How To Reinstate Installment Agreement With Irs

If you cannot pay the new tax liability in 30 days the Internal Revenue Manual permits the IRS to reinstate your installment by adding the new balance to your payment plan if doing so permits you to repay both the old and new taxes without adding more than two months to the length of the agreement. 0 fee for changes made to existing Direct Debit installment agreements.

The Ultimate Burger Ultimate Burger Caller Id Sodial

The Ultimate Burger Ultimate Burger Caller Id Sodial

For example if you have 60 months left to pay what you owe the IRS will.

How to reinstate installment agreement with irs. Debt amounts between 25000 and 50000 do not require the former payment methods but without one selected the. It is always best to call the IRS to confirm the reinstatement and not just send the payment. Its possible to reinstate your installment agreement with the IRS within 30 days of receiving notice CP 523.

Log in to the Online Payment Agreement tool using the ApplyRevise button below. The IRS may reinstate the agreement in the following circumstances. Within the next 30 days after the CP523 notice you can reinstate the installment agreement to avoid IRS levies.

Staying current and compliant filing current returns timely paying current taxes timely paying installment payments on time and in full by the due date taking notice of any addition or increase to the agreement taking notice of a 1 or 2 year financial review once the agreement is set up paying any and all notices if additional tax penalty or interest. Under the People First Initiative the IRS didnt. Recall that a taxpayers obligations under an IRS Installment Agreement are pretty simple.

The IRS will not issue a levy until 90 days after the CP523Letter 2975 date. Calculate your monthly payment. Contact the IRS right away to see if you can reinstate your agreement.

Taxpayers who suspended their installment agreement payments between April 1 and July 15 2020 will need to resume their payments by their first due date after July 15. To apply online use the Online Payment Agreement Application OPA on the IRSs website. The Internal Revenue Service may terminate installment agreements without advance notice if the Secretary or his duly authorized representative eg.

Apply revise by phone mail or in-person. This gives the taxpayer time to correct the issue that caused the default and reinstate the installment agreement. If the IRS determines that the organization meets the requirements for tax-exempt status it will issue a new determination letter.

If the IRS Revenue Officer refuses to reinstate your Installment Agreement speak to their manager. What you need to do Make your payment before your termination date to prevent your installment agreement from being terminated. Select your payment method.

The following must be maintained throughout the duration. You defaulted because of extra tax liabilities and can pay the amount due in two additional monthly installments. Call the IRS number on your notice and tell them why you want to appeal the termination.

If making a debitcredit card payment processing fees apply. Options to Reinstate a Defaulted Installment Agreements The taxpayer has 30 days from the date of the CP523 before the IRS may terminate the installment agreement. Contact the IRS at 800-829-1040 TTYTDD 800-829-4059 or the number on the notice to.

On the first page you can revise your current plan type payment date and amount. The tax agency can automatically do so under these two circumstances. You may have to pay a fee to reinstate it or.

Pay your current taxes on time file your tax returns on time and make your installment payments faithfully. If an organization has had its tax-exempt status automatically revoked and wishes to have that status reinstated it must file an application for exemption and pay the appropriate user fee even if it was not required to apply for exempt status initially. In this situation you must have some ability to pay your taxes but cant pay in full within the remaining time the IRS has to collect.

Revenue officer or other contact employee believes that collection of the tax covered by the installment agreement is in jeopardy. The IRS may allow you to make payments until this collection period expires. Heres what people need to do to restart their IRS Installment Agreements Offers in Compromise or Private Debt Collection program payments.

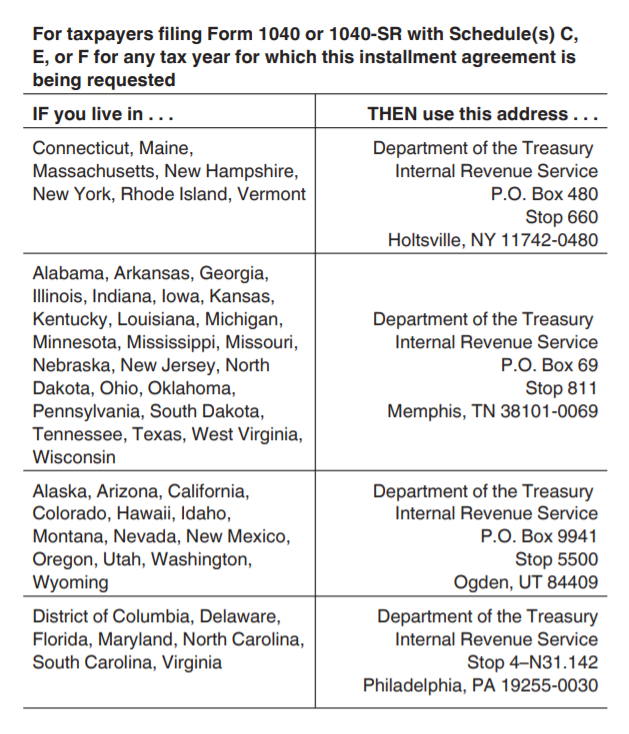

As a general rule an optimized temperance agreement does not require a new analysis of financial statements and is easier to implement than an unrationalized temperance agreement. Calling the IRS at 1-800-829-7650 Visiting a local IRS office Completing Form 9465 with information about both the original agreement balance and the expected new balance. Make sure to call within 30 days at best or 76 days at worst.

Then submit your changes. If your new monthly payment amount does not meet the requirements you will be prompted to revise the payment amount. You can request an amendment to the installment agreement by.

However the IRS has the discretion to request new financial information depending on your circumstances to reinstate the agreement. When applying through the mail complete Form 9465 Installment Agreement Request or Form 433-D Installment Agreement. Under new IRS criteria debt amounts between 50000 to 100000 require a direct debit or a payroll deduction and generally carry a tax lien.

However due to IRS practices and resource deficiencies there is quite a bit more to it than compliance and faithful monthly payments. 43 fee which may be reimbursed if certain conditions are met.

/9465-700bb91065234917b8d2866f2306afe9.jpg) Form 9465 Installment Agreement Request Definition

Form 9465 Installment Agreement Request Definition

Can I Have Two Installment Agreements With The Irs

Can I Have Two Installment Agreements With The Irs

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

What To Do If Your Irs Installment Agreement Is Terminated

What To Do If Your Irs Installment Agreement Is Terminated

Irs Letter 2975 Intent To Terminate Installment Agreement H R Block

Irs Letter 2975 Intent To Terminate Installment Agreement H R Block

Pin By Cheryl On W310 Clear Words Road Signs Audit

Pin By Cheryl On W310 Clear Words Road Signs Audit

Tax Refund Fraud Irs Crackdown May Ensnare Legit Taxpayers Income Tax Return Filing Taxes Tax Questions

Tax Refund Fraud Irs Crackdown May Ensnare Legit Taxpayers Income Tax Return Filing Taxes Tax Questions

Https Www Irs Gov Pub Irs Prior I9465 2017 Pdf

Beware Of Tax Actions That May Extend Statute Of Limitations With Irs

Beware Of Tax Actions That May Extend Statute Of Limitations With Irs

Why Do You Need A Chicago Tax Attorney Andrew Gordon Has Years Of Experience In Dealing With The Irs And He Has Defended Tax Lawyer Tax Attorney Good Lawyers

Why Do You Need A Chicago Tax Attorney Andrew Gordon Has Years Of Experience In Dealing With The Irs And He Has Defended Tax Lawyer Tax Attorney Good Lawyers

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

Irs Installment Agreement Default Irs Cp523 What To Do Next

Irs Installment Agreement Default Irs Cp523 What To Do Next

30 Payment Plan Letter Template Hamiltonplastering

30 Payment Plan Letter Template Hamiltonplastering

Irs Covid 19 Payment Plan Relief Is Over Time To Restart Your Installment Agreement Irs Mind

Irs Covid 19 Payment Plan Relief Is Over Time To Restart Your Installment Agreement Irs Mind

Pin By Antonia Ventura On Tonita Doctors Note Template Fillable Forms Rental Agreement Templates

Pin By Antonia Ventura On Tonita Doctors Note Template Fillable Forms Rental Agreement Templates

Https Www Irs Gov Pub Notices Cp523 English Pdf

Fha Gift Letter Template Elegant Gift Letter For Mortgage Letter Gifts Letter Templates Lettering

Fha Gift Letter Template Elegant Gift Letter For Mortgage Letter Gifts Letter Templates Lettering

Film Release Form Template Awesome 50 Free Location Release Forms For Documentary Film Releases Film Templates

Film Release Form Template Awesome 50 Free Location Release Forms For Documentary Film Releases Film Templates

Reinstating Defaulted Irs Installment Agreements Wagner Tax Law

Reinstating Defaulted Irs Installment Agreements Wagner Tax Law