Are Covid Grants Taxable To A Business

Many of New Yorks restaurants and small businesses will be eligible for new state grants and tax credits that could act as an economic lifeline for establishments still navigating the COVID-19. Updated information on.

Covid 19 Delaware Division Of The Arts State Of Delaware

Covid 19 Delaware Division Of The Arts State Of Delaware

Further information about the tax implications of government grants is in.

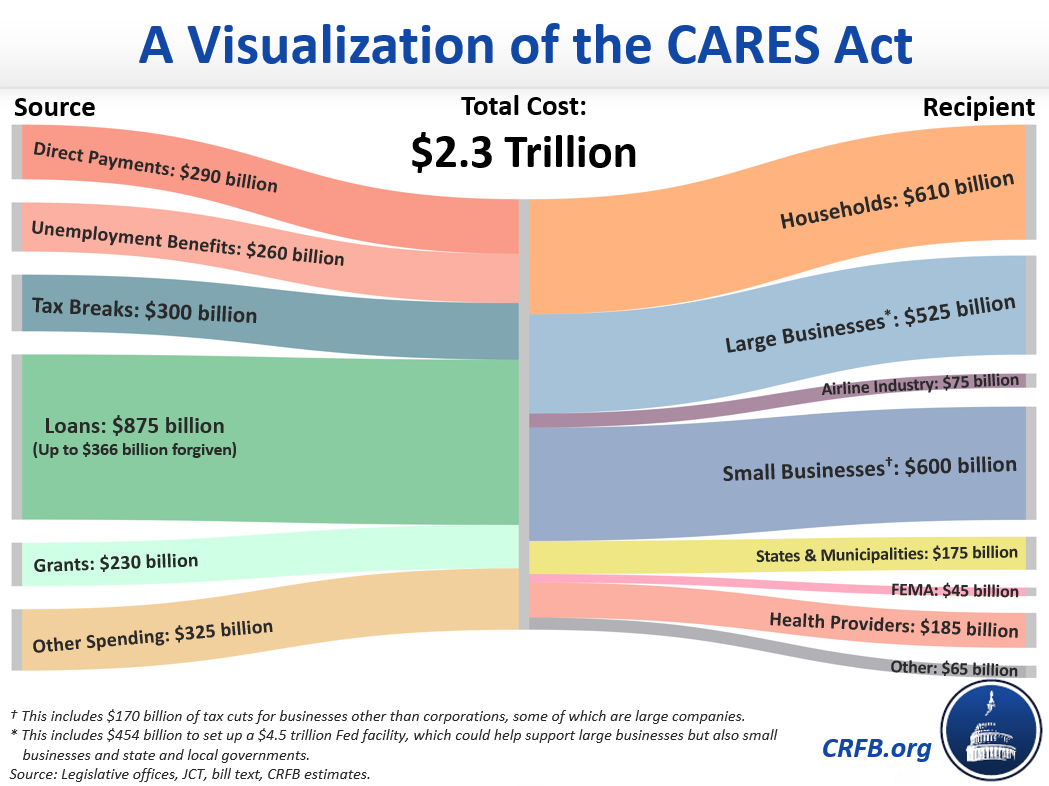

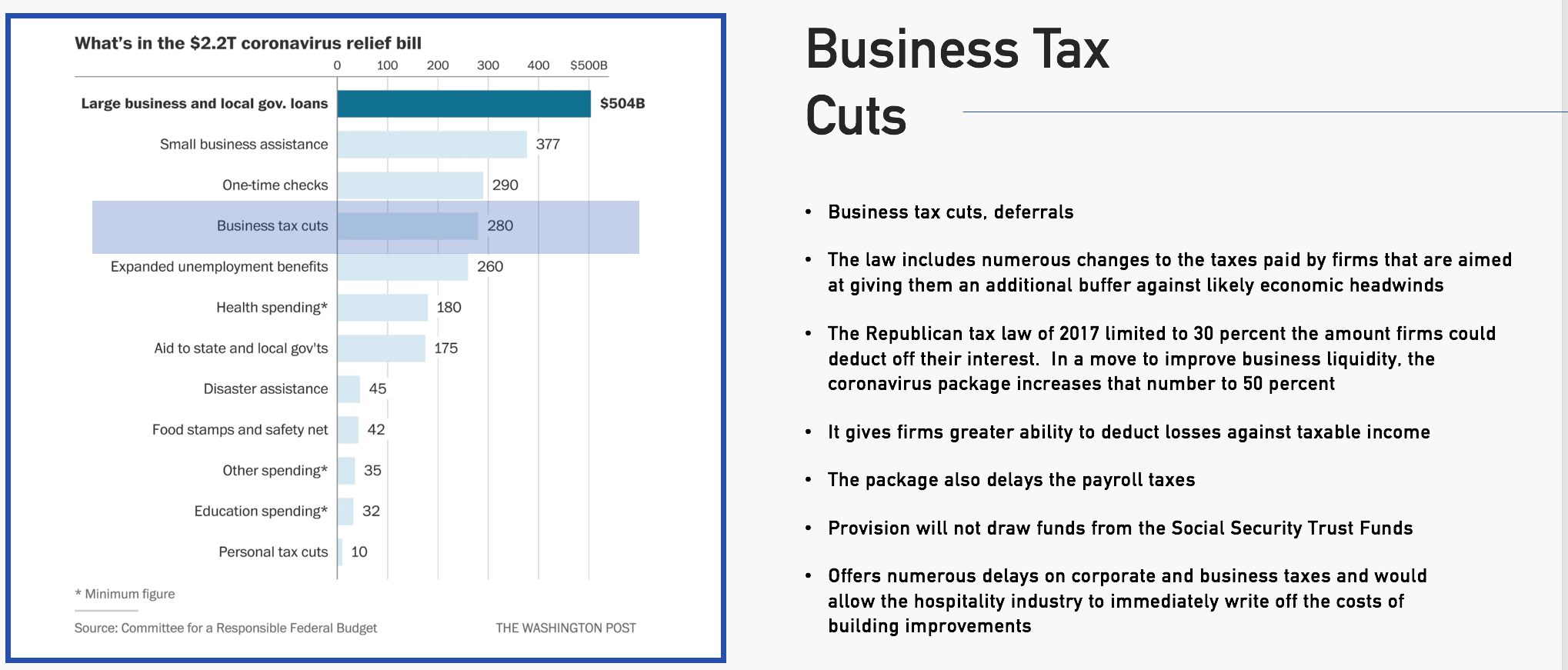

Are covid grants taxable to a business. Like most things in the world of taxes it depends. The receipt of a government grant by a business generally is not excluded from the businesss gross income under the Code and therefore is taxable. If instead of a grant the local government or state agency extends a loan to a business using these funds and the loan was not forgiven the amount of.

Taxpayer using his LLC EIN applied to the Wisconsin Economic Development Corp for a grant and received 2500. What Is a Grant. Get information on coronavirus COVID-19 tax relief for businesses and tax-exempt entities.

ProSeries links box 6 taxable grants of Form 1099-G. Clarification on whether grants are subject to tax. We cover the many tax breaks and tax.

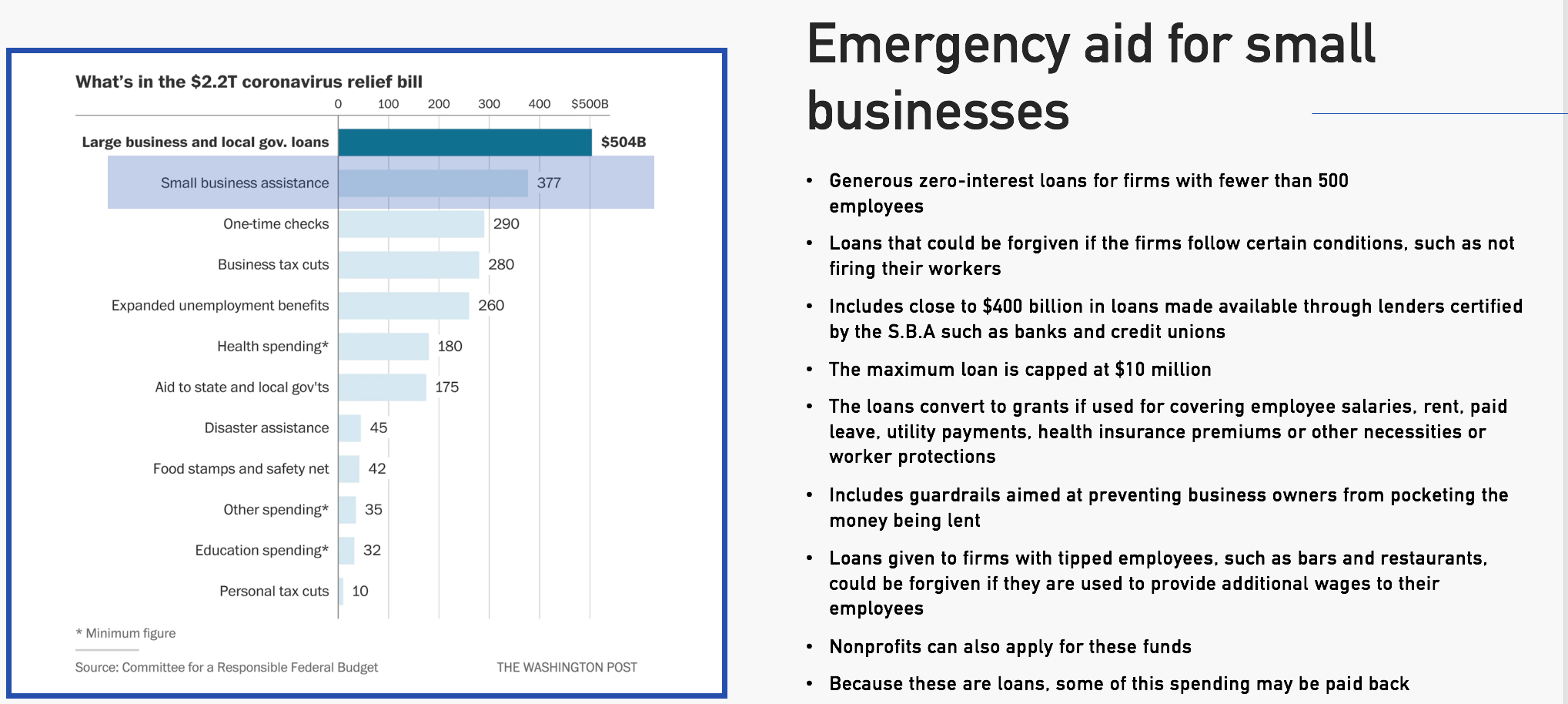

State territory and local government assistance. In an effort to stave off economic devastation caused by the COVID-19 pandemic billions of dollars in grants are being handed out to individuals and businesses by the federal government and by state and local governments as well. The 2500 was reported to the taxpayers LLC on form 1099-G in box 6 entitled taxable grants.

Added State Aid information. COVID-19 Tax Relief. Families First Coronavirus Response Act FFCRA.

The FFCRA included a handful of provisions that impacted businesses including requiring some employers to provide paid sick leave new paid family and medical leave and new tax credits for the paid leave. In addition recent legislation provides for the ability to deduct business expenses paid with forgiven PPP loans and other COVID-related loans and grants. I am completing an SA return for a self-employed client and his Small Business Grant 10k was received on 3rd April.

Find out about the income tax and GST consequences of government stimulus measures to assist Australians impacted by COVID-19. The CARES Act passed in March 2020 provided large-scale assistance to businesses and individuals. Examples of such grants include but are not limited to county-issued grants Small Business Relief Grants and grants from the Bar and Restaurant Assistance Fund.

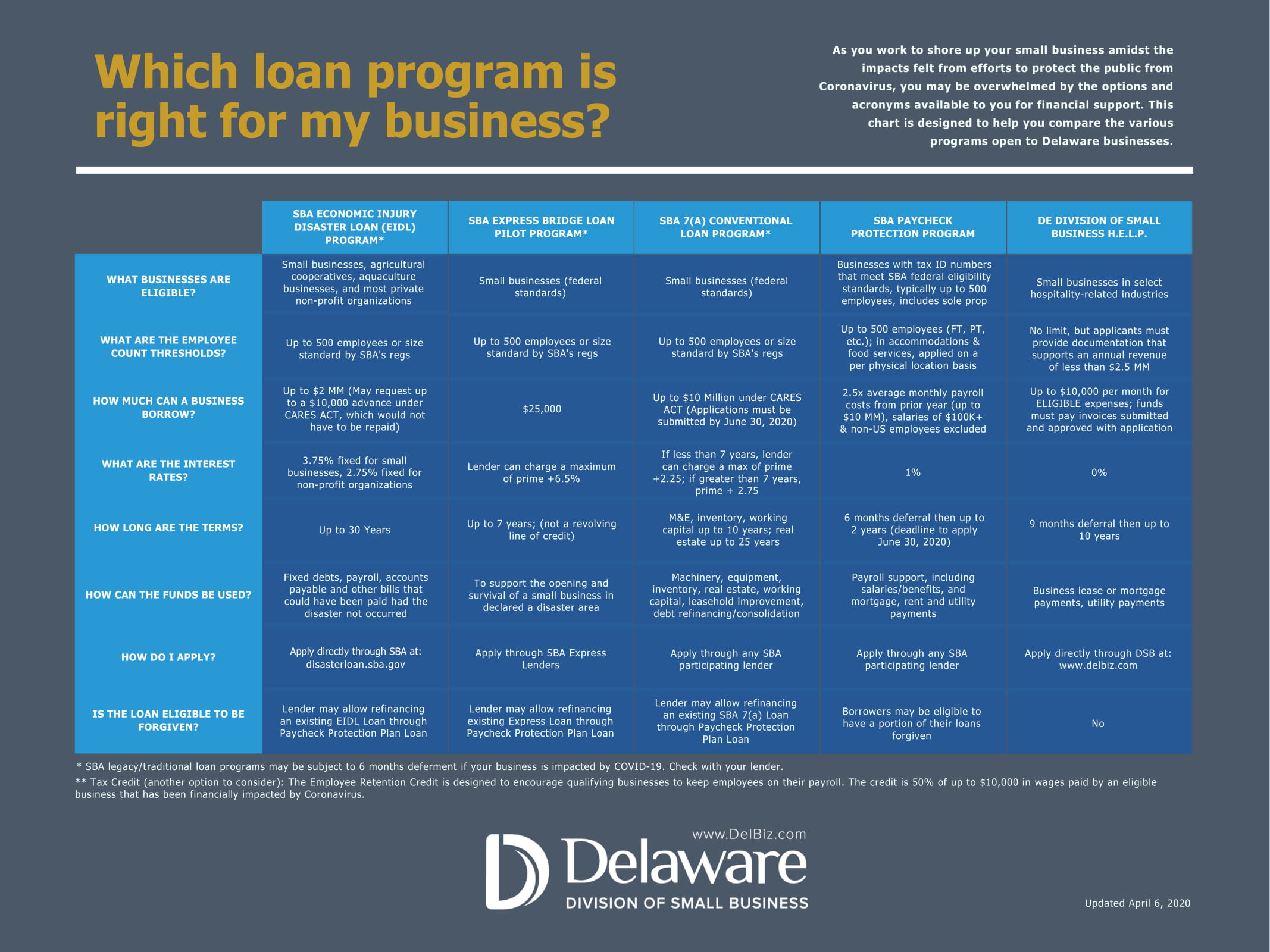

Funded by the federal Coronavirus Aid Relief and Economic Security CARES Act the Were All In Small Business Grant Phase 2 program will provide grants to Wisconsin small businesses to assist with the costs of business interruption or for health and safety improvements wages and salaries rent mortgages and inventory. So we know that the direct grants of up to 2500 per month for three months to the self employed are taxable - but has anybody found any utterances regarding the COVID-19 Small Business Grant Scheme assistance by grant to Business Rates payers taxable. Is COVID-19 Small Business Grant Scheme taxable.

Coronavirus Aid Relief and Economic Security CARES Act. COVID Business Grant Income Taxable in Montana January 25 2021 by Montana Department of Revenue Montana received 125 billion in funding from the Coronavirus Aid Relief and Economic Security CARES Act passed March 27 2020 to use for necessary expenditures related to the COVID-19 pandemic. Are these grants taxable.

Coronavirus Relief Fund CRF Payments from Local Governments. But I cannot seem to find an answer to as to whether they are subject to Class 4 NIC and to class 2 as well. People 55 and Indigenous peoples 18 can register to get vaccinated Province-wide restrictions are in effect.

To fully understand your eligibility for tax credits and deductions we recommend speaking with one of our Block Advisors small business certified tax pros to help you. The Covid-19 Pandemic Small Business Recovery Grant Program steers 800 million in funding and 138 million in tax credits in part to for-profit arts and cultural institutions. Any links to that information.

Generally there are no federal income tax exclusions that apply to businesses for reimbursement of expenses that occur in the regular course of business. So it needs to be included in the 2020 return. I understand that the Covid-19 business support grants are taxable.

Added details of grant funding allocations by local authority. Employee Retention Credit Available for Many Businesses Financially Impacted by COVID-19 The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees after March 12 2020 and before January 1 2021. The Circuit Breaker Business Relief Grant provides fully funded grants to hospitality and fitness businesses impacted by the March 31 2021 PHO orders.

Government grants and payments during COVID-19. This program is administered by the state Department of Employment and Economic Development.

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Covid 19 Information For Delaware Small Businesses Division Of Small Business State Of Delaware

Covid 19 Information For Delaware Small Businesses Division Of Small Business State Of Delaware

Https Www Dentoncounty Gov Documentcenter View 3084 Denton County Open Phase 2 Grant Agreement Pdf

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Small Business Resiliency Fund Coronavirus

Small Business Resiliency Fund Coronavirus

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

The Families First Coronavirus Response Act Summary Of Key Provisions Kff

The Families First Coronavirus Response Act Summary Of Key Provisions Kff

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Covid 19 Delaware Division Of The Arts State Of Delaware

Covid 19 Delaware Division Of The Arts State Of Delaware

Coronavirus Relief Packages Details For Businesses Individuals Health Npr

Coronavirus Relief Packages Details For Businesses Individuals Health Npr

Dc Small Business Microgrants Program Report Coronavirus

Dc Small Business Microgrants Program Report Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog