Small Business Loan Application Form Covid 19

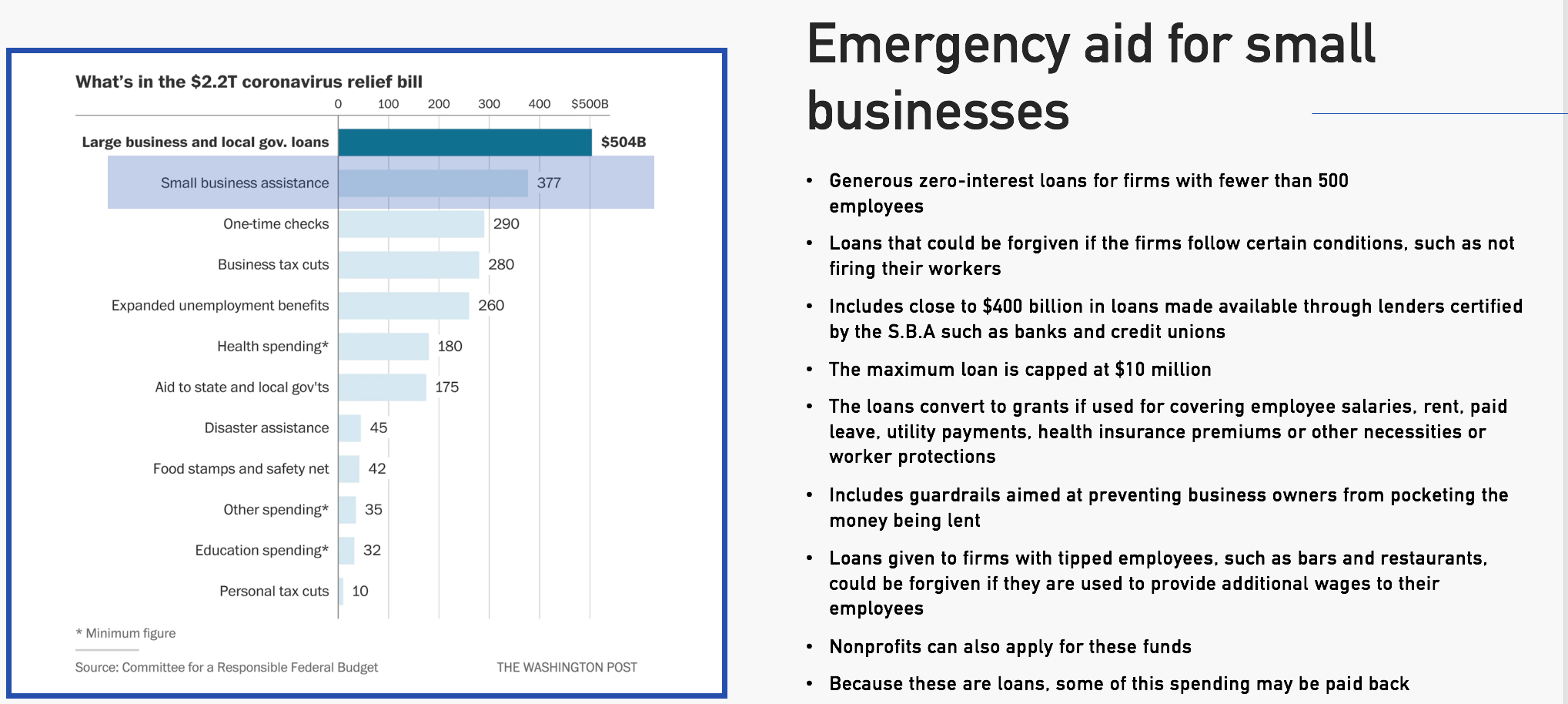

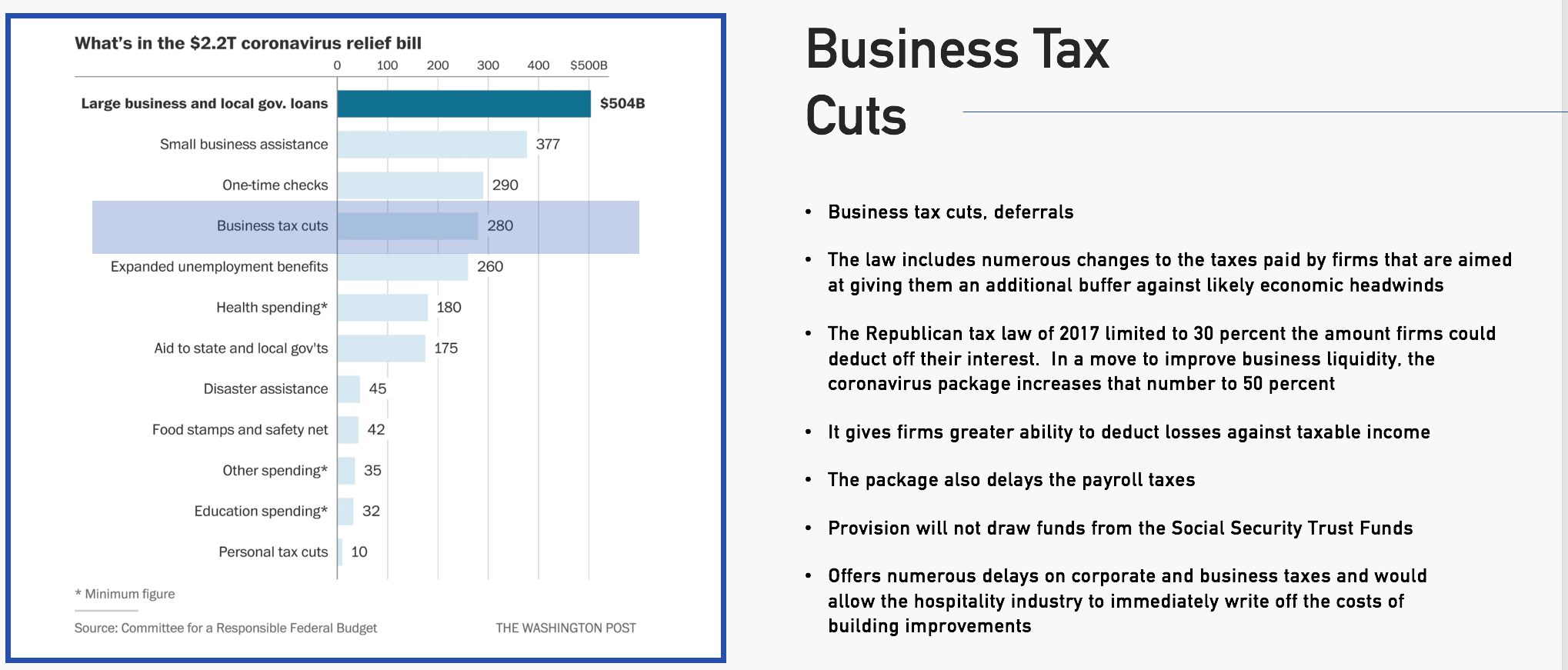

The PPP authorizes up to 349 billion in forgivable loans to small businesses to prevent more layoffs and allow companies keep their employees on the payroll during the COVID-19 pandemic. COVID-19 Recovery Grant Application.

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Eligibility Existing small enterprises with gross turnover between 50000 to 300000.

Small business loan application form covid 19. If you are eligible and choose to defer payments you would not be paying the loan principal and this means you would pay more interest over the life of the loan. We will email clients with a link to access our loan forgiveness application over the coming weeks when the application becomes available to them. Business COVID-19 The Governments Small Business Loan Program Is Lending Money Again.

Its important that you understand this impact. The RISE Small Business Loan Program is now closed for new applications. Applications are open until 31 December 2023.

This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue. Specifically on February 24 2021 at 900 am. Read the news release.

Who Can Apply for a Coronavirus Small Business Loan. As of December 1 2020 more than 793000 CEBA loans have been approved representing over 31 billion in funds. Our PPP loan forgiveness portal is now open and includes a simplified forgiveness application for PPP loans of 150000 or less.

The EIDL can give business owners fast relief through. SBA Office of Disaster Assistance 1-800-659-2955 409 3rd St SW. PRODUCT 2 COVID-19 concessional loan facility for existing small enterprises.

If you are a small business nonprofit organization of any size or a US. Agricultural business with 500 or fewer employees that has suffered substantial economic injury as a result of the COVID-19 pandemic you can apply for the COVID-19. The Clinton COVID-19 Small Business Resiliency Loan Program provides funding to qualified local businesses to address short-term impacts of the 2020.

Maximum grant amount is 2500 per business entity APPLICATION DATE. RISE an acronym for Re-Investing in our Small Business Economy is a 25 million small business loan program provided by federal CARES Act funds with the goal of helping Miami-Dade County small businesses affected by COVID-19. SBA is collecting the requested information order to make a loan under SBAs Economic Injury Disaster Loan Program to the qualified entities listed in Question 3-Organization Type below that are impacted by the Coronavirus COVID-19.

CST to Monday April 27 2020 at 5 pm. The COVID-19 public health crisis and resulting economic crisis have created a variety of challenges for small micro and solo businesses in communities across the country. This gave lenders and community partners more time to work with the smallest businesses to submit their applications while also ensuring that larger PPP-eligible businesses.

If you dont already have a myIR account you can create one. COVID-19 relief options. The Small Business Cashflow Scheme SBCS was introduced to support small to medium businesses and organisations struggling with a loss of actual revenue due to COVID-19.

After logging in to myIR go to the I want to section and select Apply for a Small Business Loan. This program is designed to help small businesses and small agricultural cooperatives who have suffered substantial economic loss due to the pandemic. Purpose Funding available for working capital support and capital investment.

An important qualification is that these businesses must be unable to secure alternative funding. SMALL BUSINESS ADMINISTRATION COVID-19 ECONOMIC INJURY DISASTER LOAN APPLICATION. COVID-19 Economic Injury Disaster Loan.

If your business has been financially impacted by COVID-19 you may be eligible to defer principal payments on your business loan. Follow the on-screen prompts to complete the application. Launched on April 9 2020 CEBA provided a 40000 zero-interest partially forgivable loan to small businesses that experienced diminished revenues due to COVID-19 and faced ongoing non-deferrable costs such as rent utilities insurance taxes and.

For more details on how to apply visit our PPP loan forgiveness site. Applications received before or after this timeframe will not be reviewed. ET SBA established a 14-day exclusive PPP loan application period for businesses and nonprofits with fewer than 20 employees.

Monday April 20 2020 at 8 am. On February 22 2021 President Biden announced the following changes to SBAs COVID-19 relief programs to ensure equity. Download Application form PDF Download these Guidelines PDF Program guidelines.

The Treasury Department is providing critical assistance to small businesses across the country facilitating the urgent deployment of capital and support to help these. Businesses cannot apply independentlyfirst local county and state officials must. You need to have a myIR account to apply for the SBCS.

Are You Qualified For The 2021 Sba Targeted Eidl Advance

Are You Qualified For The 2021 Sba Targeted Eidl Advance

Https Www Sba Gov Sites Default Files 2020 11 Covid 20eidl 20faq 20rev 20112320 508 Pdf

Instructions To Completing The Eidl Application Schwartz Schwartz Pc

Instructions To Completing The Eidl Application Schwartz Schwartz Pc

How To Fill Out The Sba Disaster Loan Application Youtube

How To Fill Out The Sba Disaster Loan Application Youtube

How To Get An Sba Disaster Loan Eidl Bench Accounting

How To Get An Sba Disaster Loan Eidl Bench Accounting

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 8 2020 2 Pm Pdf

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Https Www Sba Gov Sites Default Files Resource Files Disaster Loan Overview Eidl Ppp Carl As Of August 10 2020 Pdf

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Instructions To Completing The Eidl Application Schwartz Schwartz Pc

Instructions To Completing The Eidl Application Schwartz Schwartz Pc

How To Apply For A Sba Loan For Small Businesses Youtube

How To Apply For A Sba Loan For Small Businesses Youtube

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

7 A Loan Application Checklist The U S Small Business Administration Sba Gov

7 A Loan Application Checklist The U S Small Business Administration Sba Gov