Do Credit Card Companies Issue 1099

Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099. Due to me thinking it was identity fraud I had to freeze all my accounts including my credit and cancelled my credit card.

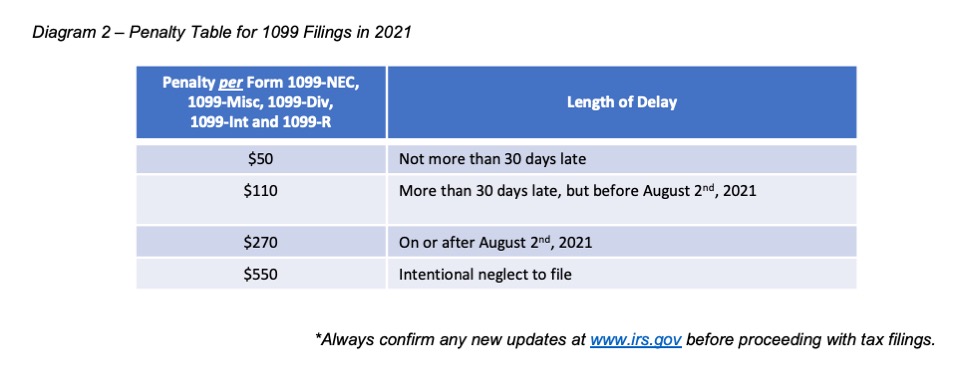

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

After a phase-in period the rules went into effect Jan.

Do credit card companies issue 1099. For many consumers after the debt collector leaves the taxman arrives. If you thought your money woes ended last year when you settled that credit card debt think again. You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent.

I have no income now for the next 4 days due to NO fault of my own. Payments made with a credit card or payment card and certain other types of payments including third party network transactions must be reported on Form1099-K by the payment settlement entity under section 6050W and are not subject. An identifiable event has occurred.

You are an applicable financial entity. For independent contractors the company is not required to issue a 1099. Payments made with a credit card or payment card and certain other types of payments including third party network transactions must be reported on.

Follow this 1099 Decision Tree to help you decide who you need to supply a form to. You cut a deal with your credit card issuer and it agreed to accept less than you owed. You will have to manually enter the information on your tax return.

Its still reportable but know 1099 is issued. It works like this. 2The excluded debt would be the total of all of the 1099c.

Do you have to issue a 1099-Misc for a payment made with a credit card. Companies to issue Forms 1099 reporting all credit card transactions. The IRS allows taxpayers to exclude from Form 1099-NEC any payments you made by credit card debit card gift card or third-party payment network such as PayPal.

If payments are reportable on both a Form 1099-MISC and 1099-K they are only reportable on a 1099-K According to IRS guidance on form 1099-K. Copies of the form are sent to both the business and to the IRS. Suppose that your law firm accepts MasterCard Visa and American Express payments for hundreds of.

Vendors who operate as C- or S-Corporations do not require a 1099. If you paid your vendor directly through your bank account check debit card ACH you are responsible for sending them a 1099. However the business will receive a Form 1099-K for these payment card transactions from the payment settlement entity.

How you paid them does not remove the requirement to file Form 1099-MISC. If you paid your 1099 recipients with only cash or check this legislation does not apply to you. Yes you have to issue your contractors a 1099-MISC for your payments to them if you paid them more than 600.

Credit card payments are reported using Form 1099-K. At its most basic level a 1099-C reports a debt that was canceled forgiven never paid back or wiped out in bankruptcy. The new form is a 1099-K and all lawyers and firms taking credit cards should beware of it.

If the creditor files a 1099-C with the IRS then typically it must provide you with a copy by January 31 so you have it for tax filing purposes that year. You had a student loan or part of a student loan forgiven. That just means the creditor must file the next year if they discharge or forgive a debt.

If you paid your vendor through PayPal or a Credit Card the merchant will issue them a 1099K and you wont have to. Next if you do meet the insolvent rule than most tax atributes will not effect you unless you run your own business. You need to file 1099 forms and have paid 1099 vendorscontractors using payment types other than cash or check such as debit card credit card or third party networking companies like PayPal.

In this situation the trade or business should continue to report payments made to independent contractors on Form 1099-MISC as they have done in the past. How to File 1099s. Months after successfully resolving credit card debts consumers may receive 1099-C Cancellation of Debt tax notices in the mail.

The IRS 1099-MISC instructions in the section titled Form 1099-K state Payments made with a credit card or payment card and certain other types of payments including third-party network transactions must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC. Dont worry about credit card payments and PayPal. Here are some reasons you may have gotten a form 1099-C.

Paypal or credit card companies only have to issue a 1099-K on transactions over 20000 or 200 transactions. File Form 1099-C for each debtor for whom you canceled 600 or more of a debt owed to you if. You will need to include all of the debt on the return so yes will have to wait for the other 1099s check with the other companies and see if they are send you a 1099.

However keep in mind you need to issue a 1099 to a landlord you are paying rent unless they meet another exception. Internal Revenue Code section 6050Wc2 requires that banks and merchant services must report annual gross payments processed by credit cards andor debit cards to the IRS as well as to the merchants who received them. This is similar to the rule for W-2s from employers.

The amounts over 600 but less than the threshold basically fall into a void.

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

How To File Your 1099 The Creative Law Shop Blog Writing Tips Business Education Blog Writing

How To File Your 1099 The Creative Law Shop Blog Writing Tips Business Education Blog Writing

Irs Courseware Link Learn Taxes

Irs Courseware Link Learn Taxes

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

Understanding The 1099 K Gusto

Understanding The 1099 K Gusto

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

Credit Cards The Irs Form 1099 K And The 19 399 Reporting Hole

Credit Cards The Irs Form 1099 K And The 19 399 Reporting Hole

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Tax Time Is Here Which Means Many Of You Are Receiving Important Irs Forms To File Your Taxes Today We W Credit Repair Credit Repair Services Credit Education

Tax Time Is Here Which Means Many Of You Are Receiving Important Irs Forms To File Your Taxes Today We W Credit Repair Credit Repair Services Credit Education

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

1099 Misc Form 2018 Credit Card Services Electronic Forms Tax Forms

1099 Misc Form 2018 Credit Card Services Electronic Forms Tax Forms

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 K Software To Create Print And E File Form 1099 K Irs Forms Irs Tax Forms

1099 K Software To Create Print And E File Form 1099 K Irs Forms Irs Tax Forms

Must You Send 1099 Forms To Contractors Paid Via Paypal Or Credit Card Small Business Trends Small Business Trends Small Business Blog Business Trends

Must You Send 1099 Forms To Contractors Paid Via Paypal Or Credit Card Small Business Trends Small Business Trends Small Business Blog Business Trends