How To Transfer Ownership Of A Sole Proprietorship Philippines

An attorney can tell you the best process for your jurisdiction and help you define what assets should be included with the sale. Register your business in the Bureau of Internal Revenue BIR Go to the Regional District Office RDO where your business is located.

How To Transfer Ownership Of A Sole Proprietorship Legalzoom Com

How To Transfer Ownership Of A Sole Proprietorship Legalzoom Com

The attorney can help you define the documents and contracts that will need to be drawn up and signed by both the buyer and the seller.

How to transfer ownership of a sole proprietorship philippines. Once you have created your corporation you must transfer assets from your sole proprietorship to the corporation. Heres a step-by-step process for registering a sole proprietorship in the Philippines. First address which assets and rights the acquiring sole proprietor wants.

The deed for declaring transfer is different from a regular partnership deed. Register with the Barangay Office where the business is going to be located to acquire a Barangay Certificate of Business. Transfer of Ownership Sole Proprietorship Requirements Ground Floor Sangguniang Panlungsod Bldg Davao City 8000 Philippines Tel No.

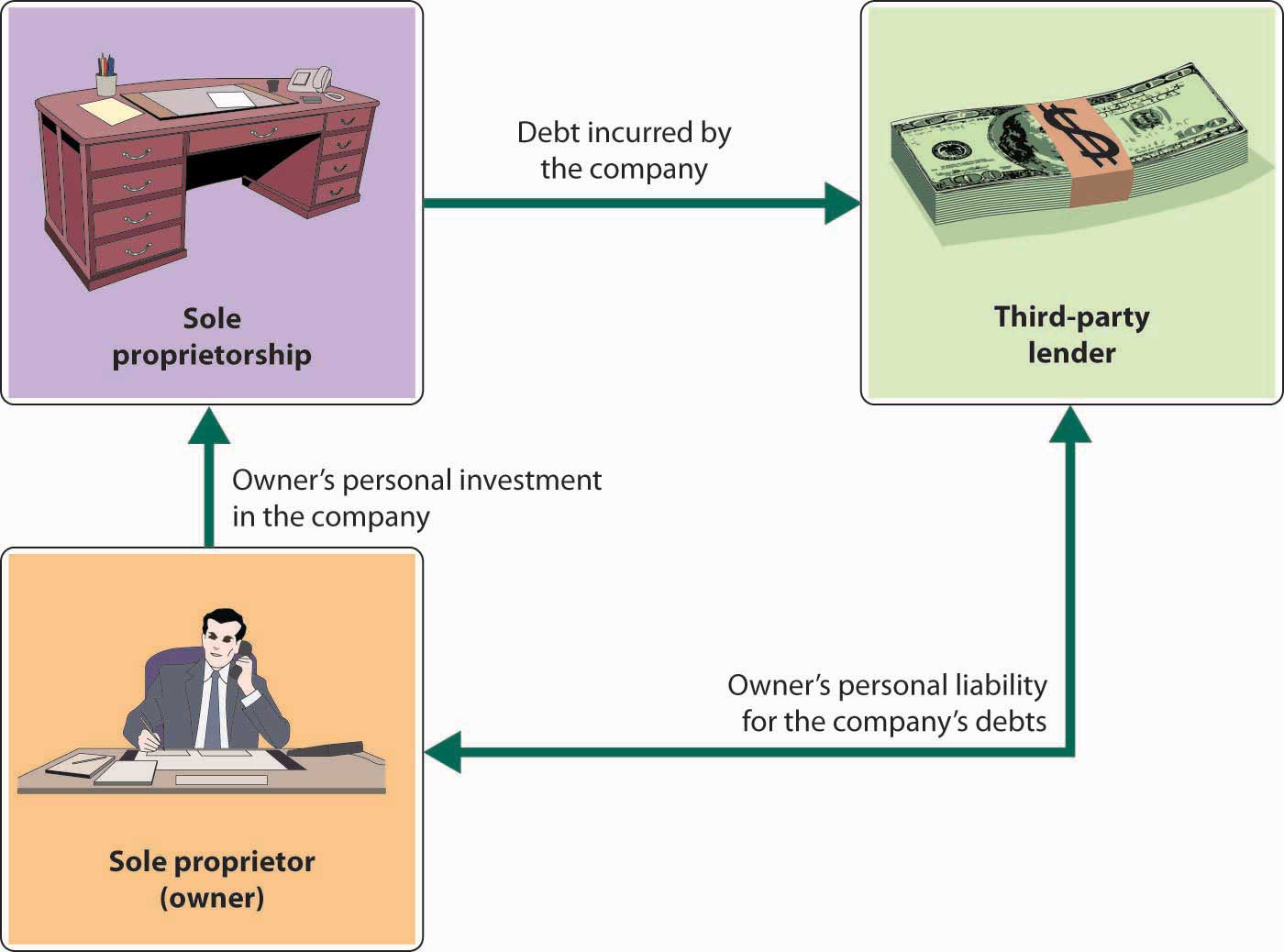

Currently there is no way to transfer ownership of a sole-proprietorship business and partnerships. 082 241-1000 Loc 378. The first step in transferring ownership of a sole proprietorship is to ensure that the personal assets and liabilities of the sole proprietor are separate from the assets and liabilities of.

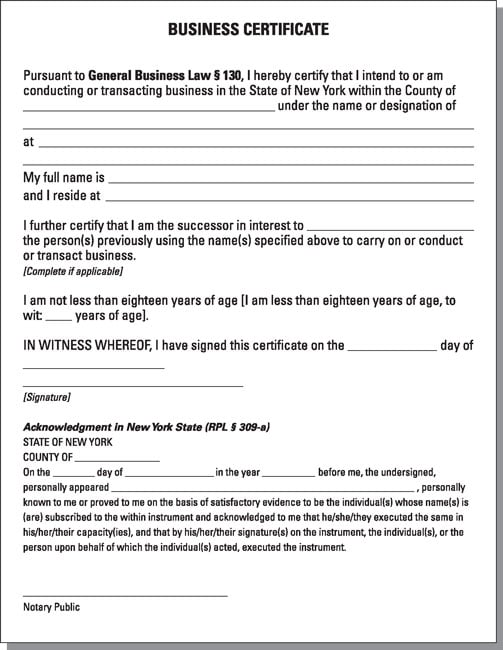

Single proprietorship how formed. Voluntary closure of a business happens when the owner decides to close the business on his or her will due to reasons like ceasing the business to avoid incurring more losses when the business is not financially performing well or cancelling the proprietorship business due to transformation to. Register your sole proprietorship Declaration of Transfer.

Fill-up the BIR Form 1901 Application for Registration for Sole Proprietor Submit completed registration form together with. Execute title transfers or quitclaim deeds if applicable in favor of the new owner. The first step in selling your sole proprietorship is consulting an attorney.

When you are transferring assets from your proprietorship to your corporation you should do so only under the provision of Section 85 of the Income Tax Act. Register a business name with DTI to acquire a DTI Certificate of Registration. Your relative would need to close their business and cancel its business name so that you can adopt the same business type.

You have to do this and you have to file the related Section 85 forms. A solo proprietorship cannot be sold or transferred in the same way that other business entities can be sold. A proprietorship business might be ceased for many reasons.

Then the private limited liability company can be changed into joint stock corporation however this procedure can be completed by increasing the share capital of the private company and listing it on the Stock Exchange in the Philippines. According to LegalZoom a sole proprietorship changes. It is not encumbered by the strict regulatory laws and rules imposed upon corporations and partnerships.

In addition to your completed BIR form 1901 you will need to submit your Certificate of Registration from DTI your Barangay Clearance Certificate your Mayors Business Permit proof of residency and valid ID. The sole trader can also be changed into a partnership however this is not such a common change in a Philippines company structure. You will be required to fill out a BIR form 1901 which is an application to register your sole proprietorship.

Government registration of a single proprietorship business is simple. It could be voluntary or involuntary. Consequently the new owner must open new accounts for the business in his own name.

It will make several references to the proprietorship business and will declare the transfer to a partnership firm. If real property is part of the business and you own the property free of any liens or encumbrances then you may simply execute a quitclaim deed to effectuate the transfer. You can incorporate a sole proprietorship at any time of the year but it is best to do it close to the beginning of the year because you must file a different tax return for each business type you operate during the year.

Compensation options range from an immediate lump sum to a series of payments over time. To transfer full ownership of the business without lingering liabilities the original owner must close out all accounts for the business that are in his name. Second establish how the acquiring sole proprietor will compensate you.

A single proprietorship is the simplest form of business organization in the Philippines.

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Also Known As The Sole Trader Or Simply A Proprietorship Is A Type Of Business Entity That Is Sole Proprietorship Sole Trader Business

A Sole Proprietorship Also Known As The Sole Trader Or Simply A Proprietorship Is A Type Of Business Entity That Is Sole Proprietorship Sole Trader Business

Sole Proprietorship Vs Partnership Top 9 Differences With Infographics

Sole Proprietorship Vs Partnership Top 9 Differences With Infographics

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Affidavit Of Sole Proprietorship Fill Out And Sign Printable Pdf Template Signnow

Affidavit Of Sole Proprietorship Fill Out And Sign Printable Pdf Template Signnow

Sole Proprietorship And Your Import Export Business Dummies

Sole Proprietorship And Your Import Export Business Dummies

Partnership Formation A Sole Proprietor And An Individual With No Business Form A Partnership Youtube

Partnership Formation A Sole Proprietor And An Individual With No Business Form A Partnership Youtube

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

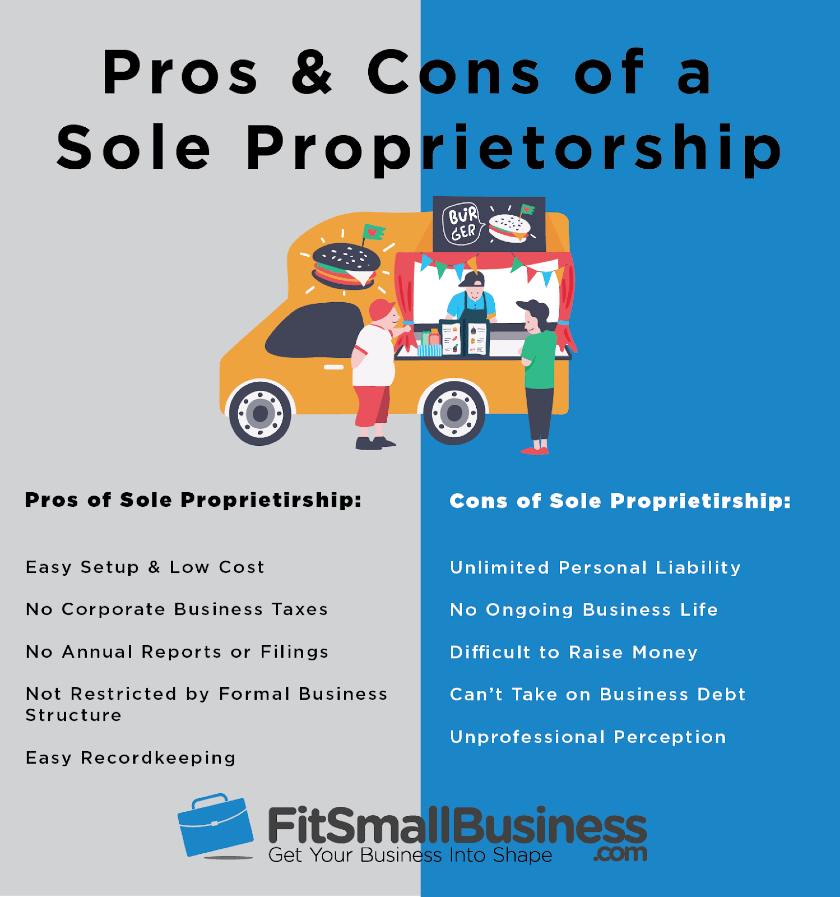

5 Sole Proprietorship Pros And Cons

5 Sole Proprietorship Pros And Cons

3 Major Differences Between Sole Proprietorship One Person Corporation Opc Cg Singh Cpa Associates

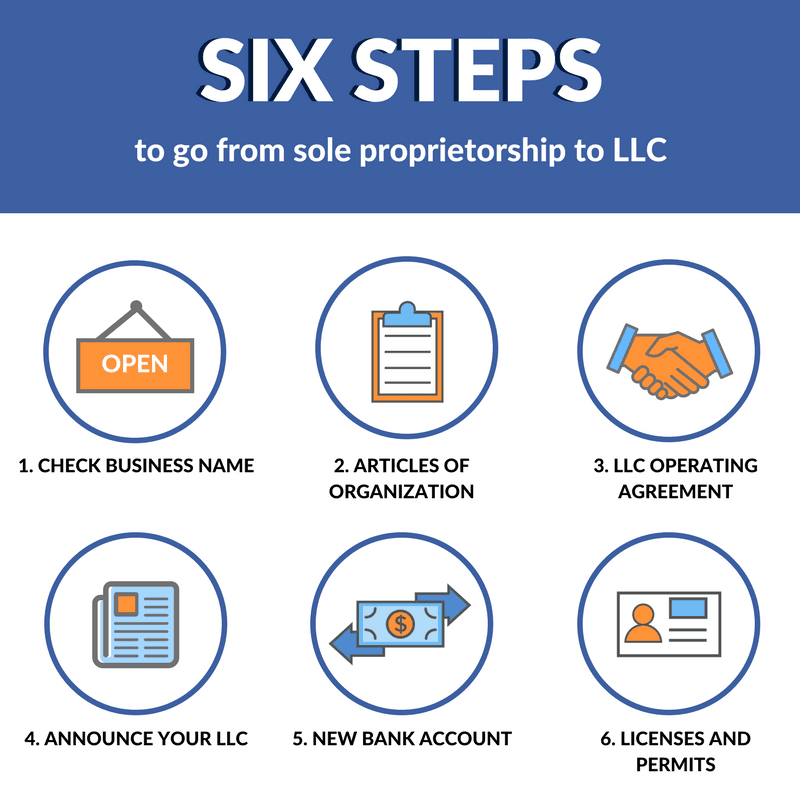

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

Converting A Sole Proprietorship To A Corporation Youtube

Converting A Sole Proprietorship To A Corporation Youtube

Forms Of Business Ownership Business Ownership Organization Development Business

Forms Of Business Ownership Business Ownership Organization Development Business

9 Disadvantages Of Sole Proprietorships Important In 2021

9 Disadvantages Of Sole Proprietorships Important In 2021

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

How To Do Bookkeeping For Sole Proprietor Explained

How To Do Bookkeeping For Sole Proprietor Explained