub

Details On The Final Regulations On Hardship Distributions For 401 K Plans Can Be Found By Visiting Pisenti Brinker S We How To Plan Regulators Distribution

Details On The Final Regulations On Hardship Distributions For 401 K Plans Can Be Found By Visiting Pisenti Brinker S We How To Plan Regulators Distribution

The Qbi Deduction Business Entities Can Claim The 20

The Qbi Deduction Business Entities Can Claim The 20

Understanding The New Qualified Business Income Deduction

Understanding The New Qualified Business Income Deduction

Guide To Taxes As An Independent Contractor Tax Deductions

Guide To Taxes As An Independent Contractor Tax Deductions

Can Independent Contractors Take The Qualified Business Income Deduction Taxhub

Can Independent Contractors Take The Qualified Business Income Deduction Taxhub

What Is The Qualified Business Income Qbi Deduct

What Is The Qualified Business Income Qbi Deduct

Transitioning From The 1099 Misc To The 1099 Nec Form How Does This Impact You

Transitioning From The 1099 Misc To The 1099 Nec Form How Does This Impact You

What Happens If I Have Form 1099 And A Form W 2 Income In The Same Year

What Happens If I Have Form 1099 And A Form W 2 Income In The Same Year

How To Know If You Can Claim The Qualified Business Income Deduction On Your Taxes Financial Poise

How To Know If You Can Claim The Qualified Business Income Deduction On Your Taxes Financial Poise