Is Business Grant Money Taxable

Money received from your forgivable PPP loan will not be included in your gross income at the federal level but youll want to check with your state to determine if the forgiven loan is taxable on your state return. You are always better off financially if you do receive a grant.

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

However a grant made by the government of a federally recognized Indian tribe to a member to expand an Indian-owned business on or near reservations is excluded from the members gross income under the general welfare exclusion.

Is business grant money taxable. Grants to individuals for travel study or other similar purposes including loans made for charitable purposes and program-related investments are taxable expenditures unless the following conditions are met. For a sole trader or partnership preparing accounts on the cash basis this income will be taxable in the 202021 tax year and the income tax payable by 31. SBGF and RHLGF grants are classed as business income and should be recorded in your accounts as such.

This income is subject to retail sales tax and retailing BO tax. Whether you record them as sales or other income in your accounts the grants are taxable income the tax treatment of such payments is well established so the Government isnt being unfair in any way by classing such payments as taxable. Unfortunately this doesnt hold true for most business grants.

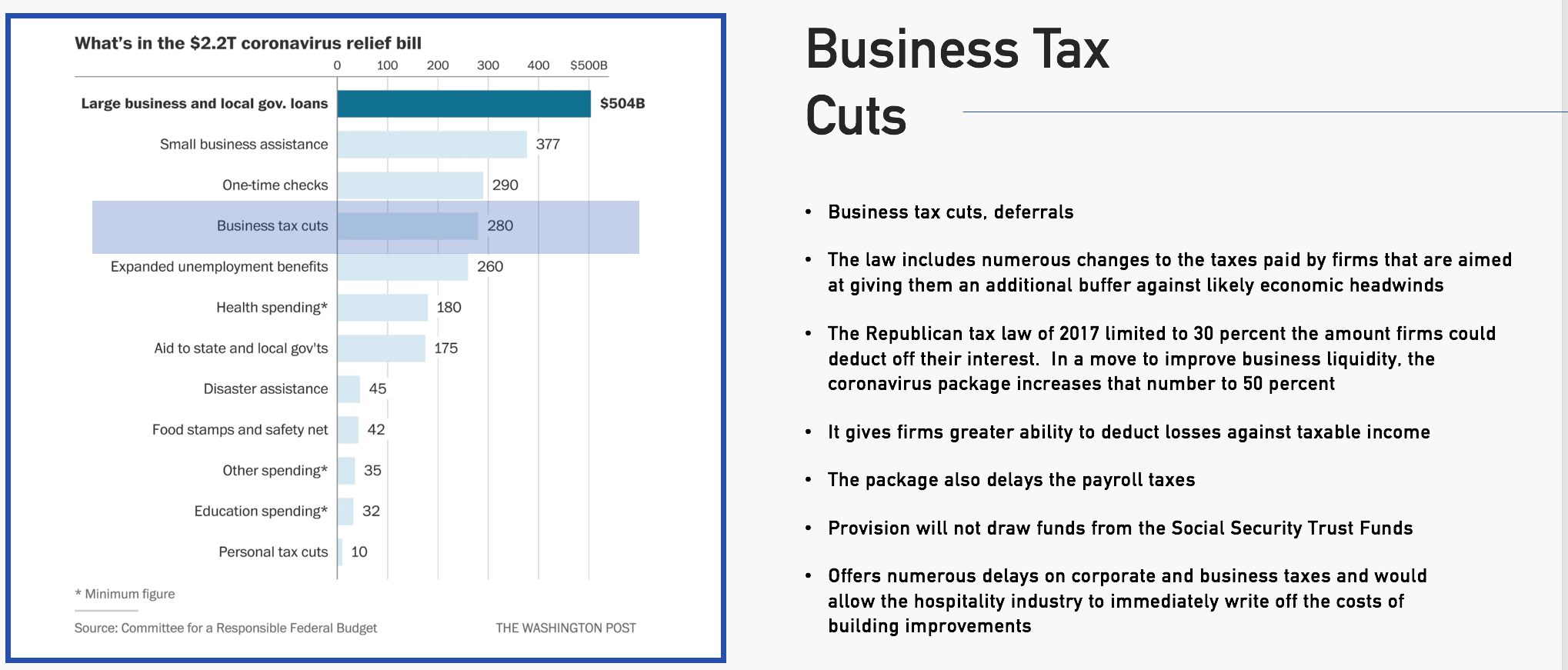

On July 6 2020 the IRS confirmed that the receipt of a government grant by a business generally is not excluded from the businesss. 61 of the Internal Revenue Code unless an exemption applies. When these grants were announced in the Budget in March 2020 it was confirmed that the funding for these two schemes was to come from local councils 202021 budgets.

In most instances grant funds are counted as taxable income on your federal tax return. However a grant made by the government of a federally recognized Indian tribe to a member to expand an Indian-owned business on or near reservations is excluded from the members gross income under the general welfare exclusion. The receipt of a government grant by a business generally is not excluded from the businesss gross income under the Code and therefore is taxable.

Business grants are exempted from tax under allowable conditions since business owners contribute to the improvement of the countrys economy. If you receive grant income that is strictly gratuitous such as a gift or donation you do not owe taxes on that amount. Income from the program is included in federal income pursuant to sec.

The budget also allocated 800 million toward a grant program for small businesses. Although the rule only applies to corporations the IRS would likely treat other businesses eg sole proprietorships partnerships LLCs and S corps similarly. Congress recently changed the tax code to make clear that any contribution by a governmental entity to the corporation is taxable.

This means that you will be required to pay taxes on these funds. You receive grant income. The grant is awarded on an objective and nondiscriminatory basis under a procedure approved in advance by the Service and.

Most claimants will not therefore have received their grant until after 5 April 2020. 61 of the Internal Revenue Code unless an exemption applies. Are payments from the Were All In Small Business Grant Phase 2 program considered taxable income.

You also provide certain retail goods or services in return. COVID-19-Related Grants to Individuals. The County of Ventura will provide 1099 tax forms to recipients at the end of 2021.

However nonresident aliens based on the Internal Revenue Code Section 117 must report those through Forms 1042 and 1042-S. Grant funding from this program is taxable and it will be reported to the IRS. Income from the program is included in federal income pursuant to sec.

It will prioritize the grant applications of women-owned minority-owned and veteran-owned businesses with less than 500000 in 2020 sales for the first 21-days of the. However there must be a donative or charitable purpose for giving the funds to qualify for this tax deduction RCW 82044282. The financial impact of a grant come tax time depends on multiple factors including your business structure.

Are payments from the Were All In Small Business Grant Phase 2 program considered taxable income. The RRF will provide tax-free federal grants equal to the amount of its pandemic revenue loss. The receipt of a government grant by a business generally is not excluded from the businesss gross income under the Code and therefore is taxable.

Grant recipients can expect to receive a Form 1099-G with the amount of grant funding it. It should be noted that while a grant recipient is required to include the grant in its gross income it can deduct andor capitalize the business expenses it paid for with these grant funds. The grant program known as the COVID-19 Pandemic Small Business Recovery Grant will make state funds available.

Grants Are Income All income from whatever source derived is taxable income unless the tax law provides an exception1 Since a government grant is income it is taxable unless otherwise provided by law. In other words you will always end up with more money after paying taxes on any grant. Thats because you will never pay more than probably 30-40 of the grant in federal and state taxes.

The RRF grants will be administered by the Small Business Administration SBA. This is true even though its taxable income.

How Your Small Business Can Get Loans Grants And Tax Breaks From

How Roth Ira Contributions Are Taxed H R Block

How Roth Ira Contributions Are Taxed H R Block

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Https Portal Ct Gov Media Decd Covid Business Recovery Phase 2 1 Ct Cares Grant One Page Updated 1132020 Pdf

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

2020 Small Business Guide To Tax And Coronavirus Relief

2020 Small Business Guide To Tax And Coronavirus Relief

Do You Have To Claim Pell Grant Money On Your Taxes Turbotax Tax Tips Videos

Do You Have To Claim Pell Grant Money On Your Taxes Turbotax Tax Tips Videos

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Gig Workers Are Eligible For This 1 000 Government Grant

Gig Workers Are Eligible For This 1 000 Government Grant

2020 Small Business Guide To Tax And Coronavirus Relief

2020 Small Business Guide To Tax And Coronavirus Relief

Taxes On Prize Winnings H R Block

Taxes On Prize Winnings H R Block

What Is The Tax Expenditure Budget Tax Policy Center

What Is The Tax Expenditure Budget Tax Policy Center

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

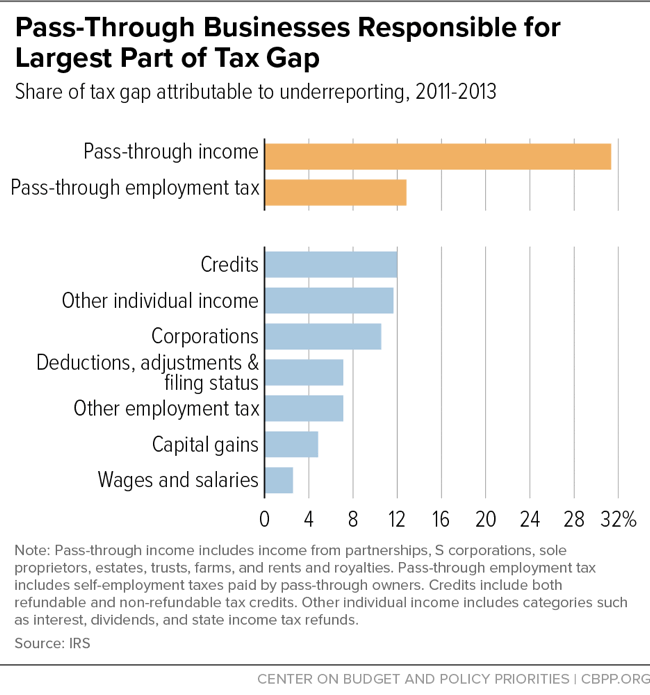

How Big Is The Problem Of Tax Evasion

How Big Is The Problem Of Tax Evasion

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Depletion Of Irs Enforcement Is Undermining The Tax Code Center On Budget And Policy Priorities

Depletion Of Irs Enforcement Is Undermining The Tax Code Center On Budget And Policy Priorities

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development