How To Get A Car Loan With 1099

The only thing is my income is based on how much I work not the same steady amount weekly. But because youre a 1099 employee you need to bring in additional documents to complete your auto loan application and prove that you meet the lenders income requirements.

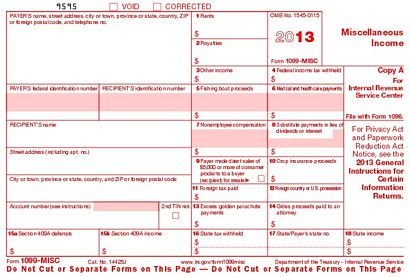

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos Tax Forms 1099 Tax Form Irs Forms

If youre buying a car theres a big chance you need to get a loan for it.

How to get a car loan with 1099. Are there auto loans for the 1099 employees. Just move to commercial like ana and deal with lenders with a brain. To find out your DTI ratio as a 1099 worker simply add together all your bills including an estimated car loan and auto insurance payment and divide the sum by your net after expense income.

Whether you are self-employed or not you should always strive to pay your bills on time and keep your debt load at an acceptable level. If a W-2 wage earner goes to a 1099 wage earner status then two years of 1099 income is required from the start date of the 1099 wage earner status date. While there are no official auto loans designed specifically for contract workers a personal loan like the ones mentioned above can be used however the borrower wants to use the funds.

Are there specific auto loans for 1099 employees. Just accept the fact you I wont be able to get traditional loans. All 1099 forms are prepared and filed by a bank only when it makes a payment to a taxpayer who must be furnished a copy by Jan.

Im a 1099 employee but get weekly checks and can prove income. 1099 wage earners who need to qualify for a mortgage loan borrowers need a two-year history as a 1099 wage earner. You upload 3 months personal bank statements and you get an instant approval.

Hence the multiple months of bank statements that way an earnings trend can be established. Whether all or part of your income is a result of being an independent contractor and you have less than perfect credit then you will want to figure out what exactly will be the best method to get approved for financing for bad credit used auto loans. This may seem obvious but maintaining a strong credit score is one of the most effective ways to secure a high-quality loan.

That money is given to the recipient whose SS appears on the 1099-C and its now taxable income to that person. Income Requirements for Subprime Lending. Nevertheless there are numerous loans that 1099 workers might qualify for and this applies to visa holders that have the status of 1099.

In this case the bank needs to determine your net compensation after business expenses so a 1099 statement by itself is insufficient. If youre already spending over 45 of what youre claiming on your tax return youre not likely to be approved for a subprime car loan. Thats part of life and will become more so as you invest.

If you are self-employed or a 1099 employee auto lenders want to see some extra documents to prove that you are able to afford a car loan. Need a car loan soon. If youre an independent contractor you should insist on being sent a Form 1099 and correctly report your income and expenses.

Since your husband was a cosigner on the loan that makes him 100 liable now that the other cosigner of the loan has passed. The lender will require a copy of Schedule C business expenses. So if a 1099 worker decided to take out a personal loan to purchase a car they would absolutely be able to do that.

For 1099 contractors who do not get W2s every single bank will ask for either tax returns or 3 months personal bank statements for a loan. As a result the bank that gives you a car loan will not send you a 1099 form because its receiving not paying your loan payments -- though other banks may send you 1099 forms for other reasons. Are There Auto Loans for 1099 Employees.

They have to report it as such on their tax return. Therefore its no longer borrowed money. Doing this for either situation will give you your best opportunity for a.

If you have credit problems and youre an employee be sure your wages get reported on a W-2. More specifically there arent financing options that are specially created for 1099 workers. Just because you are receiving a 1099 though may not necessarily mean that you should be.

Im in the same boat no way I can get a traditional loan yet I just had over 10m financed in the last 12 months. The answer is negative. But as someone suggested the easiest route is to get financing from a dealer.

1099 Wage Earners Versus W-2 Wage Earners. This process can be rather complex and has probably left you wondering How do banks verify income for an auto loan When a bank receives your application for an auto loan one of the first things it considers is your income. This can help you get the best possible car loan for your work or personal needs.

My monthly income has been about the same. Now to answer the most trivial question on our topic. You may need to complete IRS Form 4506-T Request for Transcript of the tax return.

You can still get a car loan if youre an independent contractor and have bad credit.

Car Parts Auto Parts Truck Parts Supplies And Accessories Autobarn Com Truck Parts Car Parts Automotive Accessories

1099 Employee Form Printable New Free 1099 Misc File Line Retail Resume Examples Obituaries Template Irs Forms

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

Qualify For A Car Loan Without A W 2 Auto Credit Express

Auto Loan Approvals With Bad Credit And 1099 Income Auto Credit Express

1099 Misc Form Template 1099 Misc Template 1099 Tax Form Doctors Note Template Tax Forms

2015 W2 Form Free Uber Driver Tax Specialist Uber Tax Deductions You Can Claim 1099 Tax Form Fillable Forms Tax Forms

Check Out The California Used Car Dealer Buyer S Guide Https Www Cal Surety Com Buyers Guide Dealer Insurancethe Very First Car Dealer Car Used Car Dealer

Auto Loan Approvals With Bad Credit And 1099 Income Auto Credit Express

Fha Loan With 1099 Income Fha Lenders

1099 Misc Form Download W9 Vs 1099 Irs Forms Differences When To Use Them 2018 Simple Cover Letter Template Business Letter Template Invoice Template Word

Free 1099 Pay Stub Template Inspirational Pay Stub 1099 Letter Examples Generator For Worker Letter Example Business Case Template Free Business Card Templates

1099 Form Fillable 1099 Misc Tax Form Diy Guide Rental Agreement Templates Resignation Letter Format Letter Example

Car Loan Application Form Template New 15 Loan Application Templates Free Sample Example Personal Loans Loan Application Proposal Templates

Financing Available Bad Credit No Credit No Problem 1st Time Buyers Previous Repo S 1099 Self Employed How To Apply Bad Credit Finance

Want To Finance A Used Car With Bad Credit In Texas Bad Credit Bad Credit Car Loan Better Credit Score

The Most Common 1099 Tax Deductions For Independent Contractors In 2019 Money Mimosas Tax Deductions Deduction Tax Deductions List

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Paying Off Student Loans Student Loan Help

Car Loan Application Form Template Beautiful Auto Credit Application Template Application Form Business Plan Template Pdf Estimate Template