How To Find A Company's Vat Number Eu

If youre doing business in Europe you might need an EU VAT number. This is a unique number created for each business and banking organization that resides in a territory governed by the European Union.

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

The VAT number has not been activated for intra-EU transactions.

How to find a company's vat number eu. Youll need to register for the VAT MOSS scheme in an EU country by the 10th day of the month after your first sale to an EU customer. How to Verify the Value Added Tax number. A companys VAT number is available online through the European Commission Taxation and Customs Union.

51 rows VAT lookup enables you to lookup and verify VAT numbers. You have to check if a business is registered to trade cross-border within the EU with the EUs VIES web tool. VAT numbers in the EU consist of 15 alphanumeric characters with the first two indicating the country of the registered business - eg GB for the UK.

These changes are not always reflected immediately in the national databases and consequently in VIES. It is a system that allows you to query national EU VAT registration databases. Most companies around the world are registered for VAT and have a VAT number and sometimes EU vendors ask North American companies for a VAT number as a routine question.

The VAT number does not exist. Use a VAT search engine for companies based in the European Union. The VIES website confirms or denies whether a given VAT number is valid notes the.

For more detailed information. VAT numbers are necessary for tax and excise purposes. Every VAT identification number must begin with the code of the country concerned and followed by a block of digits or characters.

You can also check VAT. Add up all the values obtained after multiplying each value of the. Get company information including registered address previous company names directors details accounts annual returns and company reports if its been dissolved.

VAT-Search has more than 600 clients including By using VAT -Searcheu you agree that this website stores cookies on your local computer in order to enhance functionality such as remembering your input for further queries. Look up the country code for a European company. BE - Belgium - 10 characters 9 prior to April 2005.

The EUs VAT Information Exchange System or VIES also aggregates VAT data from the individual countries databases and can confirm the validity of an individual VAT number. Learn how to apply for a VAT number in these simple steps. If youre looking for the VAT number for a country in the European.

AT - Austria - 9 characters always starting with a U. Who issues a VAT number. Example If you make your first sale on 12 January 2021.

Though VAT numbers usually consist of numeric digits only some western countries have VAT numbers that also contain letters. The EU Commission has been made aware that companies in different Member States have been receiving proposals offering to obtain a valid. Along with EU and Northern Ireland VAT number you can also check Swiss Thai and Norwegian VAT registration number.

The VIES website lets you check a single VAT number one at a time. VAT numbers usually start with an ISO 3166-1 alpha-2 country code followed by two or more characters up to thirteen. The largest pool of VAT-registered companies is in.

The EC VIES Swiss UID register Thai and Norwegian business register services. The North American company may try to find their VAT number or register fo. Also fair warning foreign countries outside of the EU may have a VAT number starting with EU.

VIES is short for VAT Information Exchange System. All the countries in the EU are currently as follows with their two letter country codes. According to the European Commission it is possible to get VAT numbers from each European Union countrys tax database.

The registration is not yet finalised some EU countries require a separate registration for intra-EU transactions. You should verify the validity of a VAT number issued by any Member State by selecting that Member State from the drop-down menu provided and entering the number to be validated. Format of VAT numbers.

List the VAT number vertically excluding the first two letters that is excluding the country code. Then multiply each value of VAT registered number starting with 8 and ending with 2. VAT number validation is performed against national tax administration databases.

Searching for VAT Numbers in the European Union 1. Using their service and contacting directly national tax. Each EU country uses its own format of VAT identification number.

How To Check Foreign Company Eligibility 8 Easy Steps

How To Check Foreign Company Eligibility 8 Easy Steps

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

How To Check Foreign Company Eligibility 8 Easy Steps

How To Check Foreign Company Eligibility 8 Easy Steps

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

My European Vat Number Is Not Validated What Can I Do Press Customizr Documentation

My European Vat Number Is Not Validated What Can I Do Press Customizr Documentation

Vat On Imported Goods From China A Complete Guide

Vat On Imported Goods From China A Complete Guide

Bulgaria Business Attraction In The Eu No More Tax

Bulgaria Business Attraction In The Eu No More Tax

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

How To Check A Vat Number For Free And Without Sign Up Medium

How To Check A Vat Number For Free And Without Sign Up Medium

Delaware Corporation For Eu Individuals And Entities Komorowski Law Firm

Delaware Corporation For Eu Individuals And Entities Komorowski Law Firm

Eu Tax Reporting With Plants Abroad Functionality Sap Blogs

Eu Tax Reporting With Plants Abroad Functionality Sap Blogs

12 Eu States Reject Move To Expose Companies Tax Avoidance Tax Avoidance The Guardian

12 Eu States Reject Move To Expose Companies Tax Avoidance Tax Avoidance The Guardian

Company Service Free Registration In Bulgaria How To Open A Company For 3 Three Days Accounting Services Company Bank Fees

Company Service Free Registration In Bulgaria How To Open A Company For 3 Three Days Accounting Services Company Bank Fees

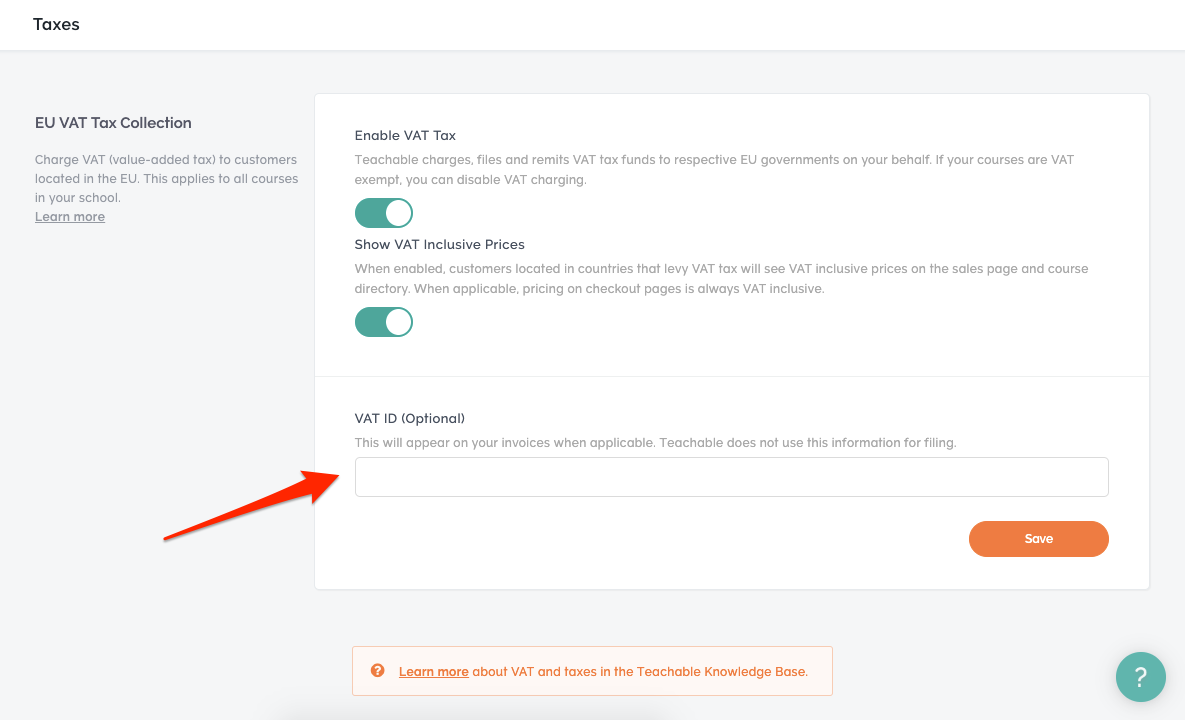

My European Vat Number Is Not Validated What Can I Do Press Customizr Documentation

My European Vat Number Is Not Validated What Can I Do Press Customizr Documentation