What Are The General Business Credits Reported On Form 3800

Unused credits are carried back one year five years for oil and gas production from marginal wells and carried forward a maximum of 20 years or until the taxpayer dies whichever comes first. Youll figure each sub-investment credit separately.

Don T Overlook General Business Credits Carryback

Don T Overlook General Business Credits Carryback

If you claim multiple business credits then our program will draft Form 3800 General Business Credits onto your return.

What are the general business credits reported on form 3800. Carryforwards to that year the earliest ones first. If there is no tax liability on the Form 1041 the Form 3800 will not generate. Credit Ordering Rule General business credits reported on Form 3800 are treated as used on a first-in first-out basis by offsetting the earliest-earned credits first.

The credits supported by our program that will populate on this form are. Sep 12 2019 The General Business Credit Form 3800 calculates the total amount of tax credits youre eligible to claim in a particular tax year. Input for the Form 3800 is in Screen 38 Other Credits and Withholding.

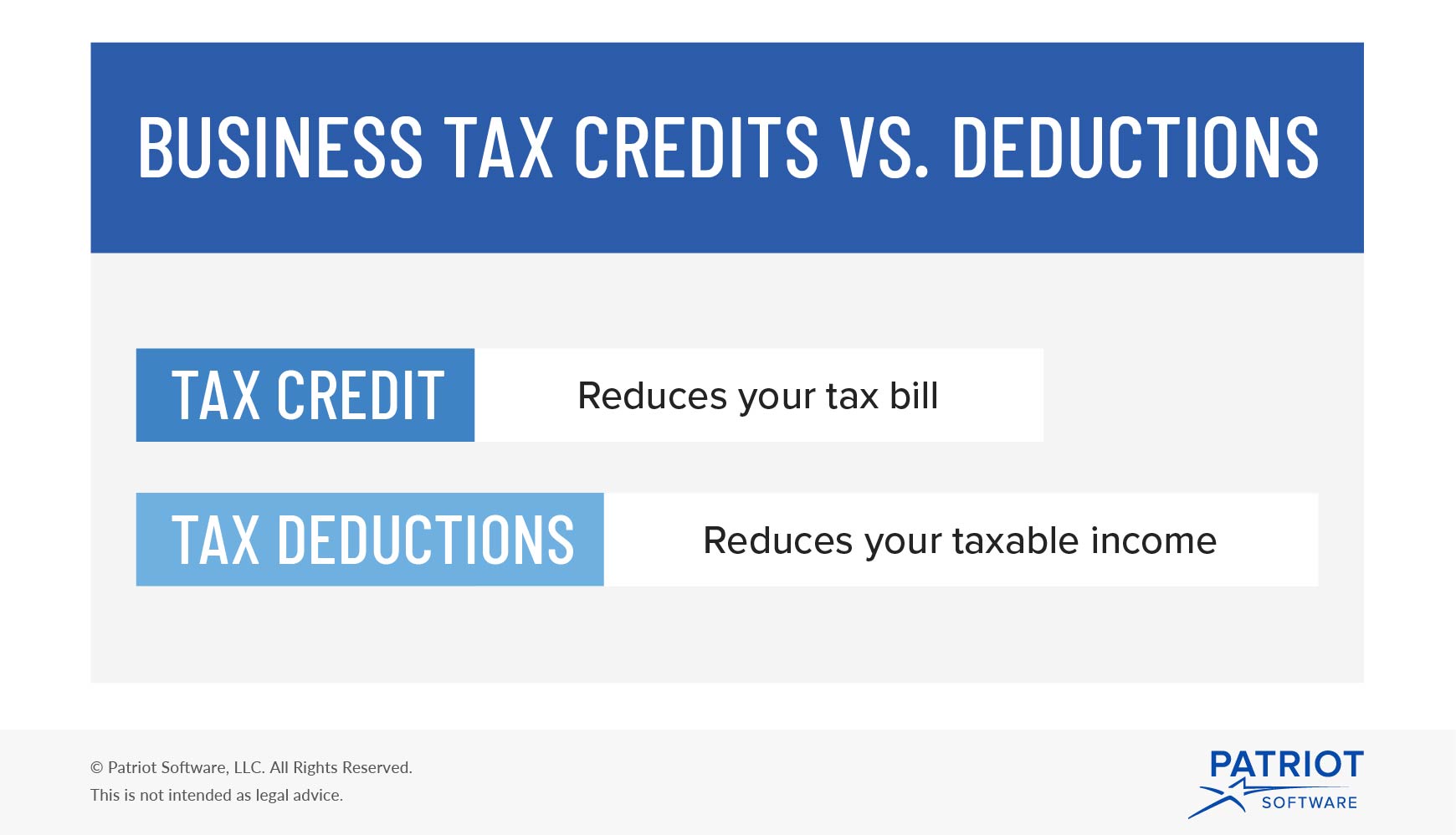

This credit is part of the general business credit and is reported on Form 3800. 25 of your regular income tax liability after other credits over 25000. Feb 03 2021 Updated February 03 2021 The General Business Credit Form 3800 is used to accumulate all of the business tax credits you are applying for in a specific tax year to come up with a total tax credit amount for your business tax return.

If you only have one credit you Form 3800 is not required. Form 3800 2020 Page 3 Names shown on return Identifying number Part III General Business Credits or Eligible Small Business Credits see instructions Complete a separate Part III for each box checked below. If a section 1603 grant is received the carryforward must be reduced to zero.

File Form 3800 to claim any of the general business credits. The general business credit is a nonrefundable credit limited to the tax liability on the return. On the 3800 form the RD Tax credit is added together with all the other General Business Credits and appropriately carried over to the front of the income tax return as follows.

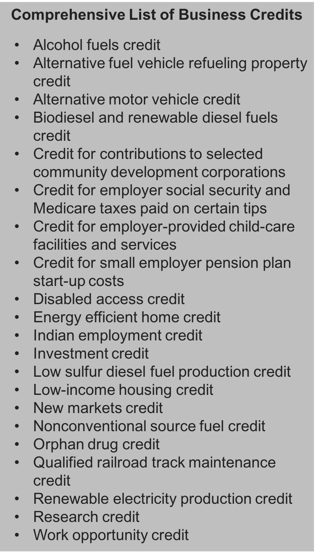

For each credit attach a statement showing the tax year the credit originated the amount of the credit reported on the original return and the amount of credit allowed for that year. Investment credit Form 3468 Low-income housing credit Form 8586 Disabled access credit Form 8826 The investment credit is also made up of several different credits. A General Business Credit From a Non-Passive Activity B General Business Credit From a Passive Activity.

Carryback and Carryforward of Unused Credit The carryforward may have to be reduced in the event of any recapture event change in ownership change in use of property etc. The input to put credits directly on the Schedule K-1 is in Screen 43 Schedule K-1 OverridesMiscellaneous. If your first year for claiming the low-income housing credit was in 1998 then 2017 will be the last year to claim this credit.

Individuals Form 1040 Schedule 3 line 54 or Form 1040NR line 51 Corporations Form 1120 Schedule J. Therefore the order in which the credits are used in any tax year is. In some cases each credit must be claimed on its own unique form the source form.

Jun 14 2017 The general business credit Form 3800 is made up of many other credits like. Jun 04 2019 This General Business Credits Carryforward section of TurboTax goes back to 1998 when selecting the first year the credit was claimed. The tentative AMT from Form 6251.

Also state whether the total. NOTETo claim credits carried over from a prior year taxpayers must provide details. I nvestment Form 3468 Increasing Research Activities Form 6765 Alternative Motor Vehicle.

You should only file Form 8846 if you meet both of. Therefore the order in which the credits are used in any tax year is. None of the credits listed can.

You will be able to deduct the remaining credit amount next year. Complete Form 3800 and the source credit form for each. Mar 08 2021 File Form 3800 to claim any of the general business credits.

You must file Form 3800 to claim any of the general business credits. Certain food and beverage establishments can use Form 8846 to claim a credit for social security and Medicare taxes paid on employees tips. We last updated the General Business Credit in January 2021 so this is the latest version of Form 3800 fully updated for tax year 2020.

Your limit for the general business credit on Form 3800 is your regular tax liability after tax credits other than the general business credit plus actual AMT liability from Form 6251 if any minus whichever of the following is larger. The resulting combined credit is carried over to the General Business Tax Credit Form 3800 to determine the overall allowable credit. Carryforwards to that year the earliest ones first.

Credits Not Reported on Form 3800. The credit claimed is subject to a limitation based on your tax liability that is figured on the form used to compute that particular credit. You must use Form 3800 if you have more than one of the credits included in the General Business Credit.

Any credit reported on the Form 3800 will be used to offset the Fiduciary tax if any on Form 1041 page 2. The IRSs website currently lists 25 eligible business credits although this can change from year to year. Three of the general business credits have special tax liability limits and are not reported on Form 3800.

Credit Ordering Rule General business credits reported on Form 3800 are treated as used on a first-in first-out basis by offsetting the earliest-earned credits first.

Tax Breaks For Hiring New Employees

Tax Breaks For Hiring New Employees

Don T Overlook General Business Credits Carryback

Don T Overlook General Business Credits Carryback

Small Business Tax Credits The Complete Guide

Small Business Tax Credits The Complete Guide

Business Tax Credits Credit Vs Deduction Types Of Credits More

Business Tax Credits Credit Vs Deduction Types Of Credits More

Form 3800 How To Complete It Fora Financial Blog

Form 3800 How To Complete It Fora Financial Blog

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Hero Motocorp Ltd Formerly Hero Honda Is The World S Single Largest Two Wheeler Motorcycle Manufacturer Company Based In Ind Hero Motocorp Banner Design Hero

Hero Motocorp Ltd Formerly Hero Honda Is The World S Single Largest Two Wheeler Motorcycle Manufacturer Company Based In Ind Hero Motocorp Banner Design Hero

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Business Tax Credits Credit Vs Deduction Types Of Credits More

Business Tax Credits Credit Vs Deduction Types Of Credits More

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

What Is A Hybrid Car Tax Credit

What Is A Hybrid Car Tax Credit

Small Business Tax Credits The Complete Guide

Small Business Tax Credits The Complete Guide

Https Www Irs Gov Pub Irs Prior F3800 2005 Pdf

What S New On The 2016 Research Credit Form 6765 Accountingweb

What S New On The 2016 Research Credit Form 6765 Accountingweb