How To Fill Out A W2 For A Household Employee

If youre required to file a 2020 Form W-2 for any household employee you must also send Form W-3 with Copy A of Forms W-2 to the SSA. For more details and exceptions for when W-2 reporting is not required see Household Employment Taxes and Nanny Tax Guide.

Editable W2 Form 2015 Printable W2 Form For Employees 2015 Employee Tax Forms Tax Forms Statement Template

Editable W2 Form 2015 Printable W2 Form For Employees 2015 Employee Tax Forms Tax Forms Statement Template

To correct a Form W-2 you have already submitted file a Form W-2c with a separate Form W-3c for each year needing correction.

How to fill out a w2 for a household employee. Prepare a Form W-2 for your employee for the previous years wages and give them Copies B C and 2 by January 31st of the following tax year. The easy part is supplying your name address marital status and other basic personal. You dont need to so the Schedule H will not be required or used with your return if you choose to.

We use cookies to give you the best possible experience on our website. Steps to Generate a W-2 for your nanny. Overall wages go in Box 1 and they include FICA wages.

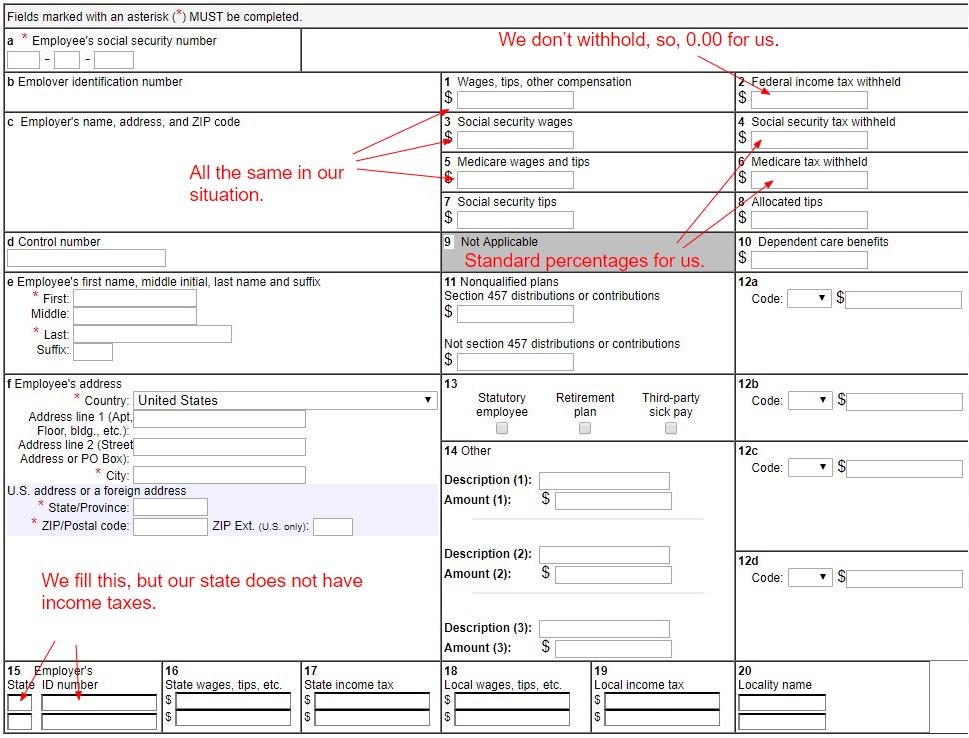

You enter 0 as Social Security wages and 0 as Medicare wages. Fill out one for each employer. You must register to use Business Services Online Social Securitys suite of services that allows you to file W-2W-2Cs online and verify your employees names and Social Security numbers against our records.

Step 1 Determine whether an individual is an employee or an independent contractor. Send the W-2 copy A with the W-3 to the Social Security Administration by the last day of January. Edited 011118 400 PM.

Go to the online tool found at httpwwwsocialsecuritygovemployer. If filing electronically via the SSAs Form W-2 Online service the SSA generates Form W-3 data from the electronic submission of Forms W-2. You will need this for your employees SSN and home address.

How to Fill Out Your Employees W-2s The W-2 starts with some basic information. Fill out one for each employee. To file these forms youll need a Tax ID.

This information is only included in the W-2 of the last church served. A form employees fill out in their first month of employment. I need to fill out a w2 for a household employee in CA for 2013.

File Forms W-2c Corrected Wage and Tax Statement and W-3c Transmittal of Corrected Wage and Tax Statement as soon as possible after you discover an error. There isnt a bright-line test but the IRS will look at a variety of factors regarding independence and control of wages and work hours such as the following2 X Trustworthy Source Internal Revenue Service US. FICA wages go in Boxes 4 and 6.

Complete a Form W-2 and give copies B C and 2 to the employee. You may include information on a. Also provide a Form W-2c to the employee as soon as possible.

For annual household employers must also complete the Employer of Household Worker Election Notice DE 89 PDF if election is made after filing DE 1HW. Code E-403b employee salary reduction contributions Box 13 is checked if the pastor is a participant in the church retirement plans Box 14 may be used for additional reporting. Also add the taxes to your employees wages reported in box 1 of Form W-2.

Your identification number EIN. You must prepare a separate Form W-2 for each household employee if you have more than one. Yes you can file a W2 for a household employee who is paid less than 2000 for the year or if you dont need to pay federal unemployment tax because you paid total cash wages less than 1000 in any calendar quarter to household employees.

A form employers fill out each year for their employees. Government agency in charge of Step 2 Obtain W-2 and W-3 forms. Follow the instructions to report Wages to.

The 124 percent Social Security tax a 29 percent Medicare tax and the 6 percent federal unemployment tax or FUTA. In 2021 you hire a household employee who is an unrelated individual over age 18 to care for your child and agree to pay cash wages of 100 every Friday. Just download it from the IRS website fill it out and give it to your human resources or payroll team.

I need help to - Answered by a verified Tax Professional. Gather Form I-9 your nanny completed around first day of employment. Boxes 11 14.

Click on the button to Log in to Business Services Online or Register if you have not done so previously. To create the W-2 without FICA withholding uncheck the check mark next to Uncheck to disable auto-calculate as by default this is checked. Its late but I need to get it done.

You can then enter 0 for both Social security and Medicare withholdings and the program will accept it. The household employment taxes that you may have to account for on Schedule H cover the same three taxes that are withheld from all employment wages. Complete the registration form Employers of Household Workers Registration and Update Form DE 1HW PDF.

Report the social security and Medicare taxes that you paid in boxes 4 and 6 of your employees Form W-2. You only file a W-2 for employees not independent contractors. Box 12 might take time to fill out because youll need to enter different codes and amounts here depending on.

Reports what you paid your employees over the course of the year. W-3 forms are for the employers. If your employee withdraws anything from a 457b plan or a non-qualified retirement plan that dollar amount gets placed in box 11.

Mail or fax your completed registration form to the address or fax number below. Youre encouraged to file your Forms W-2 and W-3 electronically. At the top of the form youll input your employees social security number followed by these items.

Tells employers how much federal tax to withhold from their pay check.

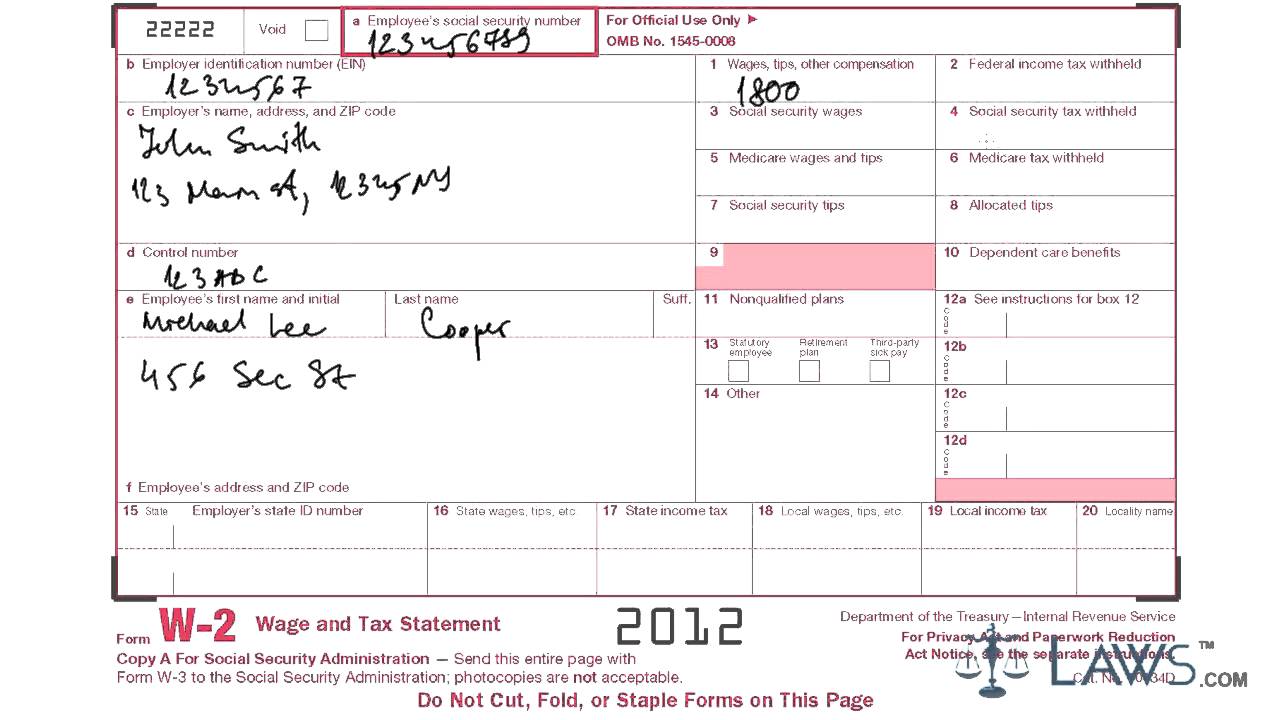

Learn How To Fill W 2 Tax Form Youtube

Learn How To Fill W 2 Tax Form Youtube

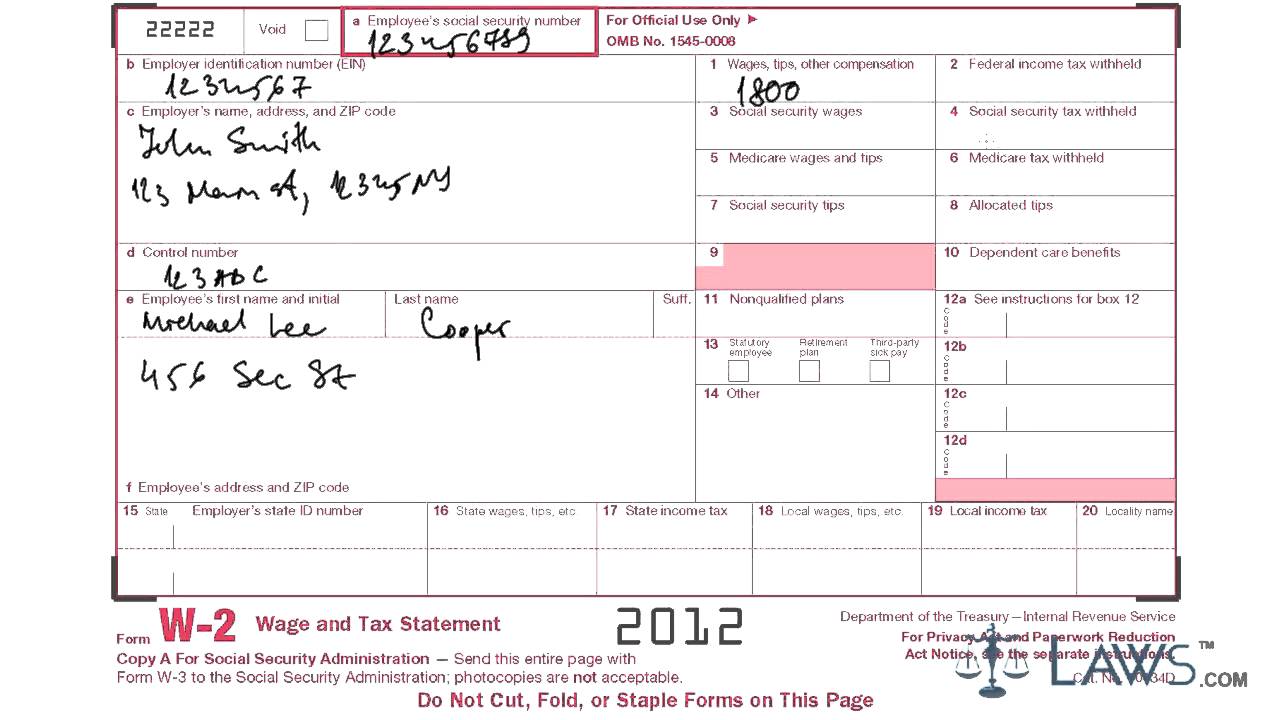

A 2021 Employer S Guide To The W 2 Form The Blueprint

A 2021 Employer S Guide To The W 2 Form The Blueprint

How To Create A W 2 For Your Nanny Nanny Tax Tools

Form W9 Box 9 Never Underestimate The Influence Of Form W9 Box 9 Employment Application Irs Forms Business Names

Form W9 Box 9 Never Underestimate The Influence Of Form W9 Box 9 Employment Application Irs Forms Business Names

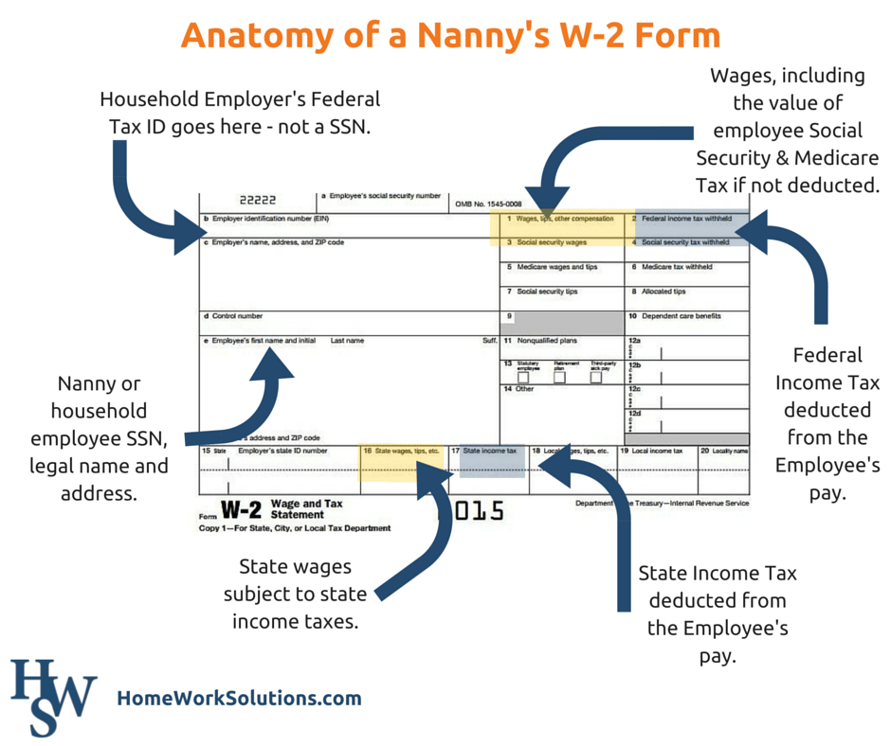

A Nanny Asks Questions About Form W 2

A Nanny Asks Questions About Form W 2

Download W 2 Form W 2 Employer Federal Copy A Printable Job Applications W2 Forms Employment Application

Download W 2 Form W 2 Employer Federal Copy A Printable Job Applications W2 Forms Employment Application

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms W2 Forms Irs Forms

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms W2 Forms Irs Forms

W2 Forms Google Search Tax Forms W2 Forms Tax Time

W2 Forms Google Search Tax Forms W2 Forms Tax Time

How To Create A W 2 For Your Nanny For Free

How To Create A W 2 For Your Nanny For Free

Download W2 Form 2016 Fillable Form W 4 Employee S Withholding Allowance Tax Forms Income Tax Form

Download W2 Form 2016 Fillable Form W 4 Employee S Withholding Allowance Tax Forms Income Tax Form

Pin By Bianca Kim On W 2 Irs Tax Forms Tax Forms Irs Taxes

Pin By Bianca Kim On W 2 Irs Tax Forms Tax Forms Irs Taxes

Download W2 Form 2016 Filling Out The W 2 Mmbb Doctors Note Template Business Letter Template Letter Template Word

Download W2 Form 2016 Filling Out The W 2 Mmbb Doctors Note Template Business Letter Template Letter Template Word

Looking For The New Form 1040 Tax Forms Irs Tax Forms Income Tax

Looking For The New Form 1040 Tax Forms Irs Tax Forms Income Tax

Form W2 2013 Fillable How To Fill Out Irs Form W 2 2017 2018 Irs Forms Power Of Attorney Form Tax Forms

Form W2 2013 Fillable How To Fill Out Irs Form W 2 2017 2018 Irs Forms Power Of Attorney Form Tax Forms

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

2013 W2 Form W 4 W2 Forms Form Sales Tax

2013 W2 Form W 4 W2 Forms Form Sales Tax