Can 1099 Deduct Business Expenses

To take the deduction you would need to be able to prove the expense. However there may be some additional business-related expenses that a broker-owner can deduct such as.

The Epic Cheatsheet To Deductions For The Self Employed Business Tax Deductions Small Business Tax Business Tax

The Epic Cheatsheet To Deductions For The Self Employed Business Tax Deductions Small Business Tax Business Tax

And because you file this with your personal tax return everything begins to work together towards your own benefit.

Can 1099 deduct business expenses. The costs must be reasonable. The short answer is yes. Then enter a description SBIR Grant reported on 1099-G and the amount.

A real estate brokerage owner can deduct many of the same expenses that an agent may deduct. So invoices canceled checks bank statements etc. In general this does not cause problems.

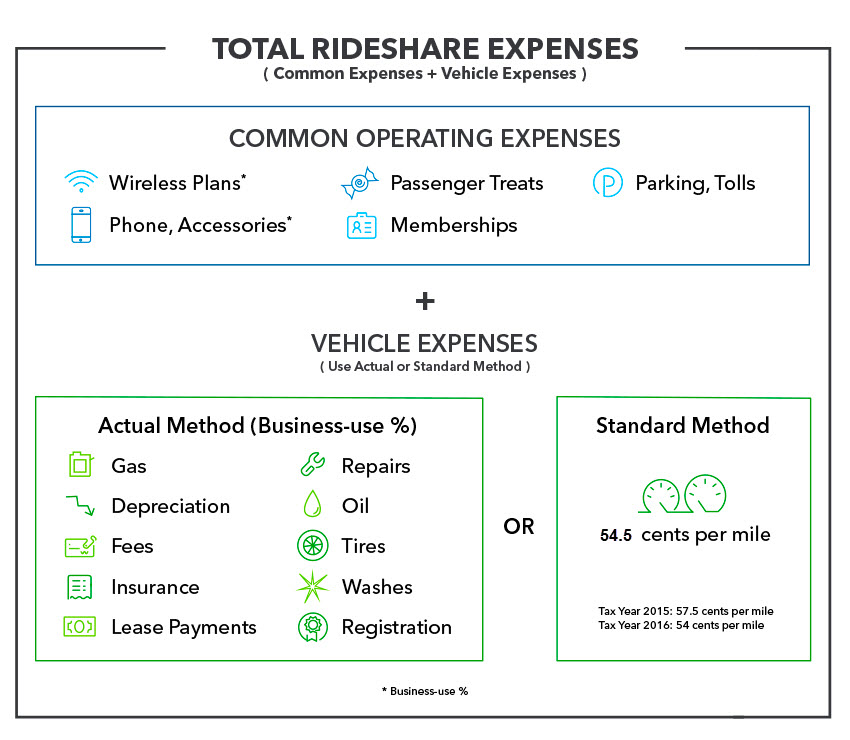

The largest deduction is primarily the vehicle. The other is the requirement to issue a 1099. You are self-employed and expenses you incur in order to create an income are deductible as business expenses from your independent contractor 1099.

However if you consistently have losses 3 years or more for example then the IRS could come back and consider this a hobby instead of a business and disallow the loss es claimed. Deductible Expenses The Internal Revenue Service says you can deduct food costs that are directly related to doing business such as if youre serving refreshments at your art gallery opening. This means the high-tech gadgets that help you streamline your work can pay for themselves come tax time.

Advertising costs professional licensing equipment travel supplies repairs and maintenance are all common deductions for 1099 income. Can I Use Tax Deductions If I Get a 1099. Cost of real estate coaching training and education for employees Installation of.

Most costs associated with operating a business can be expensed on Part II of Schedule C. You can also deduct costs associated with your business such as if you meet with a client over dinner and pick up the tab. One is the ability to take a deduction.

You can enter it under your Business income in Other Income. The amount will flow to line 6 of your schedule C and be included in gross income and net income will then flow to the schedule SE You can deduct the expense on the same Schedule C. Yes and legally you should claim all eligible business expenses along with all income.

As a 1099 independent contractor you also get to write off all your business expenses on Schedule C Profit or Loss. The ability to take a deduction comes from Section 162 where for a business all ordinary and necessary deductions are allowed. What can I deduct as business expenses as a 1099 gig worker.

If you get a 1099 you can and you absolutely should write off qualifying expenses. Although certain costs including the use of the home can be deducted as employee business expenses Ortiz Soto warned that the classification was severely restricted for certain employees in. The Internal Revenue Service kept abreast of the changes and it is possible to deduct the cost of some items used for business.

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

Small Business Tax Spreadsheet Small Business Tax Business Tax Deductions Small Business Expenses

Small Business Tax Spreadsheet Small Business Tax Business Tax Deductions Small Business Expenses

Free Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Free Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Business Tax

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Business Tax

Business Expenses What You Can And Can T Claim The Independent Girls Collective Business Tax Deductions Business Expense Business Expense Tracker

Business Expenses What You Can And Can T Claim The Independent Girls Collective Business Tax Deductions Business Expense Business Expense Tracker

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Schedul Small Business Bookkeeping Business Expense Small Business Planner

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Schedul Small Business Bookkeeping Business Expense Small Business Planner

The Master List Of All Types Of Tax Deductions Infographic Small Business Tax Business Tax Deductions Business Tax

The Master List Of All Types Of Tax Deductions Infographic Small Business Tax Business Tax Deductions Business Tax

Small Business Tax Write Off Checklist Tax Queen Business Tax Deductions Small Business Tax Business Tax

Small Business Tax Write Off Checklist Tax Queen Business Tax Deductions Small Business Tax Business Tax

Are You Unsure What Expenses Are Deductible For You Business This Infographic List The Most Business Expense Bookkeeping Business Small Business Bookkeeping

Are You Unsure What Expenses Are Deductible For You Business This Infographic List The Most Business Expense Bookkeeping Business Small Business Bookkeeping

Deducting Business Expenses Which Expenses Are Tax Deductible

Deducting Business Expenses Which Expenses Are Tax Deductible

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Tax Preparation

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Tax Preparation

Business Bookkeeping Tracking Your Expenses And Income In 2021 Business Tax Deductions Business Tax Small Business Tax

Business Bookkeeping Tracking Your Expenses And Income In 2021 Business Tax Deductions Business Tax Small Business Tax

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Small Business Bookkeeping Business Tax Deductions

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Small Business Bookkeeping Business Tax Deductions

Pin By Monica Nuxoll Beauty And Bluej On Work From Home Opportunity Business Tax Tax Write Offs Business Tips

Pin By Monica Nuxoll Beauty And Bluej On Work From Home Opportunity Business Tax Tax Write Offs Business Tips

Financial Tip Of The Month Tax Prep Checklist Tax Prep Tax Prep Checklist Financial Tips

Financial Tip Of The Month Tax Prep Checklist Tax Prep Tax Prep Checklist Financial Tips

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Tax Deductions

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Tax Deductions

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Free Business Tracking Printable Templates Business Organization Printables Business Printables Small Business Organization

Free Business Tracking Printable Templates Business Organization Printables Business Printables Small Business Organization