Does Paypal Send 1099s

Additionally Form 1099-K does not include the sales tax when it is automatically collected and remitted by eBay. BTW here is what HR Block says on their site about the 1099K.

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

PayPal is considered a third-party merchant and they are required to issue their own 1099 forms called a 1099-K.

Does paypal send 1099s. Only those customers that meet the 1099-K eligibility requirements will see the 1099-K available for download in their account. When does PayPal Send out 1099 and when can I start selling again. If you dont see your 1099 form then dont make the.

The answer is. You received 20000 in gross payment volume from sales of goods or services in a single year You received 200 payments for goods or services in the same year Once both of. Payment settlement entities such as PayPal Stripe or Square are required to send out a 1099-K if you meet the reporting thresholds.

You can access your 1099-K from your PayPal account by January 31st annually. The tax form will only be issued if the payment meets the other requirements for issuing a. In this situation the taxpayer will be looking at 1099s totaling 100000 when in fact only.

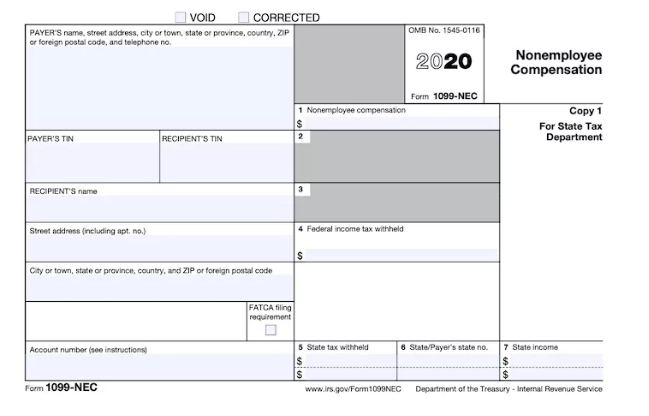

Starting with the tax year 2020 Form 1099-NEC is replacing Form 1099-MISC for non-employee payments. If you cross the IRS thresholds in a given calendar year PayPal will send Form 1099-K to you and the IRS for that tax year the following year. PayPal is required to send the IRS form 1099-K by January 31st for managed payments from the previous calendar year.

If you paid your contractors over 20k each via a payment processor technically you dont have to give them a 1099-Misc because Paypal Stripe Venmo etc. If all the payments are made through PayPal PayPal may then issue form 1099-K also for 50000. That is the case even if you paid the recipient more than 600 last year.

PayPal is not going to file a 1099-K form with the IRS and then retract it just because you wish they hadnt filed one. That rule is just when the form is actually required. Tue Oct 6 223108 2020.

You should get 1099 from Paypal sometime in Januaryif you meet 200 transactions and 20k in payment collected via goods and services. If you cross the IRS thresholds in a given calendar year PayPal will send Form 1099-K to you and the IRS for that tax year the following year. However this rule was recently changed in Massachusetts and Vermont laws whose sellers only have to make 600 to trigger a 1099.

I have not signed up for managed paymentsI sell very little but like paypal sending me a checkwhich has a 150 chargeAs I understand oct 15 you will be forced to. See the separate Instructions for Form 1099-K In short PayPal will issue Form 1099-K to your contractor. If you use the Friends and Family option for payment through PayPal or a similar option through Venmo or Wave you may need to issue a 1099-MISC for the payment.

So you do not need to send Form 1099-MISC. If you are going to process over the 20000 and 200 in PayPal or other third party network transactions then you need to tell your clients to not report a 1099-NEC on your behalf for the income they send to you through Paypal. If you dont want to wait for your form to arrive you can read it online by logging into your PayPal account.

As you can see here Paypal is required to send 1099s to the IRS if a person receives over 20000 AND receives over 200 payments in a year. View solution in original post. Both requirements must be metif you start selling in.

If you paid the contractor via PayPal business you do not have to issue the contractor a 1099-NEC. You can access your 1099-K from your PayPal account by January 31st annually. 1099-K detailed report To help reconcile the transactions included on your Form 1099-K you can download a 1099-K detailed report that provides a detailed breakdown of all unadjusted gross payment transactions on your 1099-K form.

You are not required to send a 1099 form to independent contractors such as freelancers or to other unincorporated businesses such as LLCs if you paid them via PayPal or credit card. Sellers Fear eBay Will Err in 1099 Reports to IRS.

What Is A 1099 Nec And What Do I Need To Know About 1099s Jetro Small Business Accountant

What Is A 1099 Nec And What Do I Need To Know About 1099s Jetro Small Business Accountant

1099 Misc 2019 1099 Misc 2019 2020 1099 Misc Fillable Form 2019 Irs Forms Efile Fillable Forms

1099 Misc 2019 1099 Misc 2019 2020 1099 Misc Fillable Form 2019 Irs Forms Efile Fillable Forms

What S The Deadline The 1099 Deadline Specifically 1099 Misc Is January 31 2017 To Send 1099s To The Recipien Small Business Tax Credit Repair Business Tax

What S The Deadline The 1099 Deadline Specifically 1099 Misc Is January 31 2017 To Send 1099s To The Recipien Small Business Tax Credit Repair Business Tax

Understanding The 1099 K Gusto

Understanding The 1099 K Gusto

Do You Need To Issue A 1099 Misc Due

Do You Need To Issue A 1099 Misc Due

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

What Is A 1099 Nec And What Do I Need To Know About 1099s Jetro Small Business Accountant

What Is A 1099 Nec And What Do I Need To Know About 1099s Jetro Small Business Accountant

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

Paypal 1099 Taxes The Complete Guide

Paypal 1099 Taxes The Complete Guide

If I Paid All My Contractors Via Paypal Do I Need To Issue Any 1099s Amy Northard Cpa The Accountant For Creatives

If I Paid All My Contractors Via Paypal Do I Need To Issue Any 1099s Amy Northard Cpa The Accountant For Creatives

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Must You Send 1099 Forms To Contractors Paid Via Paypal Or Credit Card Small Business Trends Small Business Trends Small Business Blog Business Trends

Must You Send 1099 Forms To Contractors Paid Via Paypal Or Credit Card Small Business Trends Small Business Trends Small Business Blog Business Trends

Home Based Biz Owners Understanding The 1099 Misc Tax Form Your Questions About Receiving Or Sending A 1099 Misc Tax F Electronic Forms Irs Forms Tax Forms

Home Based Biz Owners Understanding The 1099 Misc Tax Form Your Questions About Receiving Or Sending A 1099 Misc Tax F Electronic Forms Irs Forms Tax Forms

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Small Business Tax Tax Organization Tax Quote

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Small Business Tax Tax Organization Tax Quote

Filing 1099s Who Gets One Capforge

Filing 1099s Who Gets One Capforge

If I Paid All My Contractors Via Paypal Do I Need To Issue Any 1099s Amy Northard Cpa The Accountant For Creatives

If I Paid All My Contractors Via Paypal Do I Need To Issue Any 1099s Amy Northard Cpa The Accountant For Creatives