Cares Act Small Business Loan Forms

Request for Transcript of Tax Return Form 912. Under the law the Fund is to be used to make payments for specified uses to States and certain local governments.

Covid Relief Ppp And Eip Information Congressman Tim Walberg

Document Verification Request SmallRural Lender Advantage Application Forms Always Required Form 2301- Part A.

Cares act small business loan forms. This program established under the Coronavirus Aid Relief and Economic Security Act CARES Act provides 349 billion for small business loans to cover qualified payroll costs rent. The funds are available under section 601a of the Social Security Act as added by section 5001 of the Coronavirus Aid Relief and Economic Security Act CARES Act. It also provides additional funding for SBAs Resource Partners to provide advice and training to help small businesses respond to the unprecedented challenges in.

Valid EIN TIN or Social Security Number are required. IT ONLY TAKES 10 MINUTES TO APPLY. The bill is expected to provide relief for eligible small business through a loan guarantee program the postponement of certain tax payments and a tax credit.

Department of the Treasury and the Small Business Administration SBA released the application form for businesses to apply for and obtain loans under the Paycheck Protection Program. The Coronavirus Aid Relief and Economic Security Act CARES Act is the largest financial assistance bill issued in American history. All CARES Act SMB SBA loans are made by Solera National Bank Member FDIC Equal Housing Lender and Seattle Bank Member FDIC Equal Housing LenderSubject to payroll and business verification.

On March 31 2020 the US. The CARES Acts Paycheck Protection Program Loan Guarantee offers another source of help. Territories consisting of the Commonwealth of Puerto Rico the United States Virgin.

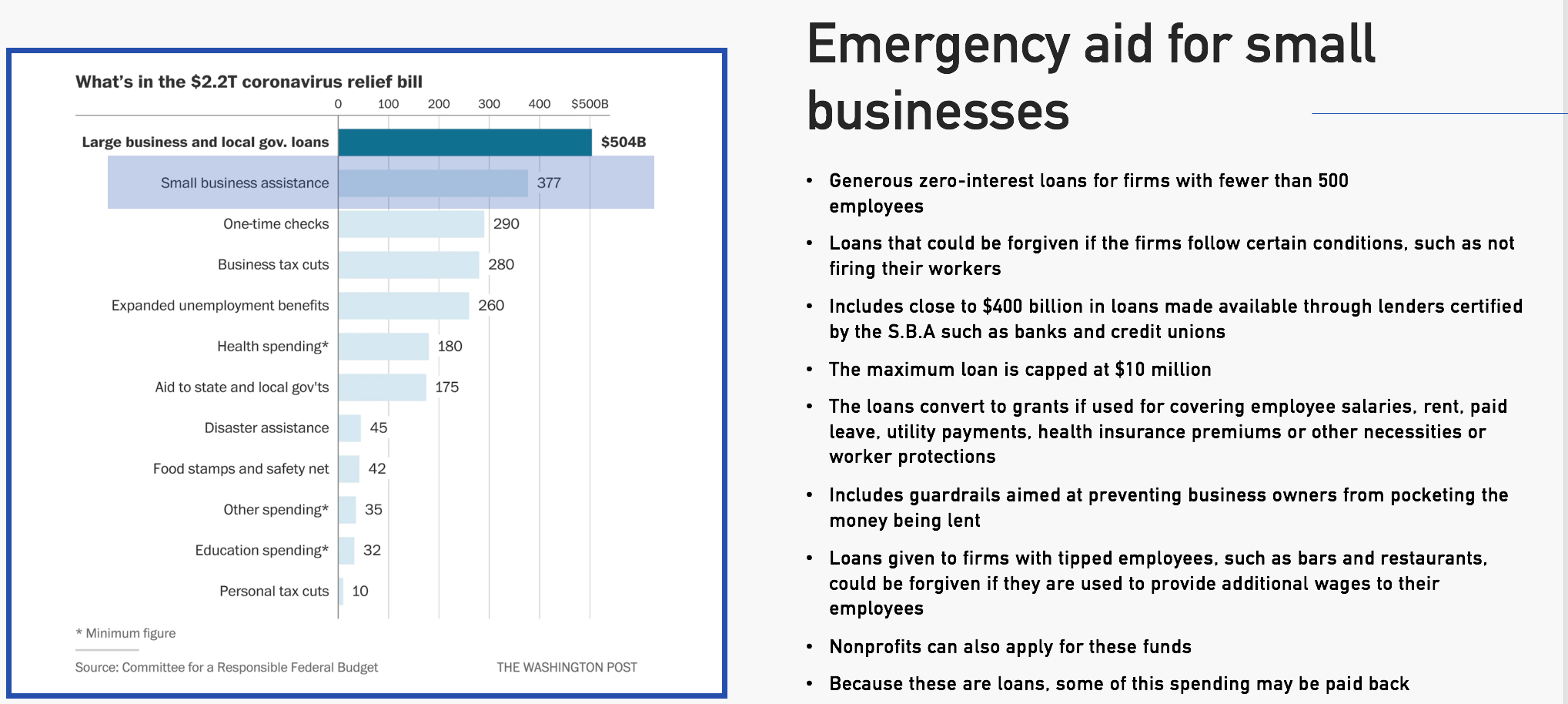

The relief bill which stands for Coronavirus Aid Relief and Economic Security is the largest of its kind in modern US. The CARES Act tasks the Small Business Administration with overseeing the distribution of millions of dollars in loans and grants to help small businesses survive the pandemic. Section 1110 of the CARES Act Emergency Government Disaster Loan and Grant expands access to Economic Injury Disaster Loans under Section 7b2 of the Small Business Act to include not only businesses with fewer than 500 employees sole proprietors with or without employees or as an independent contractor an ESOP as defined in Section 3 of the Small Business Act with not more than 500 employees or a tribal small business concern with not more than 500 employees.

CARES Act Nonprofit Application Form IS NOW ONLINE. The Small Business Owners Guide to the CARES Act The programs and initiatives in the Coronavirus Aid Relief and Economic Security CARES Act that was just passed by Congress are intended to assist business owners with whatever needs they have right now. These loans can offset reduced.

Unsurprisingly such a large infusion of funds in the economy including 376 billion in relief for American workers and small businesses has attracted fraudulent applications for CARES Act funds and scams. The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund. All loan terms will be the same for everyone and are provided through financial institutionslenders.

Recipients and awards Funds will be provided to cities and counties with populations under 500000 that were ineligible to receive direct funding under the CARES Act. Paycheck Protection Program Loans The CARES Act Paycheck Protection Program PPP provides small businesses with 500 employees or fewer up to 10 million in forgivable loans to pay their employees during the COVID-19 crisis. HistoryThough it provides different forms of financial relief for small businesses the Paycheck Protection Program PPP may be the most impactful.

Application Form Form 2301- Part B. Eligibility Questionnaire If Applicable IRS Form 4506T. When implemented there will.

Lenders Application for Guaranty Form 2301- Part C. In response to the COVID-19 pandemic the federal government passed and signed the CARES Act. Under this program the SBA backs small-business loans through local lenders.

CARES Act and Small Business Administration Economic Injury Disaster Loans Updated June 16 2020 Small businesses in Seattle are now eligible to apply for several different types of federal loans including Paycheck Protection Program PPP loans and Small Business Administration SBA loan products. The District of Columbia and US. Statement of Personal History plus required.

On March 27 2020 the Coronavirus Aid Relief and Economic Security Act or CARES Act the Act was passed. COVID-19 relief options. CARES Act Nonprofit Application Form IS NOW ONLINE directs you to the new and functioning Small Business Administrations SBA simplified EIDL online application and also clarifies the calculation for Paycheck Protection Program PPP loan forgiveness.

Did Your Business Get A Ppp Loan For 2 Million Or More Focus On These 7 Questions On Sba Form 3509

Paycheck Protection Program How It Works Funding Circle

Easy Sba Paycheck Protection Program Ppp Loan Calculator Lendio

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Https Www Ncsl Org Documents Statefed Small Business Loan Fact Sheet V01 Pdf

Coronavirus Resources For Michigan Residents Congressman John Moolenaar

Https Www Sba Gov Sites Default Files Resource Files Disaster Loan Overview Eidl Ppp Carl As Of August 10 2020 Pdf

Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund

Manp How To Apply For Cares Act Loans And Loan Forgiveness Manp

Covid Small Business Resources Page Colorado Small Business Development Center Network

Small Business Resources And Guidance Congressman David Schweikert

Are You Qualified For The 2021 Sba Targeted Eidl Advance

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

How To Fill Out The Sba Disaster Loan Application Youtube

Covid Small Business Resources Page Colorado Small Business Development Center Network