How To Find The Enterprise Value Of A Company

EV Market Cap Debt Cash and cash equivalents Market cap is found by multiplying the current market price by the shares outstanding. The calculation used to arrive at a companys enterprise value is as follows.

Where Is Enterprise Value Used Enterprise Value Financial Modeling Business Valuation

Where Is Enterprise Value Used Enterprise Value Financial Modeling Business Valuation

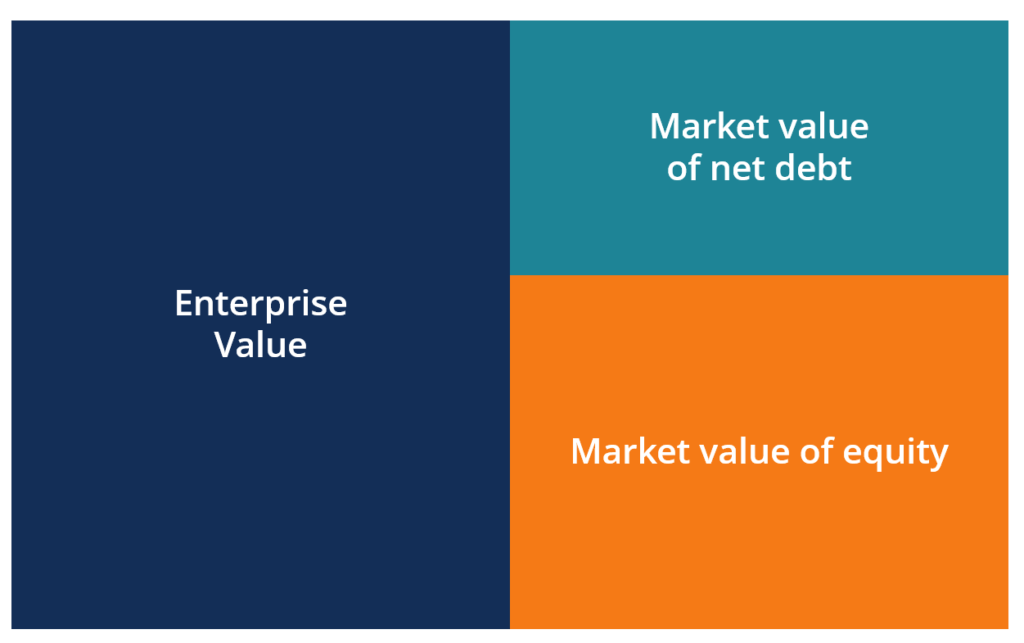

Rather than just looking at equity value enterprise value also takes market value into consideration which means that all ownership interests and asset claims are included in the valuation ie.

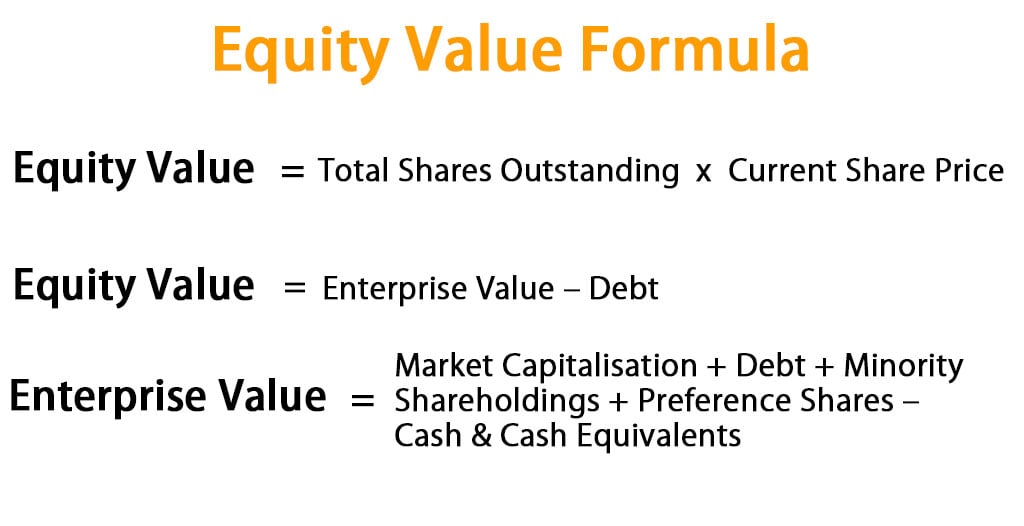

How to find the enterprise value of a company. Market capitalization value of the common shares of the company Preferred shares If they are redeemable then they are treated as debt. Enterprise value is calculated as the market capitalization plus debt minority interest and preferred shares minus total cash and cash equivalents. Market Cap Current market price shares outstanding.

To find scientific solutions for difficult-to-treat diseases. Enterprise value is a measure of a businesss total value. You can calculate enterprise value by adding a corporations market capitalization preferred stock and outstanding debt together and then subtracting out the cash and cash equivalents found on the balance sheet.

It is one of the important parameters to market capitalization evaluation of the companys stock value. How to calculate enterprise value Simple formula. Start by adding up the company market capitalization number its preferred stock and total outstanding debt.

The enterprise value of a company shows how much money would be needed to buy that company. The formula for enterprise value is. Estimate EVRevenue Multiple There are three methods for estimating EVRevenue Multiples.

A more complicated formula to calculate enterprise value. A biopharmaceutical company doubles its RD productivity. This customer is one of the largest biopharmaceutical companies in the world.

Estimate Company Revenues There are fee-based subscription services like Pitchbook Hoovers from DB and Privco. Stock price multiplied by the number of outstanding shares. Enterprise value takes over the price of a company that means it tells us about the companys net worth.

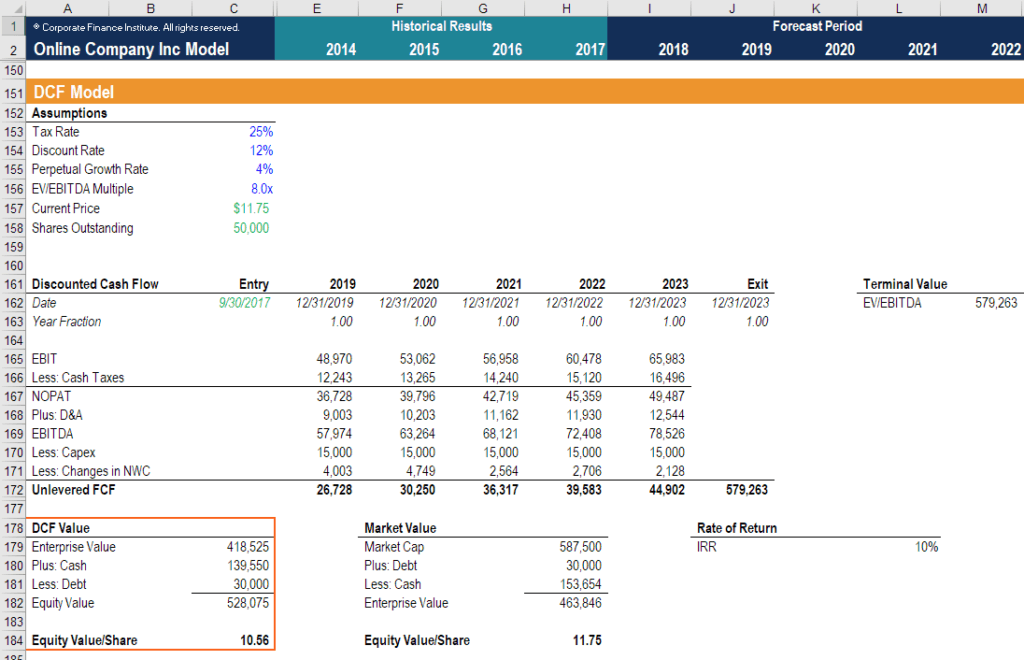

To Determine the Enterprise Value and EBITDA. Enterprise Value EV Market Capitalization Market value of debt Cash and cash equivalents Looking at the above formula it can be understood that Firm Value is in fact obtained by the refinement of the Market Capitalization. As stated earlier the formula for EV is essentially the sum of the market value of equity market capitalization and the market value of debt of a company less any cash.

By engaging multiple potential buyers the seller. Enterprise Value market capitalization value of debt minority interest preferred shares cash and cash equivalents EBITDA Earnings Before Tax Interest Depreciation Amortization. They include public company.

And its 40000 scientists researchers communicators manufacturing specialists and regulatory experts all rally around a single goal. How to Calculate the Enterprise Value of a Private Company 1. 12 hours agoUse case 1.

EV is calculated by adding market capitalization and total debt then subtracting all. Ultimately the value of an enterprise is determined by what price a buyer is willing to pay for it and what price a seller is willing to accept. The formula for enterprise value is calculated by adding the companys market capitalization preferred stock outstanding debt and minority interest together and then deducting the cash and cash equivalents obtained from the balance sheet.

Enterprise value is the measurement of a companys total value.

Enterprise Value Ev Formula Definition And Examples Of Ev

Enterprise Value Ev Formula Definition And Examples Of Ev

Intangible Assets A Hidden But Crucial Driver Of Company Value Intangible Asset Company Values Fintech Startups

Intangible Assets A Hidden But Crucial Driver Of Company Value Intangible Asset Company Values Fintech Startups

Enterprise Value Ev Formula Definition And Examples Of Ev

Enterprise Value Ev Formula Definition And Examples Of Ev

User Growth Still Lagging Heavily Behind Sales Growth Pinterest Management Enterprise Value White Glove Social Media

User Growth Still Lagging Heavily Behind Sales Growth Pinterest Management Enterprise Value White Glove Social Media

Equity Value Formula Calculator Excel Template

Equity Value Formula Calculator Excel Template

Enterprise Value Forward Sales Enterprise Value Value Stocks Growth Company

Enterprise Value Forward Sales Enterprise Value Value Stocks Growth Company

How Is Enterprise Value Calculated Enterprise Value Capital Market Equity Market

How Is Enterprise Value Calculated Enterprise Value Capital Market Equity Market

Enterprise Value Enterprise Value Financial Analysis Finance Investing

Enterprise Value Enterprise Value Financial Analysis Finance Investing

Enterprise Value Formula Step By Step Guide To Ev Calculation

Enterprise Value Formula Step By Step Guide To Ev Calculation

Market Capitalization How To Calculate It Napkin Finance In 2021 Capital Market Investing Investing Infographic

Market Capitalization How To Calculate It Napkin Finance In 2021 Capital Market Investing Investing Infographic

Here S How To Calculate The Enterprise Value Of A Company Enterprise Value Enterprise Company

Here S How To Calculate The Enterprise Value Of A Company Enterprise Value Enterprise Company

Ebitda Valuation Enterprise Value Investing Enterprise

Ebitda Valuation Enterprise Value Investing Enterprise

Company Valuation Multiples Analysis Enterprise Value Excel Templates

Company Valuation Multiples Analysis Enterprise Value Excel Templates

The Digital Landscape On Twitter Infographic Marketing Global Market Dow Jones Index

The Digital Landscape On Twitter Infographic Marketing Global Market Dow Jones Index

Enterprise Value Ev Formula Definition And Examples Of Ev

Enterprise Value Ev Formula Definition And Examples Of Ev

Ev Ebit Ratio Overview Formula Interpretation And Example

Ev Ebit Ratio Overview Formula Interpretation And Example

Enterprise Value Meaning Importance Calculation

Enterprise Value Meaning Importance Calculation

Discounted Cash Flow Valuation Template Cash Flow Cash Flow Statement Enterprise Value

Discounted Cash Flow Valuation Template Cash Flow Cash Flow Statement Enterprise Value

Enterprise Value Meaning Importance Calculation

Enterprise Value Meaning Importance Calculation