Can Your Employer Send Your W2 Again

The deadline for employers to send out W2s to their employees is January 31st. You will explain to the IRS that your former employer refused.

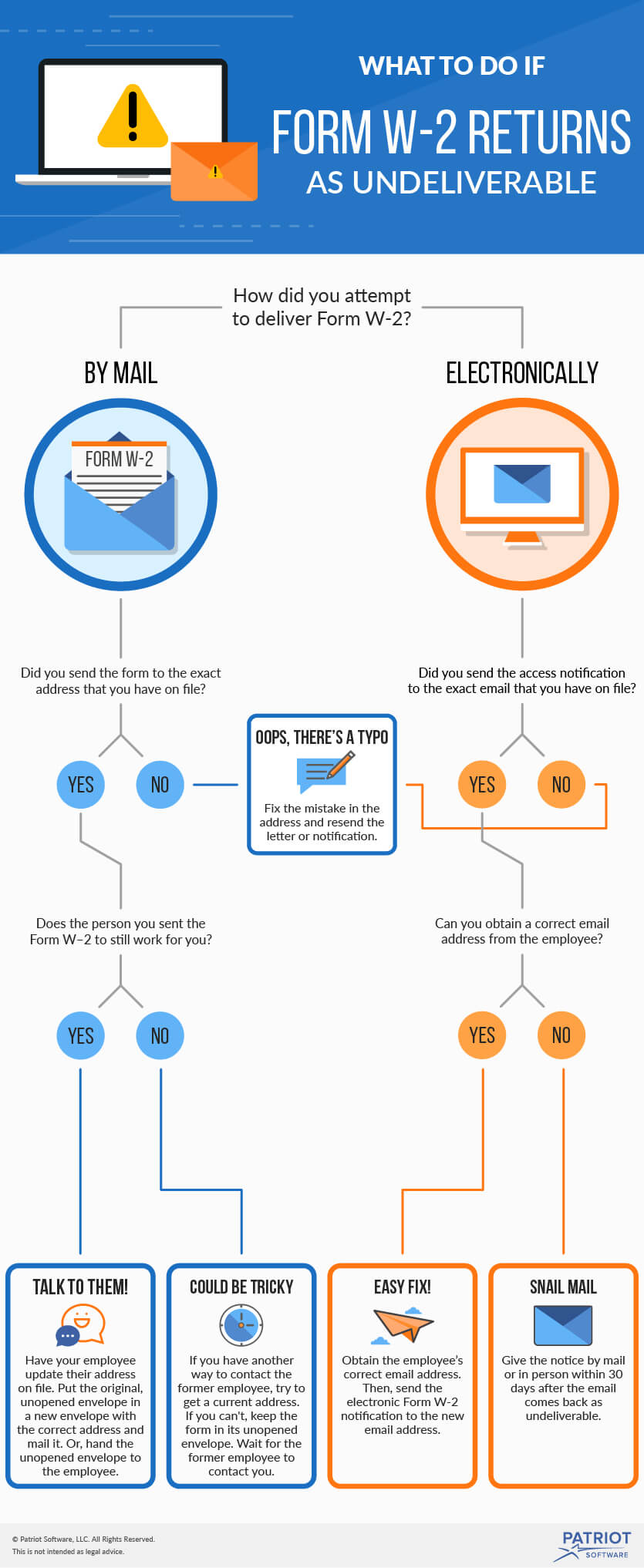

Form W 2 Returned To Employer Follow These Steps

Form W 2 Returned To Employer Follow These Steps

How long do the employer have to send out a corrected W2.

Can your employer send your w2 again. No matter how you file Block has your back File with a tax pro File online. You can mail paper copies of Form W-2 to employees. After checking the W-2 you may realize that you have made an error when you filed your income tax form.

Your former employer will also include your accumulated vacation severance and outstanding bonuses on your W-2 form. Alternatively an employer may have sent you the W-2 to a wrong address or perhaps your old address if youve moved. At times employers inadvertently send workers an erroneous Form W-2 which makes filing your taxes even more of a hassle.

If one of the forms is returned to you as undeliverable do not open the envelope. Yes your employer is required legally to give you a W2 if he paid you 600 or more for the year. Your employer may send you your W-2 after you have filed your taxes using Form 4852.

Be sure they have your correct address. If my former employer refuses to send my w2 what can I do. If you still dont have any.

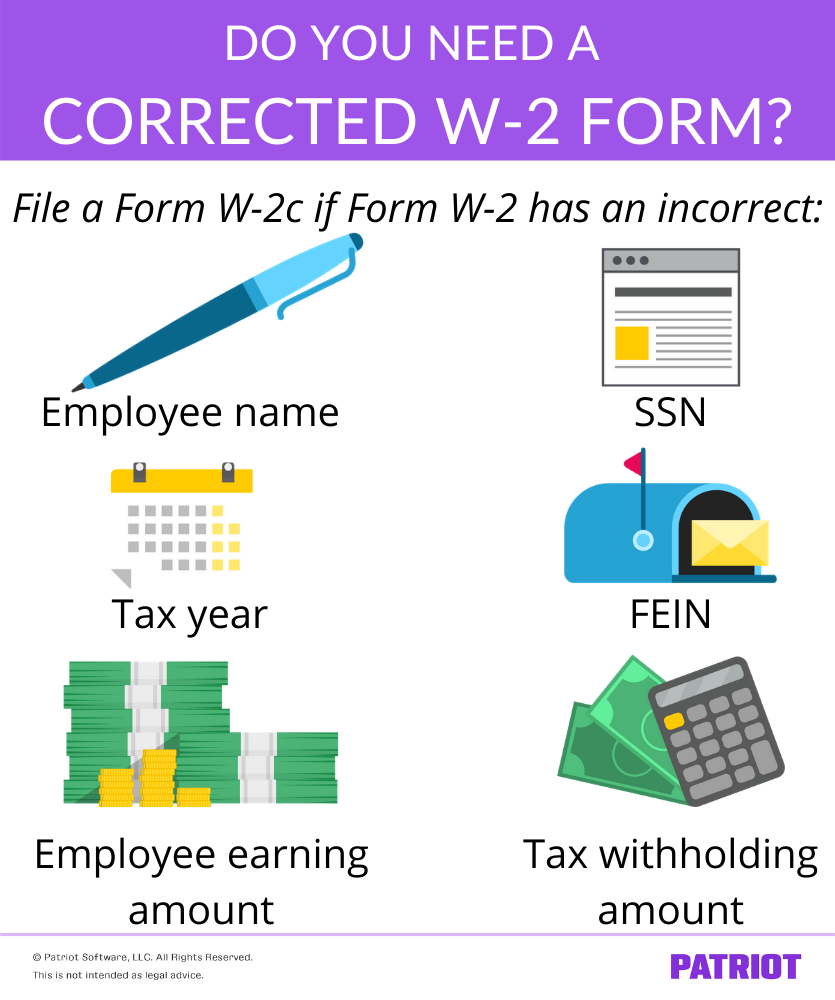

Some employers will reissue the W-2 immediately on your request but according to IRS regulations employers are only required to do so within a reasonable amount of time This could be a few days or weeks depending on the size of your organization. 31 you will simply need to request a W-2 be sent or re-sent to you and make sure that the numbers are accurate. Employers are required to correct errors on Forms W-2 as quickly as possible.

If you receive a W-2C after importing your W-2 data change the W-2 information to the correct information area on the new documentAgain you can do this easily through TurboTax or HR Block W2 online import. Even if you switched jobs they still have this deadline in place yet sometimes you can expect to receive it earlier. The IRS will send a letter to your employer on your behalf.

If you call the IRS after February 15 and after asking the employer for it then the IRS will send you a substitute form so that you can file without the W-2 and the IRS will tell your employer to send or give you the W-2. The penalty for filing an incorrect W-2 with the SSA increases over time. If youve lost your W-2 you can request a duplicate copy from your employer.

So if your employer doesnt send your W2 in time then theres a problem brewing. Find a tax office nearest you now. Ask your employer or former employer for a copy.

It now rests on you to act fast so that you can pay your taxes as per the law and also get your refunds on time. To correct the error you will need to file Form 1040X Amended US Individual Income Tax Return. Youll need the following when you call.

If employers send the form to you be sure they have your correct address. But if you call before February 15 then the IRS wont do any of this and you will have to call again after February 15. Create a replacement W2 If even after nudging from the IRS your employer doesnt send you a replacement W2 in time for you to file your tax return you may file the return using Form 4852 in place of your missing wage statement.

Youll also need this form from any former employer you worked for during the year. You are supposed to be in. While your employer will have a duplicate of your lost W-2 forms you can also get the assistance of a tax pro at HR Block to help walk you through the process.

You should first ask your employer to give you a copy of your W-2. If your employer didnt send W2 then its up to you to act fast to sidestep the consequences that come with late tax-filing or not filing your. Potential flubs include the.

The sealed envelope with its postmark serves as proof that you attempted to send the Form W-2 on time. He must either give it to you by January 31st of each year or it must be postmarked to the last known address of yours by January 31st. Not only is it legal but many employers are now making the W2s available online so that their employees can print them.

To avoid penalties a Form W-2c is generally required within 30 days of becoming aware of an error. Make a copy of the envelope and keep the copy in your. Youll need the same data you needed for the IRS call to help you create your W2 replacement.

If you have not received your W2 at this point and have made an effort you will need to use your paystubs to complete a substitute W2. As they are required to provide threaten them with this before you file. In either case if your W-2 hasnt arrived by Jan.

If you are unable to get a copy from your employer you may call the IRS at 800-829-1040 after Feb. The IRS mandates that employers have to send out or make W2s available to their employees by January 31.

Download W 2 Form Ezw2 Software Simplifies W2 Filing For New Business Owner W2 Forms Power Of Attorney Form Fillable Forms

Download W 2 Form Ezw2 Software Simplifies W2 Filing For New Business Owner W2 Forms Power Of Attorney Form Fillable Forms

Free W2 Form 2016 3 Ways To Get Copies Of Old W 2 Forms Wikihow Irs Forms W2 Forms Job Application Form

Free W2 Form 2016 3 Ways To Get Copies Of Old W 2 Forms Wikihow Irs Forms W2 Forms Job Application Form

Is Your Employer Legally Obligated To Give You Your W2 Form Quora

We Make You A Personalized W2 Tax Statement Great For Income Tax Purposes Or Proof Of Income For Self Employed Contractors Bar Income Statement Income Tax

We Make You A Personalized W2 Tax Statement Great For Income Tax Purposes Or Proof Of Income For Self Employed Contractors Bar Income Statement Income Tax

How Can I Get A Copy Of My W2 Online For Free 2020 2021 Turbotax Solution Meaning Online

How Can I Get A Copy Of My W2 Online For Free 2020 2021 Turbotax Solution Meaning Online

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

W2 Fake Good Ein Printable Taxes Check Dependents Refund Template 2017 2018 Payroll Template Birth Certificate Template Money Template

W2 Fake Good Ein Printable Taxes Check Dependents Refund Template 2017 2018 Payroll Template Birth Certificate Template Money Template

W2 Independence A New More Inclusive Umbrella For The Fire Community W2 Forms Rental Agreement Templates Power Of Attorney Form

W2 Independence A New More Inclusive Umbrella For The Fire Community W2 Forms Rental Agreement Templates Power Of Attorney Form

How To Correct A W 2 Form Irs Form W 2c Instructions

How To Correct A W 2 Form Irs Form W 2c Instructions

Crypto Users Are Receiving Irs Tax Warning Letters Again Irs Taxes Irs Tax

Crypto Users Are Receiving Irs Tax Warning Letters Again Irs Taxes Irs Tax

W5 Form 5 Example Top 5 Trends In W5 Form 5 Example To Watch Tax Software American Express Platinum Income Tax Return

W5 Form 5 Example Top 5 Trends In W5 Form 5 Example To Watch Tax Software American Express Platinum Income Tax Return

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Everything You Need To Know About Your W 2 Form Employer Identification Number Money Template Tax Forms

Everything You Need To Know About Your W 2 Form Employer Identification Number Money Template Tax Forms

W3 Form 3c 3 Things To Avoid In W3 Form 3c W2 Forms Job Application Form Resignation Letters

W3 Form 3c 3 Things To Avoid In W3 Form 3c W2 Forms Job Application Form Resignation Letters

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Find W 2 Form Online Turbotax And H R Block Are Web Based Tax Preparation Sites Which Have A Search And Import Functi Tax Preparation Termite Problem Diy Taxes

Find W 2 Form Online Turbotax And H R Block Are Web Based Tax Preparation Sites Which Have A Search And Import Functi Tax Preparation Termite Problem Diy Taxes

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021