Can I Deduct Meals As A Business Expense 2019

Jun 25 2020 Deducting Meals You Give to Employees You can deduct the cost of meals for employees both individually and in groups with some limitations. 1 day agoThere are several ways your business can deduct 100 of meal costs and even 100 of eligible entertainment expenses.

How To Handle Meals And Food Related Expenses In 2018 Tax Queen

How To Handle Meals And Food Related Expenses In 2018 Tax Queen

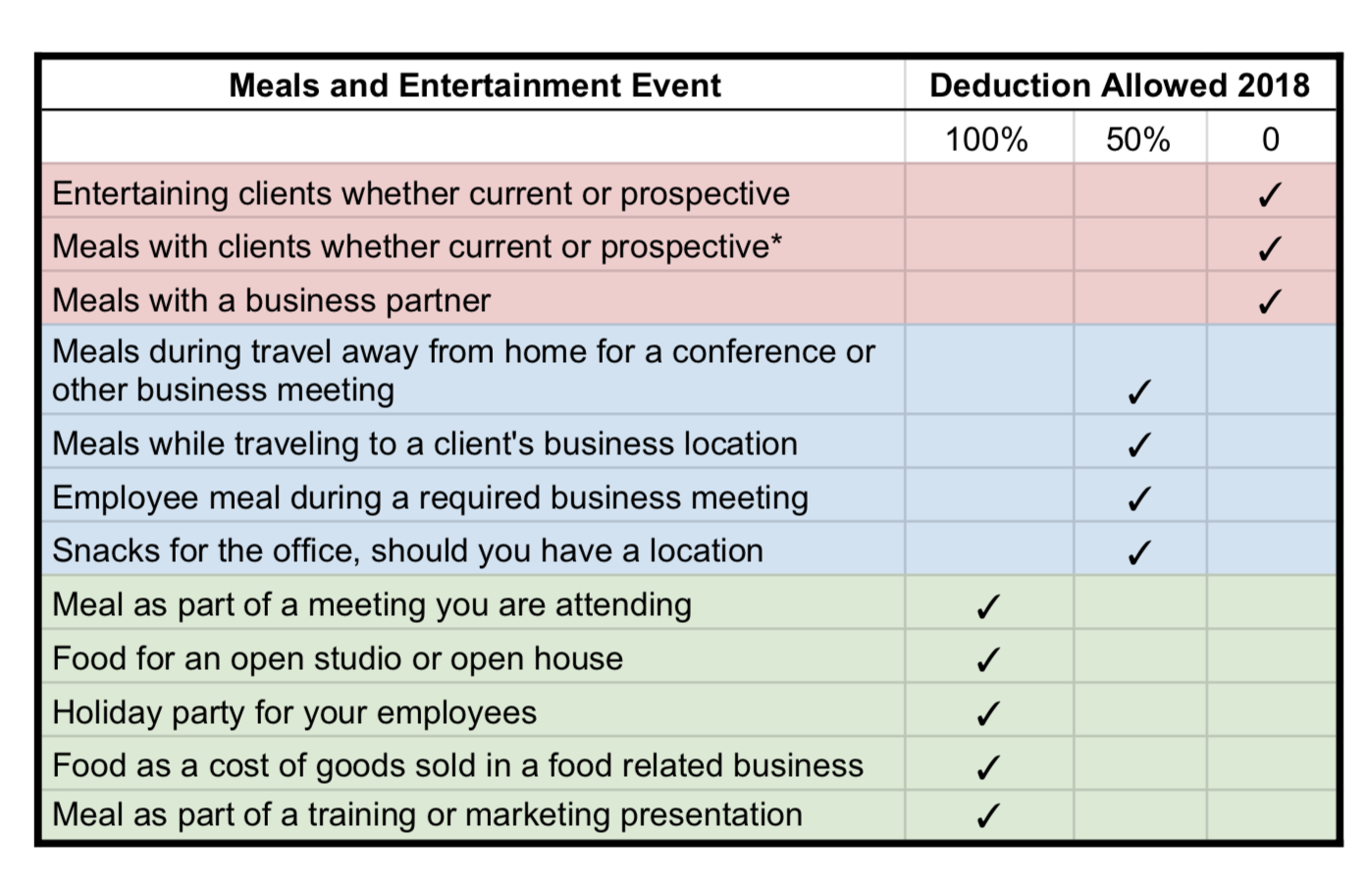

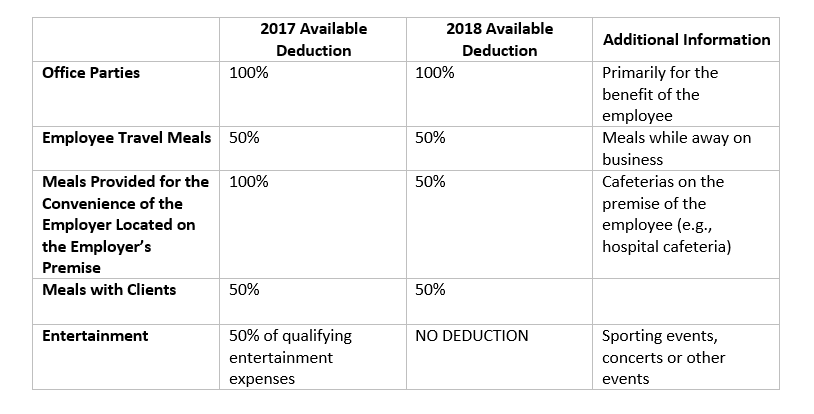

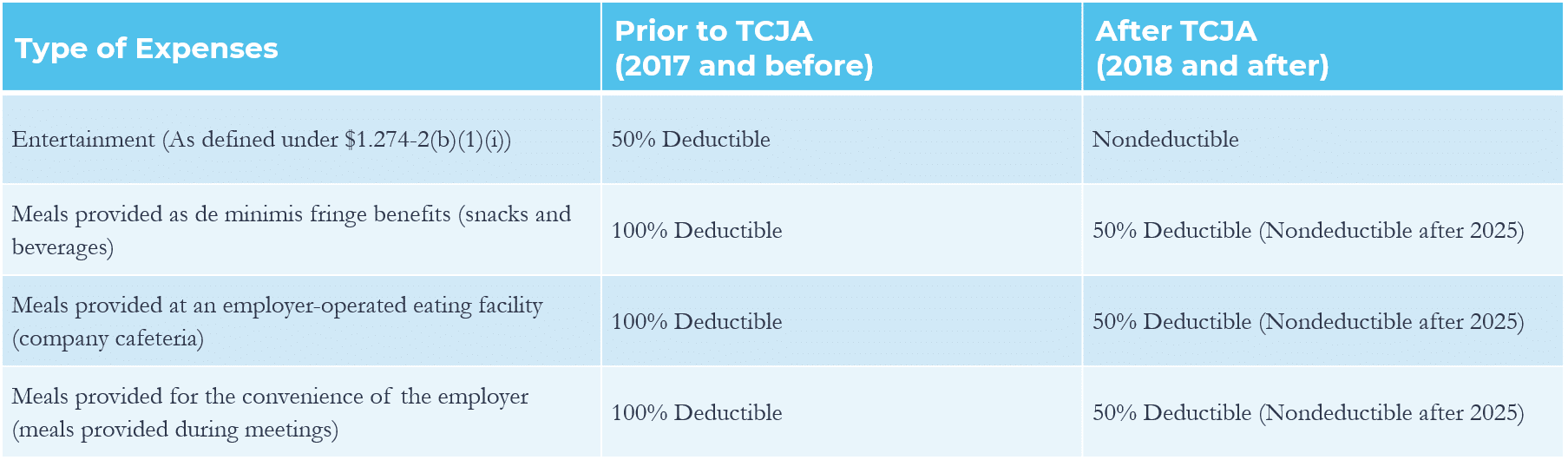

The federal income tax treatment of business-related meal and entertainment expenses has been a moving target.

Can i deduct meals as a business expense 2019. Thats an optimistic goal but here goes. If youre an employee you can deduct these only to the extent your employer doesnt reimburse you. 1 day agoWhen can I deduct business meal and entertainment expenses under current tax rules.

If youre confused about. The 2017 TCJA eliminated the deduction for any expenses related to activities generally considered entertainment amusement or recreation. If youre confused about what rules currently apply I dont blame you.

However these expenses must be directly related to or associated with your business. Our team has the experience and expertise to help your business navigate any complicated questions or tax-related details. You must furnish the meal to current or potential customers consultants clients or similar business contacts.

Meals provided at office parties and picnics are 100 deductible. And if you still have any questions contact SH. It covers your expenses for business meals beverages tax and tips.

The federal income tax treatment of business-related meal and entertainment. Some little-known tax deductions for meals. This applies if the meals are ordinary and necessary and incurred in the course of business.

The meal may not be lavish or extravagant. This column aims to eliminate confusion. There are several ways your business can deduct 100 of meal costs and even 100 of eligible entertainment expenses.

Jan 11 2021 You can deduct 50 of business meals if you take those clients out to dinner individually. The federal income tax treatment of business-related meal and entertainment expenses has been a moving target. Jan 25 2021 You can also deduct 50 of the cost of providing meals to employees such as buying pizza for dinner when your team is working late.

IR-2020-225 September 30 2020 WASHINGTON The Internal Revenue Service issued final regulations on the business expense deduction for meals and entertainment following changes made by the Tax Cuts and Jobs Act TCJA. MarketWatch - Bill Bischoff 26m. A 2020 COVID-19 relief bill made taxpayer-friendly changes.

WASHINGTON The Internal Revenue Service issued proposed regulations on the business expense deduction for meals and entertainment following changes made by the Tax Cuts and Jobs Act TCJA. When can I deduct business meal and entertainment expenses under current tax rules. Youor at least one of your employeesmust be present and must conduct business in some way with a consultant client customer or other business contact.

Instead of deducting your actual expenses you can deduct a set amount for each day of your business trip. 2 days ago In this blog we will provide an overview of which business expenses meals and entertainment you can deduct on your 2020 taxes. So the IRS provides an alternative method of deducting meals.

Jun 14 2017 Business Meal Deduction Requirements If youre a sole proprietor you can deduct ordinary and necessary business meals and entertainment expenses. You or an employee needs to be present at the meal. This amount is called the standard meal allowance.

Meals for employees while traveling for all-employee events or business meals in general are still deductible at 50. You can deduct 50 percent of meal and beverage costs as a business expense.

Business Meals Expenses And Deductions Mahoneysabol

Business Meals Expenses And Deductions Mahoneysabol

Changes To Business Meals Entertainment Expenses Warren Averett

Changes To Business Meals Entertainment Expenses Warren Averett

Business Meals And Entertainment Expenses What S Deductable

Business Meals And Entertainment Expenses What S Deductable

Safety Tracking Spreadsheet Business Tax Deductions Small Business Tax Deductions Spreadsheet Business

Safety Tracking Spreadsheet Business Tax Deductions Small Business Tax Deductions Spreadsheet Business

Harris Cpas Blog Does Your Business Qualify For The Work Opportunity Tax Credit

Harris Cpas Blog Does Your Business Qualify For The Work Opportunity Tax Credit

Are Meals And Entertainment Still Tax Deductible Under The New Tax Law

Are Meals And Entertainment Still Tax Deductible Under The New Tax Law

Are You Unsure What Expenses Are Deductible For You Business This Infographic List The Most Business Expense Bookkeeping Business Small Business Bookkeeping

Are You Unsure What Expenses Are Deductible For You Business This Infographic List The Most Business Expense Bookkeeping Business Small Business Bookkeeping

Deducting Business Meal Expenses Under Today S Tax Rules

Deducting Business Meal Expenses Under Today S Tax Rules

The Entertainment Deduction Deduction Tax Deductions Tax Season

The Entertainment Deduction Deduction Tax Deductions Tax Season

You Re Rocking Your Creative Business Meeting With Leads Traveling To Events And Pumping Out Amazing Things For Yo Deduction Tax Deductions Creative Business

You Re Rocking Your Creative Business Meeting With Leads Traveling To Events And Pumping Out Amazing Things For Yo Deduction Tax Deductions Creative Business

Navigating The New Meals And Entertainment Deductions Under Tcja Grf Cpas Advisors

Navigating The New Meals And Entertainment Deductions Under Tcja Grf Cpas Advisors

Meals And Entertainment Expenses Still Deductible Rkl Llp

Meals And Entertainment Expenses Still Deductible Rkl Llp

Business Meals And Parties Full Vs Partial Deductions

Business Meals And Parties Full Vs Partial Deductions

Business Meal Deductions Accounting Ecommerce Deduction

Business Meal Deductions Accounting Ecommerce Deduction

When Can You Deduct Business Meals Thompson Greenspon Cpa

When Can You Deduct Business Meals Thompson Greenspon Cpa

Home Office Tax Deductions Calculator 2019 Microsoft Excel Spreadsheet Tax Deductions Excel Spreadsheets Deduction

Home Office Tax Deductions Calculator 2019 Microsoft Excel Spreadsheet Tax Deductions Excel Spreadsheets Deduction

Irs Makes Clear That Most Business Meals Still 50 Deductible Security Sales Integration

Irs Makes Clear That Most Business Meals Still 50 Deductible Security Sales Integration

Tax Deductibility Of Meals Entertainment Expenses Bader Martin

Tax Deductibility Of Meals Entertainment Expenses Bader Martin

Real Estate Lead Tracking Spreadsheet Tax Deductions Business Tax Deductions Music Business Cards

Real Estate Lead Tracking Spreadsheet Tax Deductions Business Tax Deductions Music Business Cards